Secure Act 2.0: A Timeline

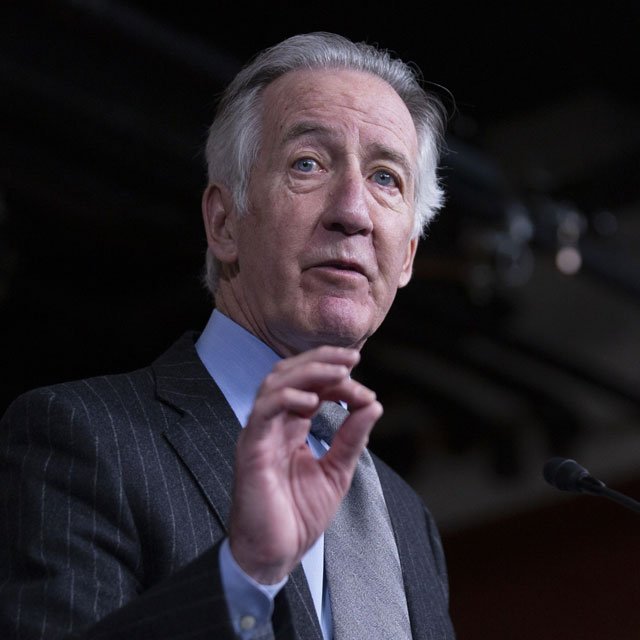

Since passage of the Setting Every Community Up for Retirement Enhancement (Secure) Act in 2019, lawmakers — chiefly House Ways and Means Committee Chairman Richard Neal — have been steadfast in pushing a second batch of changes to retirement account rules.

The House passed the Securing a Strong Retirement Act of 2022, known as Secure Act 2.0, on March 29. The huge retirement bill now moves to the Senate.

Political watchers expect the Senate committees on Finance and on Health, Education, Labor and Pensions to mark up and pass their version of Secure 2.0 later this spring, likely in May or June.

Sen. Patty Murray, D-Wash., chairwoman of the Senate HELP Committee, plans to work with Sen. Richard Burr, R-N.C., and their colleagues on a “bipartisan retirement package, which they are aiming to release later this spring,” a spokesperson for Murray told ThinkAdvisor in a recent email.

Shai Akabas, director of economic policy at the Bipartisan Policy Center in Washington, told ThinkAdvisor that the lame-duck session after the midterm elections in early November “is probably the most likely time frame for when a bill could move on the Senate floor. It’s possible that an opportunity arises before then, but finding floor time is always a challenge.”

Many senators, Akabas said, “are eager to include provisions that offer solutions” to Americans’ retirement savings challenge.

Akabas pointed to legislation that will likely be included in the Senate’s version of Secure Act 2.0.

Sens. Cory Booker, D-N.J., and Todd Young, R-Ind., co-sponsored the Strengthening Financial Security Through Short-Term Savings Accounts Act of 2021, which focuses on emergency savings. “I expect [it] to receive serious consideration for inclusion in the Senate version,” Akabas said.

The bill would “clarify regulations to allow employers to automatically enroll their workers into an emergency savings account alongside their retirement account,” Akabas explained.