Critics Take Aim at New DOL Fiduciary Rule

Labor’s rule “also raises significant legal questions,” Iacovella said. “Rather than follow the letter of the law, the DOL has chosen to blatantly violate the legal authority” under which Acting Labor Secretary Julie Su may perform duties related to official actions like rulemakings, Iacovella said, “under the Federal Vacancies Reform Act and the Appointments Clause of the Constitution.”

Given that Su has been acting secretary for over 210 days, Iacovella continued, the fiduciary proposal “and any other official action approved by Su at the DOL will be the subject of strict legal scrutiny.”

Labor, Iacovella added, “needs to cease any further action on this rulemaking because no American deserves to be locked out of retirement options or have their financial security threatened for political gain.”

Fred Reish, partner at Faegre Drinker in Los Angeles, said he sees the insurance industry challenging the new fiduciary proposal and the related amendments to Prohibited Transaction Exemption 84-24, which covers annuity transactions.

“While it is less certain, I think it is likely that some part of the securities industry will also challenge the proposed fiduciary definition that says that a rollover recommendation is a fiduciary regulation subject to the fiduciary standards and the conflicts restrictions,” Reish told ThinkAdvisor Wednesday in an email.

Labor’s new fiduciary proposal, according to Wayne Chopus, president and CEO of the Insured Retirement Institute in Washington, doubles down “on a previously failed policy that clearly runs counter to the goals of Bidenomics.”

Said Chopus in a statement: “Despite labeling the proposal as ‘retirement security’ … the rule will only increase retirement insecurity and result in millions of lower- and middle-income workers and retirement savers losing access to needed financial advice.”

Bidenomics, Chopus opined, “is supposed to be about growing the economy from the bottom up and the middle out, but this proposal will drop the bottom out for millions of Americans struggling to achieve their retirement goals.”

IRI, Chopus said, “will fight this proposal just as we did with DOL’s 2016 poorly concocted fiduciary rule that also masqueraded as consumer protection but instead caused extensive harm.”

The U.S. Court of Appeals for the Fifth Circuit vacated the 2016 rule in 2018, Chopus said, “but not before 10 million smaller retirement account owners, with more than $900 billion in retirement savings, lost the ability to work with their preferred financial professionals.”

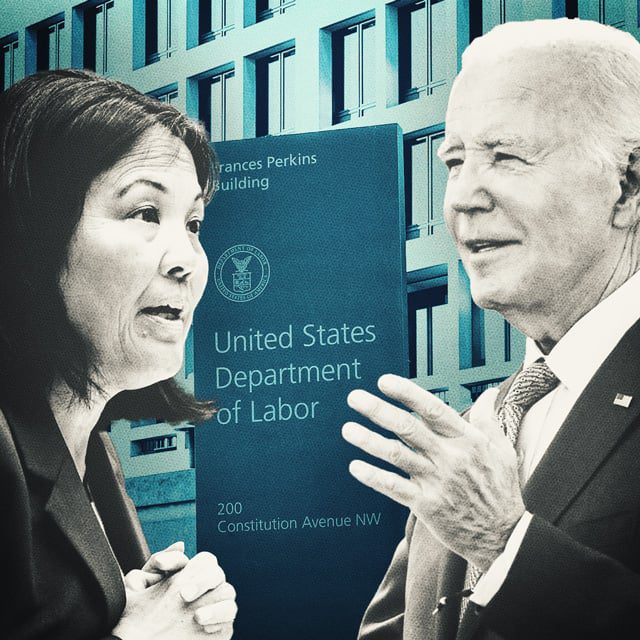

Photo Illustration: Chris Nicholls/ALM; photos of Acting Labor Secretary Julie Su and President Joe Biden, Bloomberg; photo of DOL headquarters: Shutterstock