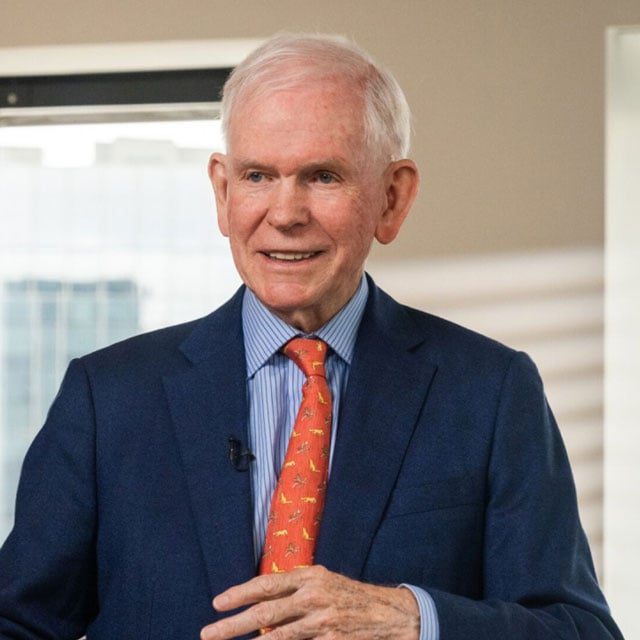

Jeremy Grantham Warns Investors to 'Be Quite Careful' as Big Risks Loom

Against a backdrop of what Jeremy Grantham, co-founder and long-term investment strategist of Grantham, Mayo, Van Otterloo & Co., forecasts for the United States in 2024 as disappointing profits, a weakening economy, a mild recession — at least — and a tough year for the stock market, his chief advice is: “Avoid U.S. stocks.”

That’s what he tells ThinkAdvisor in a recent interview, although he also talks about opportunities. For the perennially bearish investor, those include Japan and emerging markets. In the United States, Grantham points to quality — “The most important inefficiency in the U.S. market,” he says — climate change, resources and ultra-cheap equities.

The first exchange-traded fund at GMO, the Boston-based asset management firm, was launched in November. The actively managed GMO U.S. Quality ETF (QLTY) focuses on high-quality stocks.

In the recent interview, Grantham also offers his long-term outlook for artificial intelligence.

“What I specialize in other than bubbles are long-term, underrated negatives,” he says. “And my God, there’s a rich collection of negatives right now.”

Here are highlights of our conversation:

THINKADVISOR: What are your top predictions for the economy and stock market in 2024?

The negatives I’ve been talking about for a year or two are still coming down the pipelines. Most of them will eventually occur.

The economy will get weaker. We’ll have, at least, a mild recession. Profits will be disappointing. The stock market will have a tough year.

How should financial advisors prepare their clients for all that?

If you want commercial advice, financial advisors should always be madly bullish! That’s clearly the best way for them to run a business.

If it’s your own money, however, I should be quite careful.

What specifically do you think will occur in the stock market this year?

Returns on U.S. stocks will be disappointing. Returns on non-U.S. stocks probably will be fairly close to normal.

I would avoid U.S. stocks. They’re almost ridiculously higher priced than the rest of the world — about as big a gap as there has ever been.

And the profit margins are about as high as they have ever been compared to the rest of the world.

That’s potentially double jeopardy because they can reverse either separately or together.

What non-U.S. stock sectors do you like?

Japan, which could be perfectly reasonable. Emerging markets are very cheap in comparison to the U.S.

Are there any opportunities at all in U.S. stocks?

If you have to [invest] a lot of money in the U.S, these are the places to [go]: quality, climate change, resources and ultra-cheap stocks.

Quality is always a good idea because it’s very dependable in a bear market. Quality is the most important inefficiency in the U.S. market.

Triple-A stocks have always been mispriced, but they have outperformed. And they’ve done particularly well over the last year.

Why?

Because they’re boring. In a bull market, you want to own the Magnificent 7 stocks [Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla], not high-quality stocks because they seem too boring.

But in a bear market, their very boringness is an attractive feature.

Why do you like the climate change category?