Women Leaders in Insurance | Elite Women

Jump to winners | Jump to methodology

Inspiring future generations

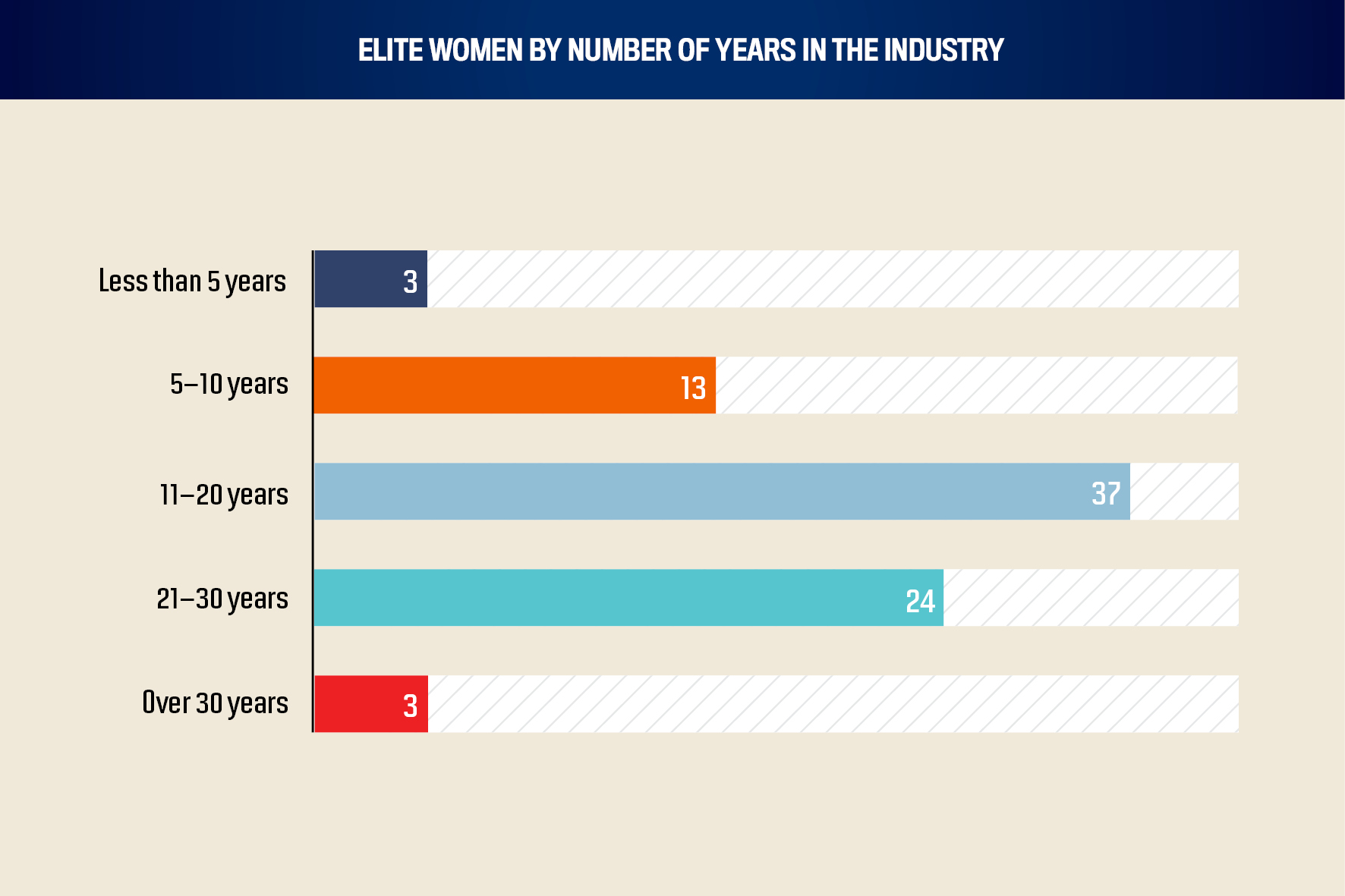

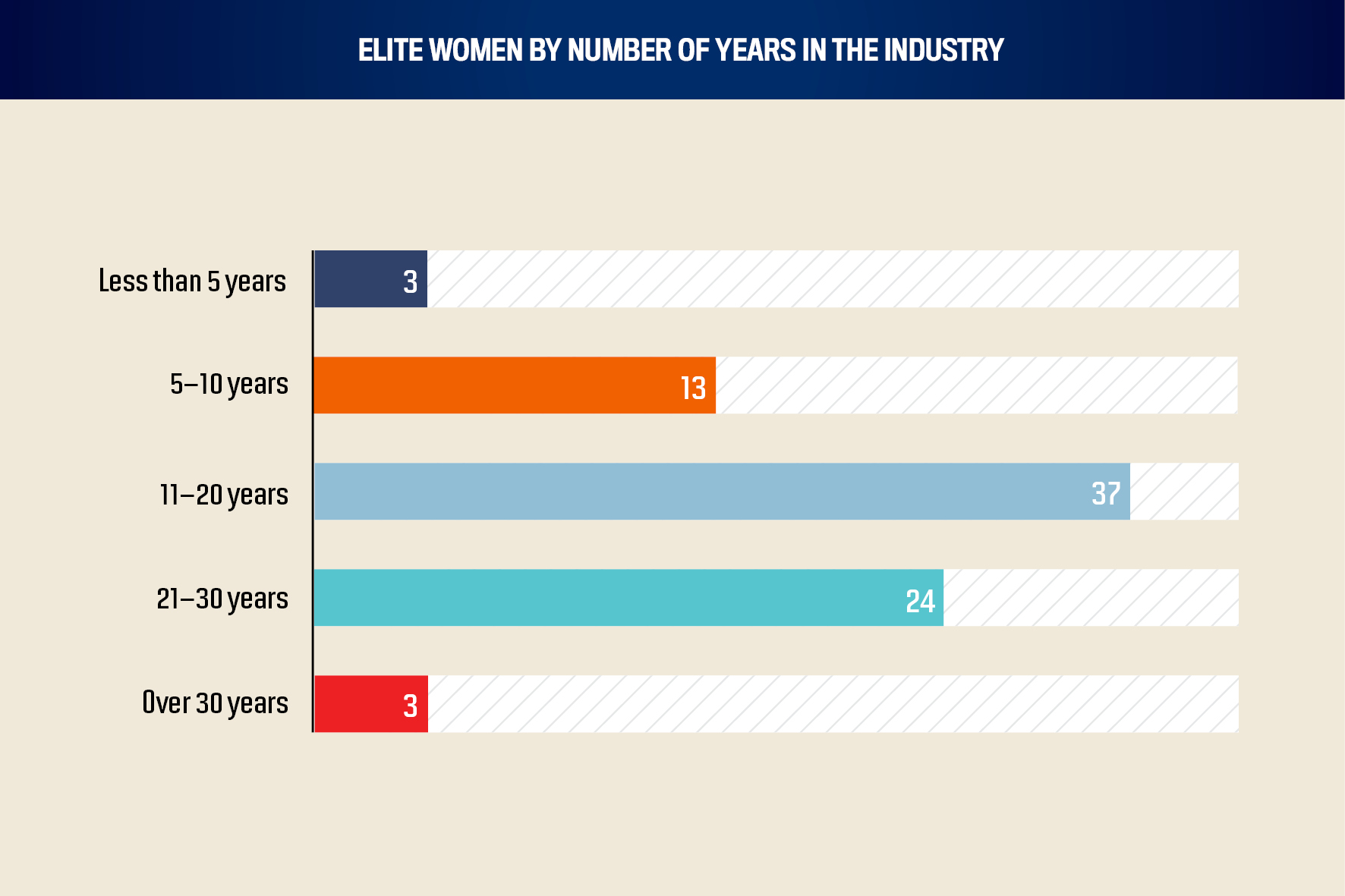

Insurance Business recognises 80 women leaders from Australia and New Zealand as Elite Women of 2024, a thriving cohort of trailblazers whose leadership positively influences the industry’s trajectory.

“Women who are successful in insurance rarely focus on their gender,” remarks Natasha Fenech, Avant Mutual Group CEO and managing director, who also serves as non-executive director of the Insurance Council of Australia. “They simply believe in their abilities and don’t accept failure, but rather see it as a learning opportunity to drive success.”

The women leaders celebrated are undeterred by industry or professional and personal challenges, underscoring that sentiment.

Instead, they have honed a breadth and depth of skills, strategies, and expertise, enabling them to:

deliver top-tier business results and performance

advance the industry’s knowledge and understanding of DE&I

modernise the sector with innovative products and solutions

give back through mentoring and thought leadership

The following four award winners demonstrate exemplary leadership, meaningful contributions, and a commitment to making a lasting impact.

Debbie Vounakis – Gallagher Bassett

Leveraging expertise to drive positive change

Now the head of sales and client services for personal injury, Vounakis’ creative and forward-thinking approaches to tackling the significant increase in mental health claims in the insurance industry have garnered widespread respect.

“I aim to make a lasting impact by developing and implementing tailored client solutions that effectively address current and future risks within the industry,” she explains. “By combining innovative and strategic thinking, I strive to contribute to the industry’s growth and resilience, paving the way for a positive and transformative future.”

Key among the contributions she has made across her 20-year career include:

collaborating with mental health professionals, including renowned occupational psychiatrist Dielle Felman, to support complex claims management

creating a strategy that improved return-to-work outcomes for challenging cases

The program, now known as Work Life Well, is vital to the Victorian Mental Health Hub initiative.

In support of her Elite Woman recognition, a nominator notes, “Debbie’s approach is characterised by her tireless work ethic and dedication to her clients, partnering with them to solve complex issues. She consistently goes above and beyond to ensure her team delivers the best possible client outcomes.”

“By establishing strong connections and partnerships, I stay ahead of industry trends and drive meaningful change to address our industry’s evolving needs”

Debbie VounakisGallagher Bassett

Vounakis has thrived throughout her multiple senior roles in insurance and is most engaged and fulfilled by:

collaborating with diverse leaders and clients

embracing new challenges

acquiring additional skills

breaking new ground on solutions that improve client outcomes

“Learning from mistakes, taking calculated risks and embracing resilience in the face of setbacks has had a lasting impact on my career,” she reflects. “This mindset drives me to explore new avenues consistently and contributes to my continuous growth.”

Claire Burke – CHU Underwriting Agencies

Authenticity and inclusion champion

During her 12-year career at CHU, Burke has consistently demonstrated professional growth and seized opportunities to make significant contributions in the strata underwriting space.

In 2022, she was appointed national specialty risk team manager, a new role created to tackle underwriting challenges in the trending niche market.

“Being in a position to provide an insurance solution, where possible, for these accounts that are otherwise difficult to obtain is something I enjoy,” she remarks. “I feel empowered when I’m educating an underwriter or a broker about a complex account because they’re often tricky, and it feels great to share all this experience I have under my belt.”

That dedication spills over into Burke’s charitable endeavours as a diversity and inclusion advocate, predominantly in the LGBTQIA+ space. She works diligently to promote awareness and education at CHU and within the industry to ensure a safe space for all.

Among the main achievements, which earned her Elite Woman status, are:

initiated a new insurance form that streamlined the underwriting decision-making process and improved communication with intermediaries

won the 2023 ANZIIF Making a Difference Award – Underwriting Category

selected as a panellist for the 2023 ANZIIF Diversity & Inclusion seminar, where she spoke about her lived experience as a member of the LGBTQIA+ community

presented CHU’s highest-attended webinar on defects in strata buildings to over 1,300 brokers and strata managers

Driven by a passion for authenticity and openness, Burke aims to set new standards of industry excellence by being a caring and consistent champion for underrepresented groups.

“I’m very comfortable with who I am and being my authentic self,” she states. “That approach has served me well in building strong relationships with colleagues and clients.”

“The rewarding part of moving outside your comfort zone and doing something you didn’t think you could do can help you realise you are, indeed, capable”

Claire BurkeCHU Underwriting Agencies

Marni Jackson – Youi Insurance

Inclusive leader maintains momentum

After nearly 14 years of learning the facets of Youi’s business in various roles, Jackson’s current role as head of product is a new position enabling her talents and expertise to shine.

As a senior leadership team member, she prioritises creating an inclusive environment while leading her team to outperform growth targets on the company’s direct-to-market headline product in the vehicle, lifestyle and leisure lines.

“There’s a lot to be said about showing up, figuring out who you are and bringing that to the table,” Jackson notes about her authentic leadership style. “Confidence is a muscle, and you can’t just go out and run a marathon. You have to train and do the little things that help to build your confidence, especially if you find them challenging.”

Among her noteworthy industry contributions are:

QLD Small Business Mentors for Growth program volunteer

International Women’s Day guest speaker

long-serving judging panel member for Insurance Business’s annual awards gala

Jackson takes pride in influencing thoughtful product designs that are straightforward and easily understood by clients, balanced to create a sustainable business model. She has also been riding the wave of emerging technology, such as AI, devoting considerable thought to its impact on the company and how best to leverage its benefits.

By emphasising the importance of momentum in getting things done, Jackson differentiates herself with a complementary approach that has allowed her to grow professionally. She prioritises teamwork, communication and connection.

“No job is done alone,” she states.

“Sharing your story is a great way to start a conversation, to encourage and empower others to put themselves out there”

Marni JacksonYoui Insurance

Kylie Ciechanowicz – Network Insurance Group

Leading with empathy and humility

Highly regarded as an outstanding, humble executive, Ciechanowicz has led the subsidiary of Steadfast IRS’s largest division to impressive growth and prosperity.

As the general manager of Centra, she passionately drives success and inspires a diverse team of 35 to exceed targets. In July 2023, she was appointed to the Network Steadfast executive team, establishing herself as a key voice on this quorum.

“I’d like to inspire future leaders by fostering a workplace environment that promotes diversity, mentorship and an open-minded culture,” she explains. “All this leads to the company flourishing.”

Ciechanowicz has overcome numerous challenges, including regulatory reform, compliance, and recruitment and retention by:

emphasising resiliency and adaptability

focusing on problem-solving

relying on a talented team

“Watching my team members grow and succeed, being able to contribute to their professional development, and seeing them excel in their roles is truly gratifying,” she reflects.

Her nominator attests to her effectiveness, “Kylie has already exceeded expectations and is leading several strategic projects that will see significant shifts in efficacy, efficiency and use of technology, all in support of proactive, positive customer outcomes.”

She counts among her accomplishments the positive impact she has had on her team and being nominated to participate in the Hollard and Steadfast-sponsored year-long Aspire Women Leaders development program in recognition of her potential.

As this year’s women leaders have showcased and recent McKinsey & Company research supports, insurance companies in the top quartile for gender diversity in executive teams are, on average, 18% more likely to outperform their peers, notes industry expert Fenech.

“It is important that we continue to strive for more diverse leadership teams in the Australian insurance sector,” she adds. “In 2023, only 38% of managers were women, according to the WEGA statistics for financial and insurance services. This statistic declines to only 32% of individuals in governing bodies being women.”

“It’s important to lead by example, display dedication and model desired behaviours to build trust and purpose within your team”

Kylie CiechanowiczNetwork Insurance Group