You Should Probably Lease A New EV Instead Of Buying One

Despite a big push from the automakers, electric vehicles are not flying off the lots. Of course, the updated tax rules disqualifying many EVs from additional savings aren’t helping. If you’re in the market for an EV, though, there are still some deals to be scored — but you might be better off leasing it.

Fewer New-Car Leases Means Disaster for the Used-Car Market

While some people say “leasing is a terrible financial move,” I’ve always approached the lease-versus-buy question on a very case-by-case basis. It all depends on what a customer is trying to accomplish regarding their monthly payment target and vehicle needs.

The other key factor is the market conditions for leasing versus buying within certain segments. It wasn’t that long ago when I indicated that most gas-powered cars have terrible lease programs, and you would be better off buying something. With the electric vehicle market favoring the buyers instead of the sellers, the lease could actually be the better play for the following reasons.

You Still Get The Tax Credit

The Inflation Reduction Act that passed last year built in some staged restrictions regarding which vehicles would qualify for the $7,500 Federal Tax Credit. Last year several vehicles that were not produced in North America were disqualified from the credit. This year is all about where the batteries come from, “EVs with battery materials sourced from “foreign entities of concern” [China, North Korea, and Russia, namely] will get no federal incentive at all.”

However, most EVs still can get the $7500 credit if they are leased, and customers get this discount regardless of their filing status.

Better Rebates From The Automakers

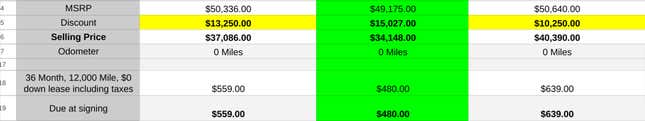

In addition to the $7,500 tax credit reduction, several automakers are piling on additional rebates and discounts to further sweeten the deal. Here is a grid of bids that my team gathered on a Volvo C40 Recharge; you’ll see the $7,500 tax credit applied but also some significant other discounts in the form of dealer cash rebates for leasing.

Screenshot: Tom McParland

Lower Payments Means More Car For Your Dollar

The average price for an electric vehicle is still higher than a gas-powered counterpart, and with average car payments well over $700 per month, financing and electric vehicles may be out of reach for most consumers. However, the combination of tax credits and heavy discounts may mean that an EV lease has more “reasonable” monthly costs.

For example, here’s a grid of some VW ID.4 Pro bids for a leasing customer in New England.

Screenshot: Tom McParland

This is a car that retails for close to $50,000, and we were able to find combined discounts upwards of $15,000, which meant a lease payment of only $480 per month with just the first month’s payment due at signing.

If a buyer was looking to finance a car with a payment of $480 per month assuming a 60-month loan at six percent APR, that would translate to an all-in cost of about $25,000. This ID.4 example illustrates how you can get a car that is almost twice as expensive for the same payment.

An argument can be made that with a lease you don’t have ownership of the vehicle and therefore you are “stuck” in the cycle of payments; from a purely financial perspective, the best move is to buy a car, pay it off, and hold onto it for as long as possible. Given that the longevity and reliability of EVs are a bit unknown at this point, most EV buyers aren’t planning to use these cars as long-term purchases, so resale value needs to be taken into account.

You Won’t Gamble On Resale Value With A Lease

A quick peek at the used EV market shows that electric models are suffering from accelerated depreciation due to a combination of lower demand and technological improvements from more recent models. This trend of low-resale value isn’t predicted to change in the next few years, so if someone were to purchase a new EV now they may be in for a rough time when they go to trade that car in. With an EV lease, that customer doesn’t need to worry about the massive depreciation, if the value of their EV is lower than what the leasing company had predicted they just give it back and move on to something else.

The industry is coming around to the fact that the pace of EV adoption is going to be slower than was initially predicted. America’s charging infrastructure still needs a lot of work, and for many buyers, a hybrid or plug-in makes more sense for their driving needs. But for folks looking to make the leap to electric now, a lease on a brand new one may lower risk and better opportunities for deals.

Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to Tom@AutomatchConsulting.com