Embroker’s Technology-Centric Strategy, from the CEO

Our platform is growing.

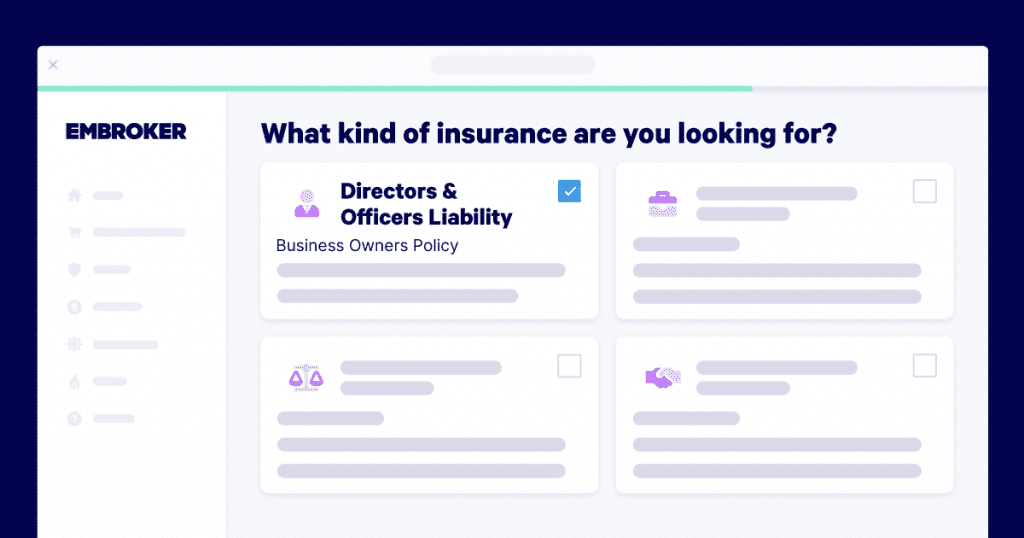

We wanted to provide an update and insight on how the company is rolling out its mission to advance the Embroker ONE platform: its universal application that uses AI and machine learning to generate business insurance products tailored to specific industry needs. The platform will ultimately serve as a single destination designed for an ever-expanding network of vertically-centric buyers to simply purchase the right coverage program from the most appropriate source for their business in just minutes.

Embroker ONE expands coverage options for current customers by working with underwriting partners and employing machine learning and third-party data to craft programs tailored to a business’ specific risk profile. As the platform advances, users will be directly recommended coverage from Embroker’s branching network of partners.

Since announcing the technology platform in early 2023, Embroker has reduced the cognitive load of insurance-buying with a single-application experience for users in underserved industries. The platform’s single application experience delivers multiple coverages to get customers optimal policies faster by removing redundant questions and other sources of friction.

The ONE by Embroker platform is built to efficiently stand up holistic insurance programs to new and existing industries. It can digitize non-digital programs, seamlessly integrate with partner APIs, and create digital application hand-offs to industry participants determined to maintain the status quo. Embroker recently expanded the ONE platform capabilities for law firms and will roll out additional industry vertical offerings in late 2023 and into 2024.

Reflecting on 90 days: Strategic Hires and Partnerships

Since Jennings became CEO three months ago, Embroker has also hired Gene Linetsky as chief technology officer (CTO) and Chris Spagnuolo as chief product officer (CPO). These critical strategic hires are focused on leading Embroker ONE’s technology and platform development as it expands into new industries and offerings.

“Embroker will continue to drive technology disruption in the commercial insurance space, embracing cutting edge technologies, AI, ML and Big Data to dramatically improve the customer’s overall buying experience,” said Ben Jennings, CEO at Embroker. “Embroker ONE does exactly that. ONE provides an easily understood, low friction purchasing process that educates the buyer while stripping away the needless complexity of traditional insurance. The customer is presented with a policy or policies tailored specifically to their unique business needs.”

In building a digital-first, customer-centric insurance experience, Jennings has expedited Embroker’s mission to dismantle the legacy inefficiencies from the commercial insurance buying experience. Embroker connects businesses directly to their policies to better protect underinsured industries often overlooked by others, and make them more informed about their risks and how they can combat them.

In his first 90 days, Jennings also completed two strategic partnerships with Dashlane and Cowbell, both key advancements in the development of the Embroker ONE Platform. These partnerships increase customer security through Dashlane’s industry-renowned cyber protection services and expand Embroker’s Cyber Liability coverage by offering Cowbell Cyber insurance to its growing library of policy options.