Casualty comes back to bite

Casualty comes back to bite | Insurance Business America

Insurance News

Casualty comes back to bite

Analysts expect full year results reserving hits to keep on coming

Insurance News

By

Jen Frost

Casualty has eaten into 2023 insurer results, as carriers experience adverse reserving pressure in a post-pandemic landscape.

The pinch is unlikely to be limited to insurers that have already reported, with analysts anticipating that other carriers are likely to find themselves facing a costly rethink.

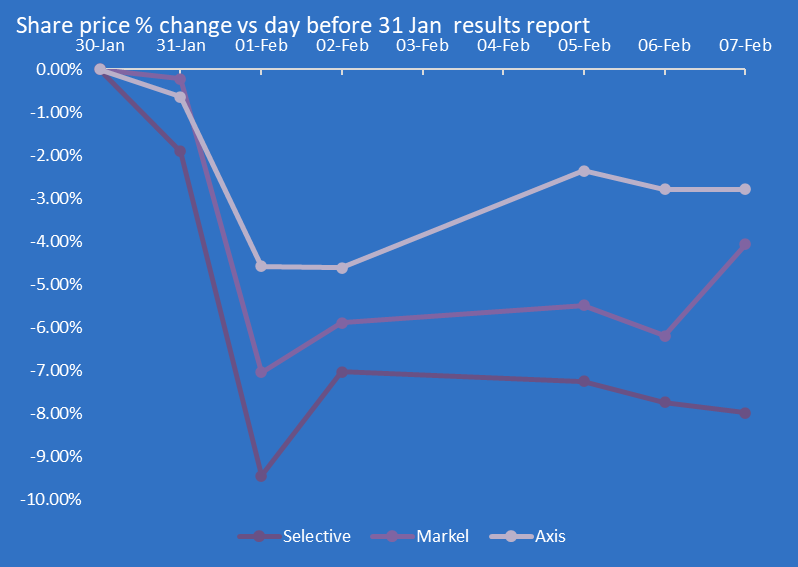

Markel, AXIS Capital, and Selective Insurance have yet to fully recover from post-results share price dips that followed reserving updates.

Selective, which recorded net adverse casualty development of $10 million in Q4, hiked general liability reserves to the tune of $55 million.

How other insurers look to apply their philosophies to reserve revisions remains to be seen. Some, but not all, will be taking an “ultra conservative” approach, AM Best senior director Sridhar Manyem told Insurance Business.

Pandemic exacerbates casualty reserving pressures

The hits come as insurance companies grapple with the pandemic’s impact on long-tail business.

Inflation, claims costs, medical inflation, supply chain impacts, and cyber risk have all added to pressure.

Insurers have, in recent years, found themselves battling to catch up with inadequate pricing, with commercial auto liability and directors and officers (D&O) proving pain points.

Commercial auto results saw a deterioration across the first three quarters of 2023. It is too early to say the extent to which adverse reserve development is baked in, AM Best analysts said.

Since-softened D&O pricing only spiked after the latter half of 2020 as insurers rushed to address a decade’s worth of adverse development and results.

Concerns around historic casualty pricing and reserving may not be new “news”, as Chubb CEO Evan Greenberg put it to investors last August, but insurers are now experiencing the strain.

Chubb itself booked $55 million of unfavorable reserve development across auto and excess casualty in Q3 2023.

Anti-corporate bias manifests in social inflation as litigation funding adds to pressure

This all comes as insurers are battling to get to grips with anti-corporate bias that has blazed a social inflation trail through the courts.

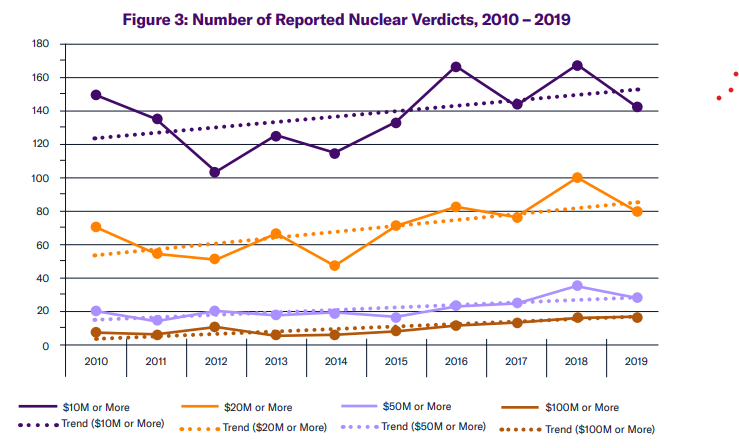

COVID-related court delays have provided a sting in the tail, with claims locked in limbo and nuclear verdicts trending up.

“The longer cases stay open, the more subjected they are to that one jury verdict that then sets a precedent for everything else in that jurisdiction,” said Christopher Graham, AM Best senior industry research analyst. “Once you get… [for example] that $5 million verdict, no plaintiff attorney is going to settle for less than that.”

Image credit: US Chamber of Commerce Institute for Legal Reform, Nuclear Verdicts 2022 report

Some investors have found that backing legal actions can deliver better returns than more traditional capital markets routes. They may lose out if a case does not go a plaintiff’s way, but this “hit and miss” volatility tends to average out with a big award, Graham said.

Some states have moved to enforce greater transparency and regulation around third-party litigation funding (TPLF); however, their efforts have yet to produce a dampening effect.

In a recent blog, Gutterman cautioned that casualty reserves will continue to be a net drag on earnings for years to come.

A senior broking executive has called into question insurers’ ability to deliver on their version of future adequate pricing.

“I don’t think that they [insurers] are going to be able to get the pricing that they want, or think they need, which is a nice way of saying that I would be surprised if you see a significant upward pressure on casualty pricing,” J. Powell Brown, Brown & Brown CEO, told investors during the broker’s Q4 2023 earnings call.

Nevertheless, there is some industry “optimism” that a similar level of adverse development to that seen in 2023 may be avoided into 2024 and beyond, AM Best analyst David Blades told Insurance Business.

Got a view on casualty reserving challenges? Leave a comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!