Last Look of 2023: Update on the MA Commercial Auto Insurance Marketplace

The State of the Marketplace as of November 2023

Every other month, Agency Checklists published a bi-monthly “check-up” on the current state of the Commercial Auto Insurance marketplace. The data reviewed for this line of insurance is provided courtesy of the Commonwealth Automobile Reinsurers. For those readers who may be unfamiliar with the Commonwealth Automobile Reinsurers, “CAR” is the official statistical agent for motor vehicle insurance in the Commonwealth of Massachusetts.

The ultimate aim of these “looks” is to get a better sense of the trends and movements happening within this line of insurance. For our current update, the data reflects the state of the market as of November 2023, the latest date for which complete CAR data is currently available.

So, without further ado, the latest numbers follow below:

Exposures & Market Share Data

COMPANYPREMIUMSMARKET SHARE1. COMMERCE147,856,13213.79%2. SAFETY136,280,70912.71%3. ARBELLA113,042,87510.54%4. PROGRESSIVE97,006,9009.05%5. TRAVELERS76,442,7537.13%6. PLYMOUTH ROCK50,242,5384.69%7. TOKIO MARINE & NACHIDO40,319,6943.76%8. FIREMAN’S40,122,1323.74%9. ZURICH30,428,2642.84%10. HANOVER29,371,1622.74%11. LIBERTY MUTUAL INS27,943,7012.61%12. SELECTIVE INSURANCE27,068,0642.52%13. TWIN CITY FIRE INS20,475,6541.91%14. UTICA19,632,1951.83%15. GREAT AMERICAN14,874,1351.39%16. NATIONAL GRANGE14,232,1331.33%17. OLD REPUBLIC13,908,0571.30%18. NEW HAMPSHIRE12,465,3791.16%19. GREEN MOUNTAIN12,067,5371.13%20. FEDERATED MUTUAL11,598,7131.08%21. AMERICAN CASUALTY11,021,8111.03%22. ARGONAUT10,421,7560.97%23. EMPLOYERS MUTUAL9,985,4230.93%24. FEDERAL9,944,9500.93%25. N&D MUTUAL8,851,3050.83%26. FARM FAMLY8,381,0680.78%27. CENTRAL MUTUAL INS8,068,1470.75%28. US FIRE6,451,5640.60%29. BANKERS5,588,1330.52%30. CINCINNATI5,372,0690.50%31. MIDDLESEX INS CO5,221,8820.49%32. MERCH MUTUAL4,706,3450.44%33. ARCH4,344,5110.41%34. IMPERIUM4,090,7630.38%35. QUINCY MUTUAL3,328,0740.31%36. STARR INDEMNITY3,172,2810.30%37. HARLEYSVILLE INS3,010,2760.28%38. NEW YORK AND GENERAL INS2,788,7810.26%39. PREFERRED MUTUAL2,300,3460.21%40. LANCER INSURANCE CO.2,211,1820.21%41. MOTORISTS2,149,5670.20%42. PROTECTIVE1,957,4930.18%43. STATE AUTO1,808,2180.17%44. ATLANTIC SPECIALTY1,358,8440.13%45. GEICO1,325,5840.12%46. SECURITY NATIONAL1,012,4710.09%47. CHURCH MUTUAL947,3110.09%48. BERKSHIRE HATHAWAY939,1400.09%49. GREENWICH822,7260.08%50. PENN MNFCT ASSC INS817,8110.08%51. EVEREST NATIONAL758,8460.07%52. PENN LUMBERMENS698,9610.07%53. AMERICAN AUTOMOBILE563,8930.05%54. ALLSTATE427,8940.04%55. AXIS REINSURANCE328,6650.03%56. FALLS LAKE283,4280.03%57. SOMPO AMERICA250,6500.02%58. MITSUI SUMITOMO242,8980.02%59. AMERICAN FAMILY199,6760.02%60. RLI178,0430.02%61. AMICA MUTUAL166,9880.02%62. QBE161,1090.02%63. STARSTONE NATIONAL135,4370.01%64. STATE FARM90,6760.01%65. GUIDEONE MUTUAL49,5980.00%66. CUMIS37,0980.00%67. AMERICAN ALTERNATIVE30,9890.00%68. MARKEL AMERICAN9,7260.00%69. T.H.E. INS CO6870.00%70. ALLIED WORLD SPECIALTY-940.00%1,072,393,727100.00%

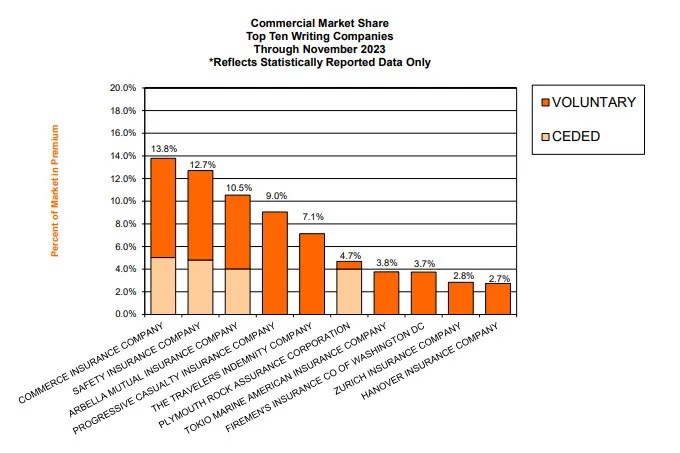

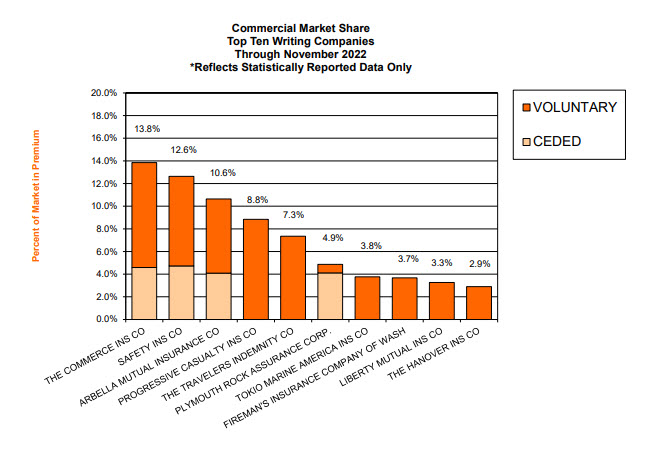

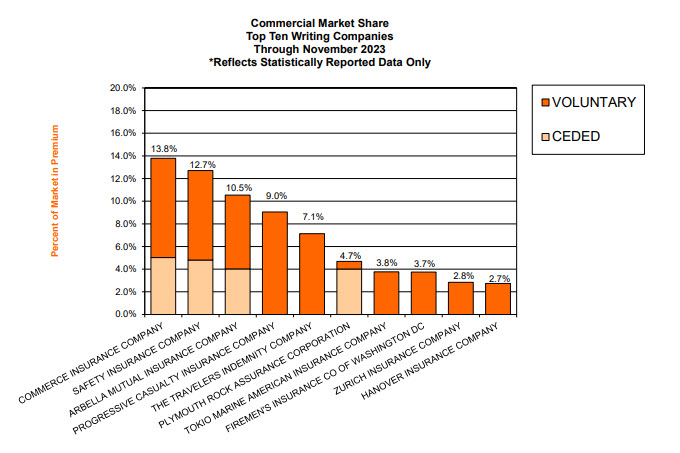

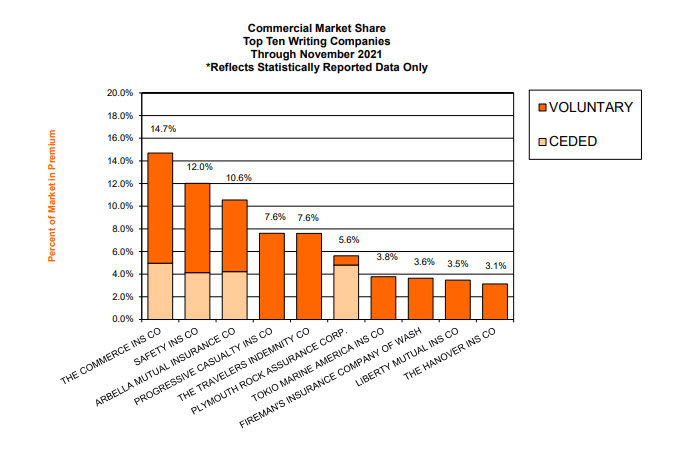

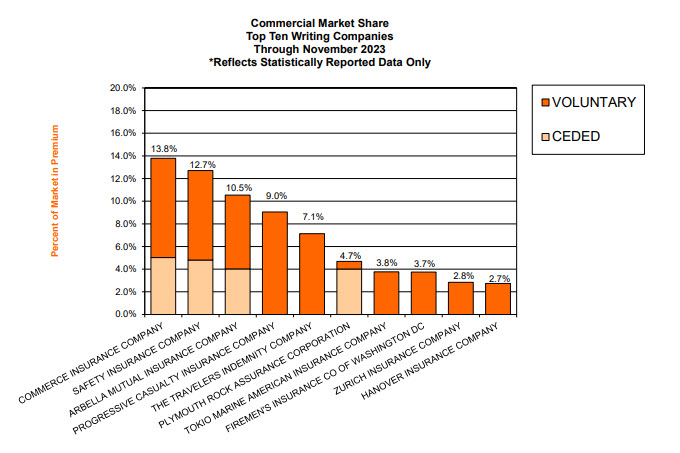

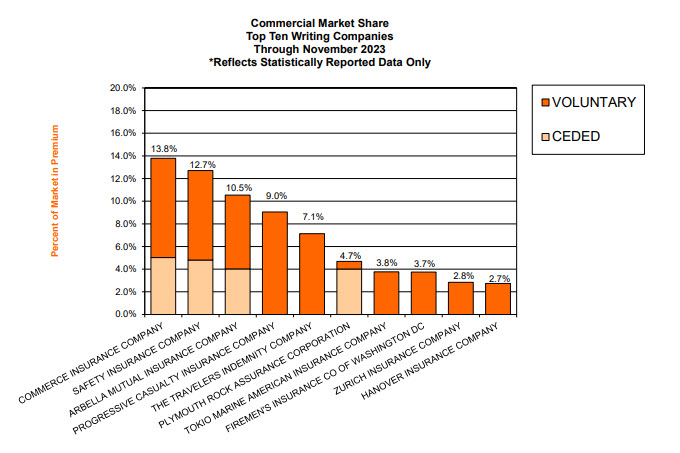

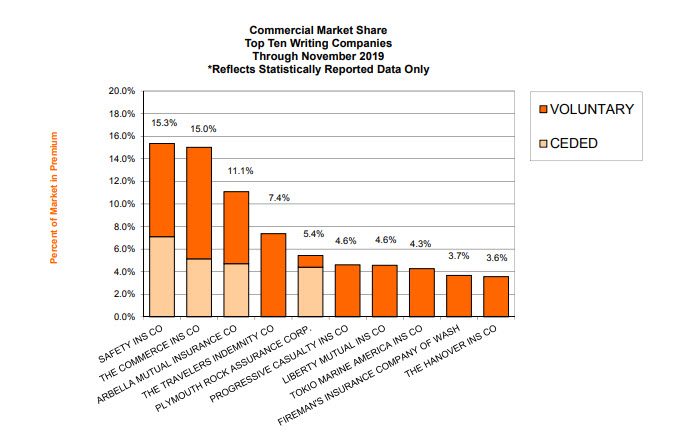

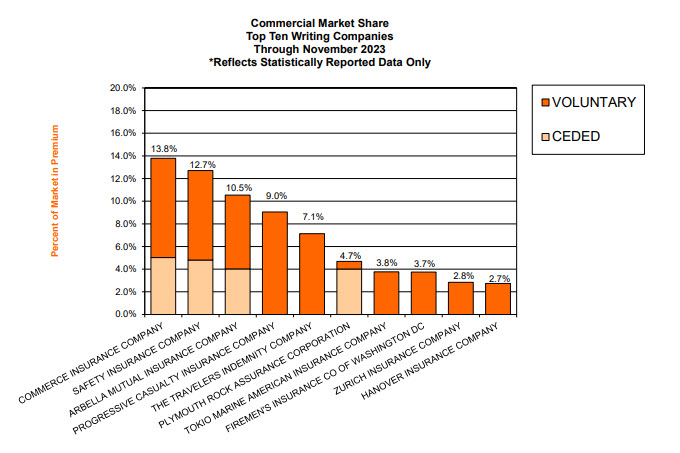

Retrospective of the Commercial Auto Marketplace

The following are graphs depicting the state of the Commercial Auto Insurance Marketplace over the past 10 years. The first graph shows the top 10 Commercial Auto Insurers as of November 2023, as compared to similar November in 2022, November 2021, November 2020, and November 2019. Following these comparisons, there are two more comparisons with, one from five years ago in November 2023 and then the last from ten years ago in November 2013.

Each year can be compared by sliding the window to either the left or right on each of the graph comparisons below.

November 2023 v. November 2022

Use the arrows to slide over each graph to view them individually or for further comparison.

November 2023 v. November 2021

November 2023 v. November 2020

November 2023 v. November 2019

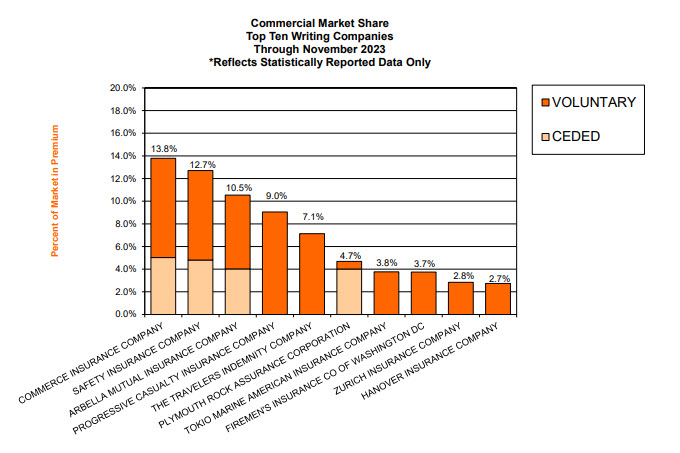

A 5-Year Comparison of the Marketplace

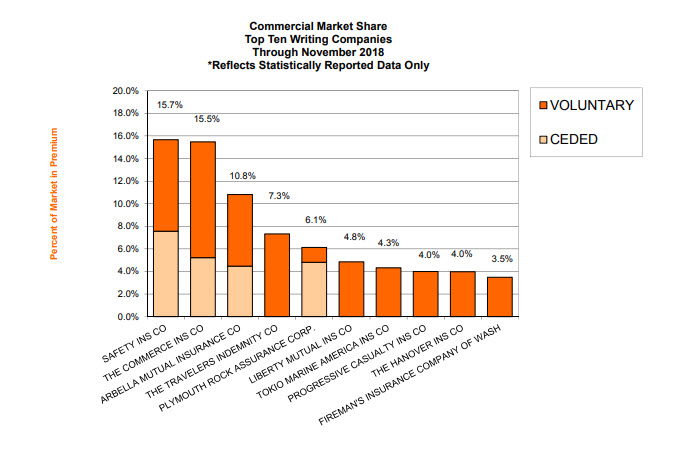

November 2023 v. November 2018

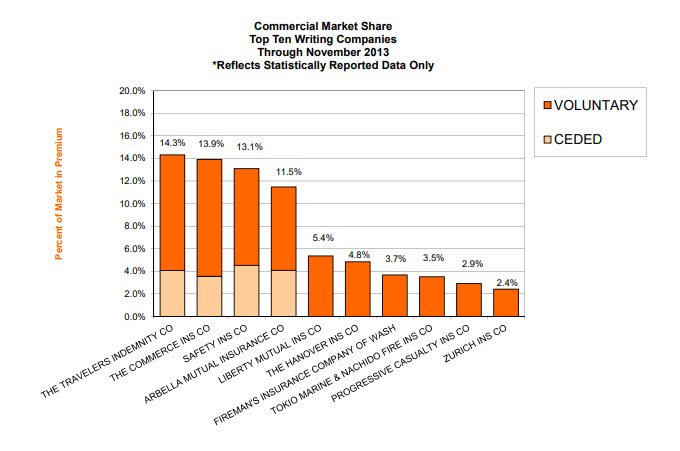

A 10-Year Comparison of the Marketplace

November 2023 v. November 2013

Past Market Share Reports

For those interested in reviewing all of our bi-monthly updates throughout 2022 & 2023 in order to get a sense of how the Commercial Auto Insurance marketplace continues to evolve, please find links to Agency Checklists’ previous updates below:

2023 Market Share Reports