Global natural disasters cost insurers $95bn in 2023: Munich Re

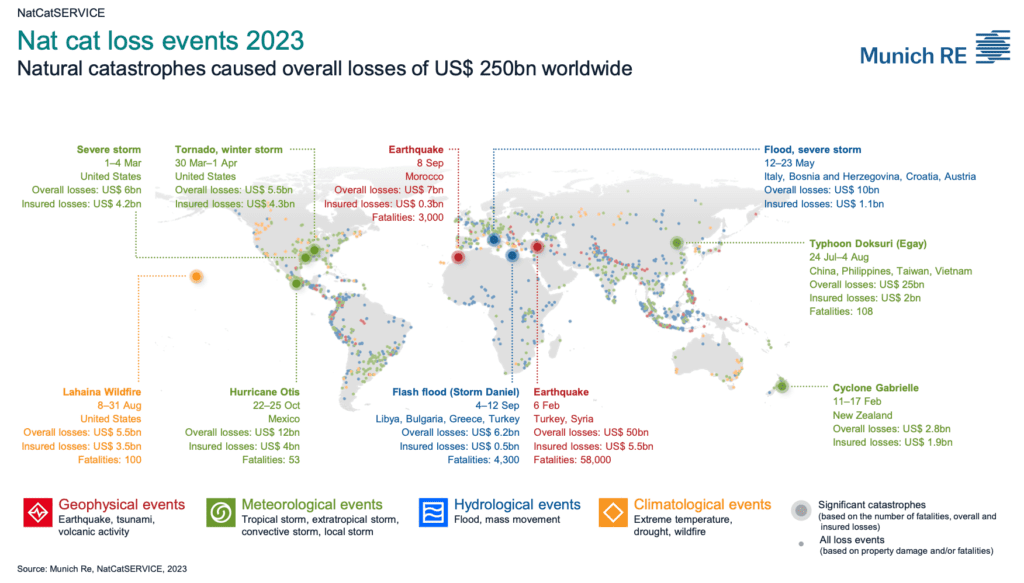

Over the course of last year, global natural disasters and severe weather are estimated to have caused the insurance and reinsurance industry losses of US $95 billion, Munich Re estimates, while the economic cost of the same disasters is put at $250 billion by the reinsurer.

At $95 billion, global insured disaster losses are close to the 5-year average of $105 billion, Munich Re explained, but slightly above the 10-year average of $90 billion.

Unlike previous years, there were no mega-disaster events to push up the industry loss total, the reinsurer said.

Instead, significant losses from numerous severe storms were the main driver of 2023’s insured catastrophe losses.

Thomas Blunck, Member of the Board of Management at Munich Re, commented, “The year 2023 was once again characterised by extremely high insured losses from natural disasters, despite the fact that there were no extreme individual losses. This underlines the important role that insurance plays in cushioning the consequences of natural disasters.

“Comprehensive data and in-depth knowledge of changes in risks remain key factors when designing covers to protect people against natural disasters. A further important aspect is prevention. The number of victims from the devastating earthquakes this year is a wake-up call to ensure better protection for people by adapting construction methods.”

Thunderstorm losses reached a new high globally, with the US severe convective storm season driving record losses of $66 billion, of which $50 billion were covered by insurance.

In Europe the figures were $10 billion of thunderstorm damages, with $8 billion insured, Munich Re said.

“A large body of scientific research indicates that climate change favours severe weather with heavy hailstorms. Similarly, loss statistics from thunderstorms in North America and other regions are trending upwards,” the reinsurer further explained.

Munich Re also noted that, “Weather disasters were exacerbated by extremely high temperatures.”

Adding, “Worldwide, average temperatures to November were roughly 1.3°C above those in pre-industrial times (1850–1900). It soon became clear that 2023 would become the hottest year since temperature measurements began, which means that the last ten years are the hottest on record.”

“The warming of the earth that has been accelerating for some years is intensifying the extreme weather in many regions, leading to increasing loss potentials. More water evaporates at higher temperatures, and additional moisture in the atmosphere provides further energy for severe storms. Society and industry need to adapt to the changing risks – otherwise loss burdens will inevitably increase. Analysing risks and the changes to them is hardwired into Munich Re’s DNA. That is what enables us to consistently offer insurance covers against natural disasters – and even to expand them. This allows us to cushion a portion of the losses and alleviate some of the hardship caused,” Ernst Rauch, Chief Climate Scientist at Munich Re explained.

In terms of the most costliest disaster losses for the global insurance and reinsurance industry in 2023, Munich Re estimates industry losses as follows:

Turkey / Syria earthquakes in Feb 2023 – US $5.5 billion.

USA tornado and winter storm in Mar/Apri 2023 – US $4.3 billion.

USA severe storm in Mar 2023 – $4.2 billion.

Mexico’s Hurricane Otis in Oct 2023 – US $4 billion.

USA tornado series and severe storms in Jun 2023 – US $3.9 billion.

Lahaina wildfire, Maui in Aug 2023 – US $3.5 billion.

Typhoon Doksuri in Jul 2023 – US $2 billion.