Hannover Re ‘satisfied’ with outcome of more stable Jan renewals as portfolio grows 6.9%

German reinsurer Hannover Re has today reported an inflation and risk-adjusted price increase on renewed business of 2.3% at the January 1st, 2024, renewals, as the firm took advantage of greater demand for protection, growing its portfolio 6.9% to more than EUR 10.2 billion.

Hannover Re describes the market at 1/1 2024 as more stable than in the previous year, with increased demand for reinsurance limited primarily to covers from existing players.

The reinsurer had treaties with a premium volume of EUR 9.552 billion up for renewal on Jan 1, which accounts for 62% of business in traditional property and casualty reinsurance.

All in all, the company renewed a premium volume of EUR 8.671 billion, while treaties worth EUR 881 million were either cancelled or renewed in modified form. Together with increases of EUR 1.541 billion from new treaties and from changes in prices and treaty shares, Hannover Re reports that renewed premium volume grew in an “attractive market environment” by 6.9% to EUR 10.212 billion.

According to the firm, prices were, for the most part, stable or slightly higher. In line with 2023, the carrier grew its non-proportional reinsurance book more strongly at 1/1 2024, with premium volume here up more than 10% to EUR 3.178 billion, with a risk-adjusted price increase of 4.4%. The firm did still grow its proportional business by 5.3% to slightly more than EUR 7 billion, resulting in a risk-adjusted price increase of 1.3%.

In the natural catastrophe business, Hannover Re achieved high single-digit growth at the renewals, with significantly higher prices and improvements in coverage structures secured once again, notably for loss-impacted programmes.

Hannover Re states that there was also sufficient natural catastrophe capacity available in the retrocession market at the renewals, and while the market exhibited discipline, the firm opted to slightly reduce its retro coverage in line with plan.

Artemis spoke with Hannover Re’s Henning Ludolphs about the retro market environment at 1/1 2024 and why the firm decided to shrink its K-Cessions quota share sidecar for 2024.

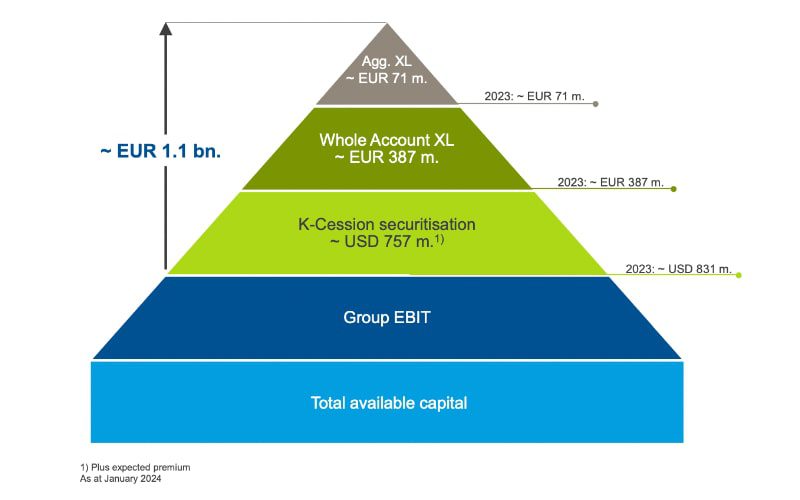

Hannover Re’s retrocessional reinsurance arrangements for 2024 can be seen in the diagram below. It shows that as well as the reduced size of the K-Cessions sidecar, the aggregate excess of loss cover renewed stable, as did the whole account excess of loss cover, although the company decided not to renew its catastrophe swap for 2024, which was sized at EUR 100 million for 2023. As a result of the changes, the firm’s nat cat retro arrangements provide roughly EUR 1.1 billion of protection for 2024, compared with EUR 1.34 billion for 2023.

In addition to these core retro protections, Hannover Re’s retro programmes for 2024 includes the continuation of a cyber quota share which started in 2023 sized at USD 100 million, and is backed by New York based asset manager, Stone Ridge Asset Management. This will be continued in 2024 with capacity of USD 90 million, confirms the reinsurer.

Elsewhere, Hannover Re notes expected stability in facultative reinsurance came to fruition with still high risk-adjusted prices, as the firm posted moderate rate increases in catastrophe-exposed business.

Structured reinsurance also presented opportunities at 1/1, enabling Hannover Re to generate further profitable growth in its portfolio.

Outside of nat cat, in the credit, surety and political risks lines premium volume grew by 10.7%, while aviation and marine lines saw premium volume growth of 11.5%, and the agricultural insurance book grew 16.4%.

“We are satisfied with the outcome of the renewals. Against the backdrop of the loss experience in 2023, continuing high levels of inflation and geopolitical uncertainties, we were able to secure further necessary rate improvements in many lines and regions,” said Jean-Jacques Henchoz, Chief Executive Officer. “Building on the previous year’s sustained improvement in the quality of our book of business, we are thus well placed to tackle future challenges.”

By region, the reinsurer has today reported premium volume growth of 6.5% in the Europe, Middle East and Africa region. The region was hit by heavy losses in 2023, and as such, rate increases and improvements in terms and conditions were especially marked in loss-impacted natural catastrophe business.

More capacity was available in Germany this year, with higher prices achieved here as well as in Italy.

In the Americas, premium volume grew 2.2% year-on-year at 1/1 2024, with further rate improvements in North America which extended to liability business.

Hannover Re says that capacity for catastrophe risks is still inadequate in some Latin American countries, while Asia-Pacific markets were generally stable.

Sven Althoff, the member of Hannover Re’s Executive Board responsible for property and casualty reinsurance, commented: “Demand for our high-quality reinsurance protection was again very strong. This enabled us to generate further profitable growth in our diversified portfolio, especially on the non-proportional side. At the same time, attractive growth opportunities opened up in structured reinsurance and in the area of insurance-linked securities. All in all, we further improved the quality of our book of business.”

As well as an update on its renewal outcome, Hannover Re has released preliminary, unaudited financial figures for 2023, including an operating result of EUR 1.97 billion.

However, the firm has warned that a rise in reserves in P&C reinsurance had a significant impact on EBIT, notably in Q4, which led to a “much greater increase in the confidence level of reserves than originally planned.” Based on initial estimates, Hannover Re expects the resiliency reserve at the end of the 2023 financial year will be significantly higher than the targeted EUR 1.7 billion.

As a result, the operating result for the P&C segment hit EUR 1.1 billion, although the firm emphasises that the underlying profitability “developed very favourably due to the attractive market environment and was fully in line with expectations.”

The company’s Life & Health reinsurance segment contributed EUR 870 million to the 2023 operating result.

All in all, group net income increased from EUR 780 million in 2022 to EUR 1.8 billion in 2023, exceeding the target for the year by EUR 100 million.

Additionally, Hannover Re today confirmed its guidance for 2024.

“The significantly improved profitability of our reinsurance business assures our resilience in a volatile environment. I am therefore convinced that we shall achieve our goals for the 2024 financial year,” said Henchoz.