Top Professional Liability Insurance and D&O Insurance Companies in Canada

Jump to winners | Jump to methodology

Liability leaders

Industry professionals nationwide have selected an esteemed group of companies recognized by Insurance Business Canada as the 5-Star Professional Liability insurance carriers of 2024.

These trusted insurance providers consistently outpaced their competitors in the professional liability and directors and officers (D&O) specialty lines. Their success is attributed to an unwavering commitment to the following criteria:

As evidenced by IBC’s broker feedback, insurance companies pushing the boundaries of excellence focus on broker communication, offer flexible policies and coverage options, and innovate ways to make it easier to do business.

This year’s 5-Star winners have maintained a competitive market presence, solidifying their reputation as brokers’ go-to carriers of choice for their expertise and exceptional customer service.

“Their ability to push to the forefront is all the more remarkable as competition heats up from global insurers laying down roots in Canada and markets look to new business for growth,” says Laura Marcantonio, senior underwriter of professional lines at Alberta-based Sovereign Insurance.

“Over the past few months leading into 2024, the professional liability sector has taken a turn toward a softening market,” Marcantonio says. “Global insurers have focused on professional lines, providing additional capacity and creating competition, which reduces rates, except increases on errors and omissions (E&O) lines for insureds with poor claims histories, high-risk areas of practice, or poor risk management controls.”

As the top-performing professional liability providers demonstrate, service is first and foremost in prioritizing the broker and client experience according to Marcantonio.

Fellow industry expert Rob Manson, commercial insurance broker at Mitch Insurance, says, “I’d say a key element to success is to ensure a deep understanding of both our client and the product. As brokers, it’s important that we understand the different policy wordings and secure coverage that’s designed to solve the client’s needs, based on their industry exposures, contractual requirements, and risk tolerance.”

Northbridge Insurance

5-Star winner leads the pack with service

Headquartered in Ontario with regional offices across Canada, multi-award-winning commercial insurance provider Northbridge Insurance has long enjoyed a strong reputation in the industry.

“We believe service is what sets us apart; that includes being responsive, answering the phone, providing timely quotes, and quickly issuing policies,” says underwriting director Patrick Cruikshank. “In 2023, we made considerable investments in our underwriting team to support our commitment to service, and we’ve seen positive results.”

This strategy is highlighted by Manson.

He says, “I’ve long contended that an elite underwriter is involved in just as much of the sales process as the frontline broker. They coach you on best practices for their industry segments, provide great risk mitigation considerations, and help the broker understand why the policies are priced a certain way. Elite underwriters not only understand our clients’ business and exposures, but they also have unique insight into our clients’ peers and competitors, which can be a very valuable resource in broker/consumer conversations.”

Northbridge distinguishes itself in professional liability by offering professional and management liability products that support customers of any size. By maintaining a service-oriented approach, the company ensures that coverage is tailored to address each client’s unique risks.

A solid commitment to underwriting and claims service underpins Northbridge’s industry-leading status. Delivering exceptional service to its partners is a top priority.

Cruikshank says, “Over the past five years, we’ve been dedicated to growing in the specialty space. While leveraging a strong brand and stable financial rating are important, being entrepreneurial and demonstrating our expertise in this space is what has catapulted us toward this distinction.”

The 5-Star professional liability insurance winner takes pride in its approach to the claims experience, which includes experts that stand out by:

handling each situation with professionalism, keen attention to detail, and clear communication

treating the process as an essential part of the company’s overall value proposition

continually striving for improvement

“I believe this award recognizes the hard work we’ve done in the executive and professional lines space,” says Cruikshank. “It creates a baseline for continued success and is a constant motivator to keep striving for improvement.

“Ultimately, we’re selling peace of mind that if something happens, we’ll be there”

Patrick CruikshankNorthbridge Insurance

Quality counts for client-centric brokers

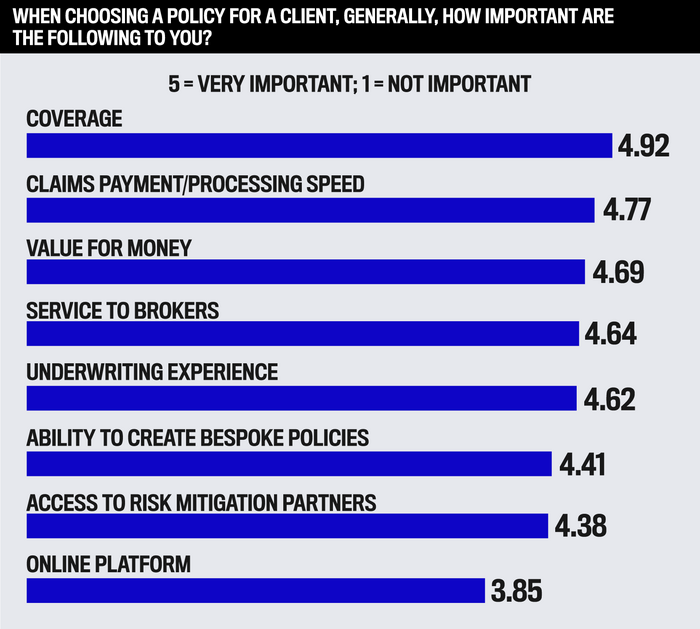

Coverage continues to be brokers’ top priority when choosing a policy on behalf of a client, but there was a shift in what is most valued compared to 2023.

Brokers placed an increased emphasis on the claims process, which rose from third to second place by a wide margin. Access to risk mitigation partners saw a significant increase in importance this year over last, along with an insurer’s ability to create bespoke policies.

IBC’s survey data also shows that brokers have prioritized value for money and broker service, which came in third and fourth place on their priority lists, respectively.

Although still a top five priority, underwriting expertise declined slightly in importance this year, suggesting brokers may be evaluating other factors, such as competitive pricing and service quality, when making recommendations to their clients.

Marcantonio acknowledged that underwriters must go out of their way to understand the risk, especially if it’s hard to place. From her unique perspective, the underwriting experience is, in fact, the most critical policy feature and supports other key aspects such as coverage and tailoring policies to meet clients’ needs.

She says, “I find a fast approach to this is speaking with the broker directly and dissecting the risk in person or over the phone.”

Nearly 90% of brokers surveyed by IBC anticipate an increase in their professional liability volume in 2024, signalling a growing demand for specialty insurance products.

To position themselves to capitalize on these opportunities, grow their businesses, and efficiently serve clients, brokers would like to see the following changes in the professional liability space:

“All-in-one policy where coverage is optional and can be included or declined”

“Availability to service more unique risks”

“Quick access to documents”

“Greater flexibility for miscellaneous professional liability coverage”

“More capacity and fewer coverage limitations”

“Online fast quote for D&O”

“More knowledgeable underwriters”

“Increased appetite and fewer renewal requirements”

“I would like to see the product expanded to cover companies that need E&O for municipal contracts only,” says an Ontario broker respondent.

For her part, Marcantonio would prefer there to be less remarketing due to pricing and more of a push to stay with an insurer that fully understands the complex needs of the insured’s business and operations.

Manson views an opportunity for the sector to grow.

“I would love to see some of Canada’s largest insurers expand their professional liability appetites. In my experience, these carriers seem to prefer to outsource their capacity to experienced underwriters working at niche MGAs for higher-risk operations,” he says. “I see an opportunity for these carriers to absorb that same underwriting talent through hiring or acquisition. If these markets were able to bring this talent in house, they could create their own bespoke programs.”

Industry experts agree that the challenges faced by professional liability insurance carriers offer the most significant opportunities for them to surpass broker and client expectations.

“AI is at the forefront of insurance executives’ agendas,” says Marcantonio. “AI holds great potential for organizations regarding efficiency and streamlining operations. It can help reshape claims, distribution, underwriting, and pricing.”

Manson emphasizes that in addition to hiring and retaining top underwriter talent, the top-performing insurance carriers will also have to integrate a claims team capable of handling lines of coverage that are not extensively underwritten compared to other lines.

“It’s a tall ask, but I believe these carriers have the resources and expertise to secure some of Canada’s best talent in underwriting, adjusting, and lawyers,” he says.

Professional Liability

CFC

Intact Insurance

Liberty

Markel

Travelers

D&O