GM Is Still Making Billions Of Dollars Despite Auto Workers’ Strike

Good morning! It’s Tuesday, October 24, 2023, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

Unboxing An $8,000 BMW E-Bike

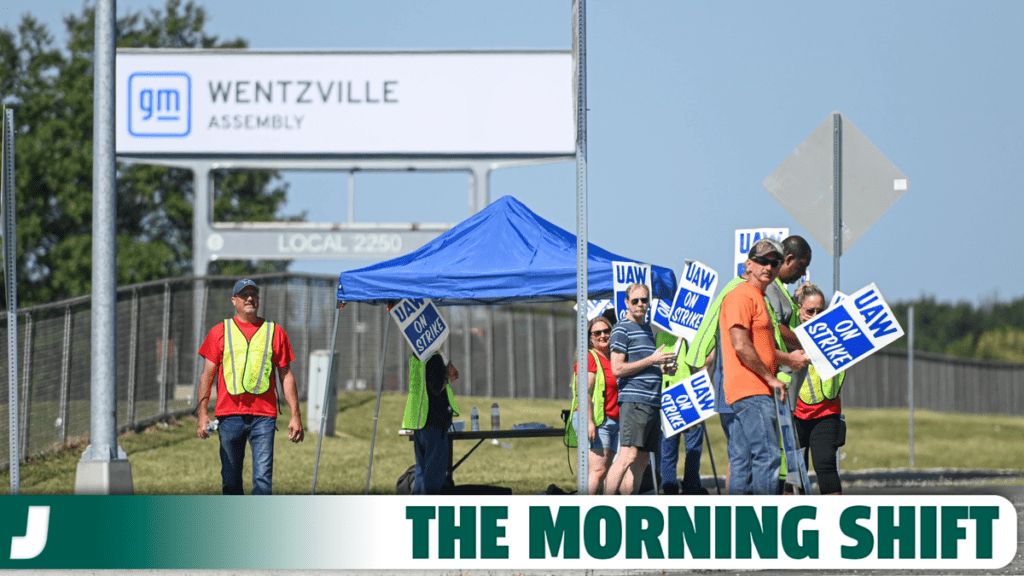

1st Gear: The UAW Strike Is Sort Of Hurting GM

General Motors says the United Auto Workers union strike has cost the automaker $800 million so far, and it’s increasing by $200 million for every week it continues. It has also withdrawn its 2023 financial guidance as well as its electric vehicle production targets through mid-2024. Despite this, the company still reported a third-quarter net income of $3.1 billion. A huge number, but it does represent a 7.3 percent decline. From Automotive News:

GM said adjusted earnings before interest and taxes fell 17 percent in the third quarter to $3.6 billion, including a $200 million reduction attributed to the strike that began Sept. 15. Production lost so far in the fourth quarter amounts to $600 million, CFO Paul Jacobson told reporters.

Global revenue rose 5.4 percent in the quarter ended Sept. 30 to $44.1 billion, and net profit margins fell to 6.9 percent from 7.9 percent a year earlier.

GM earned $3.5 billion in North America before interest and taxes, down 9.5 percent, and its adjusted margin for the region fell to 9.8 percent, from 11.2 percent a year ago.

“Our supply chain team and logistics partners in North America have done great work improving the flow of vehicles from our assembly plants to our dealers,” CEO Mary Barra said in a letter to shareholders. “Our U.S. dealers helped us outperform the market with strong pricing and essentially flat incentives. We were profitable in every region, including China.”

The automaker withdrew its guidance for the full year, citing uncertainty from the strike, which is now in its sixth week. GM in July had raised its 2023 guidance to net income of $9.3 billion to $10.7 billion and adjusted EBIT of $12 billion to $14 billion.

GM also said its EV production goals have become a lot less certain, but that reportedly doesn’t have anything to do with the strike. The automaker is no longer saying it expects to build 400,000 EVs in North America by the middle of 2024 in an effort to balance “production to demand,” according to Jacobson. Despite this, GM still plans to have the capacity to build 1 million EVs in North America by the end of 2025.

Looking back, the UAW’s 40-day strike against GM in 2019 cost the automaker $3.6 billion, but that strike involved more plants and workers than the current Stand Up Strike.

2nd Gear: Big Three EV Battery Partnerships Are A Mess

As it turns out, the United Auto Workers union strike against the Big Three is having some serious ripple effects when it comes to the automakers’ overseas battery plans and partnerships. Ford, General Motors and Stellantis are all in jeopardy of messing up partnerships with various Korean companies if they do not end the strike soon. From Bloomberg:

LG Energy Solution Ltd., SK On Co. and Samsung SDI Co. have planned about $28 billion of investment along with General Motors Co., Ford Motor Co. and Stellantis NV in US electric-vehicle battery factories they’ll run as joint ventures. Those plants are major sticking points in contract negotiations between the three automakers and the United Auto Workers, which wants to unionize the 19,600 people the companies plan to hire.

While South Korea’s three biggest battery suppliers have kept a low profile during a more than monthlong strikes at GM, Ford and Stellantis facilities, they’re anxious about the union pressing for substantial wage increases, according to Kim Kwang-ju, chief executive officer of SNE Research. Some companies, including component makers that have announced significant investment in the US, are reconsidering their plans, he said.

“The cost of running plants in the US is already about twice the cost of other regions,” Kim said. “The atmosphere of the industry is not good these days — battery prices are falling, and inventory is rising due to weaker-than-expected demand for EVs.”

The UAW’s push to organize the battery factories — all but one of which hasn’t opened yet — is sapping some of the enthusiasm from projects the companies have billed as transformative. While higher labor costs risk being a long-term issue, copious amounts of government funding will be coming their way. President Joe Biden’s signature climate bill, the Inflation Reduction Act, will award companies billions of dollars worth of tax credits toward cell and pack manufacturing, and the Department of Energy has offered to loan Ford and GM’s ventures a combined $11.7 billion.

Even with that sort of support, these battery companies are reportedly facing a pretty up-hill battle. In order for the EVs they are helping to produce to qualify for consumer tax credits, automakers and battery partners have to reduce their reliance on Chinese-sourced parts and materials.

The UAW’s demands could further complicate matters. The union has been striking at select plants across the country since mid-September and has threatened to walk out from more facilities if contract talks don’t progress. On Monday, another 6,800 union members went on strike at the biggest Stellantis plant in the US: a Ram pickup factory in Sterling Heights, Michigan.

Workers were preparing to walk out of GM’s full-size sport utility vehicle plant in Arlington, Texas, early this month, but decided against it at the last minute when the union believed it had reached an accord for the carmaker to recognize future hires at battery plants as part of its master labor agreement. GM and the UAW have yet to hammer out a deal that the union would then hope to impose on Ford and Stellantis.

“We were too optimistic about the IRA, just thinking about the credits only,” Park told Bloomberg, adding that they should consider slowing down how aggressively they are investing in the U.S.

3rd Gear: Tesla Autopilot Death Trial Near Final Stages

Closing arguments are set to begin on Tuesday in the Tesla Autopilot death trial. It’s alleged that the driver-assist system led to a person’s death. This is the first trial of its kind in the U.S., and its results could help shape similar cases across the country.

The civil lawsuit alleges Autopilot caused Micah Lee’s Model 3 to suddenly veer off a highway near Los Angeles at 65 mph, hit a palm tree and burst into flames, all in the span of seconds. The crash killed Lee and seriously injured his two passengers, including a then-8-year-old boy who was disemboweled.

The lawsuit, filed against the Austin, Texas-based automaker by the passengers, accuses the company of knowing that Autopilot and other onboard safety systems were defective when the car was sold. From Reuters:

The jury trial, in a California state court, featured testimony from one Tesla employee about Autopilot that the company repeatedly asked to be kept hidden from the public. A judge refused.

[…]

Tesla has denied liability, saying Lee consumed alcohol before getting behind the wheel. The electric-vehicle maker also claims it was unclear whether Autopilot was engaged at the time of the crash.

Tesla has been testing and rolling out its Autopilot and more advanced Full Self-Driving (FSD) system, which Chief Executive Elon Musk has touted as crucial to his company’s future but which has drawn regulatory and legal scrutiny.

The company argued that punitive damages should not be awarded in the case. But plaintiff lawyers cited testimony from Tesla engineer Eloy Rubio Blanco, who acknowledged during the trial that Tesla understood software on the car could have latent defects.

On the stand, Rubio also rejected a suggestion from Lee’s attorney that the company chose the name “Full Self-Driving” because it hoped the public would think its vehicles had more features.

Closing arguments are set to begin at 10 a.m. Pacific time on October 24, so 1 p.m. EST for us folks out East.

4th Gear: Mitsubishi Ends Chinese Production

Mitsubishi Motors is apparently pulling vehicle production out of China, and its transferring its stake in the joint venture to its Chinese partner. It is the latest foreign automaker to cut back on operations in China, the world’s largest auto market. From Reuters:

The decision by the Japanese car maker comes amid fierce price competition in China which has led global automakers such as Hyundai Motor (005380.KS) and Stellantis to take steps to bring down costs by restructuring their businesses.

Mitsubishi Motors separately said on Tuesday it will invest up to 200 million euros ($214 million) in the new electric vehicle unit of French counterpart Renault, as it seeks to strengthen its foothold in Europe and other markets.

The Japanese automaker established its JV in China with Guangzhou Automobile Group (GAC) and trading house Mitsubishi Corp in 2012.

Following a transfer of Mitsubishi Motors’ and Mitsubishi’s stake in the JV to their Chinese partner, it will become a wholly-owned subsidiary of GAC, the Japanese automaker said.

The JV plant will start producing GAC’s Aion cars from June 2024, which would help the EV brand to achieve a total annual capacity of 600,000 units by then, GAC said in a separate statement on the social media WeChat platform.

Mitsubishi would take on a special loss of 24.3 billion yen ($162.4 million) for this current financial year because of its restructuring in China, according to Reuters. However, it didn’t make any changes to its full-year earnings forecast.

Reverse: A Real Goddamn Shame

Neutral: I Took My Cat To The Park

Clio the cat in Central ParkPhoto: Andy Kalmowitz / Jalopnik

She didn’t like it.

On The Radio: Paul Revere & The Raiders – “Hungry”

Paul Revere & The Raiders – Hungry (Audio)