Can You Get Life Insurance if You Have Bipolar Disorder?

In a hurry, complete this questionnaire and I’ll send you a quote taking BPD into account

—

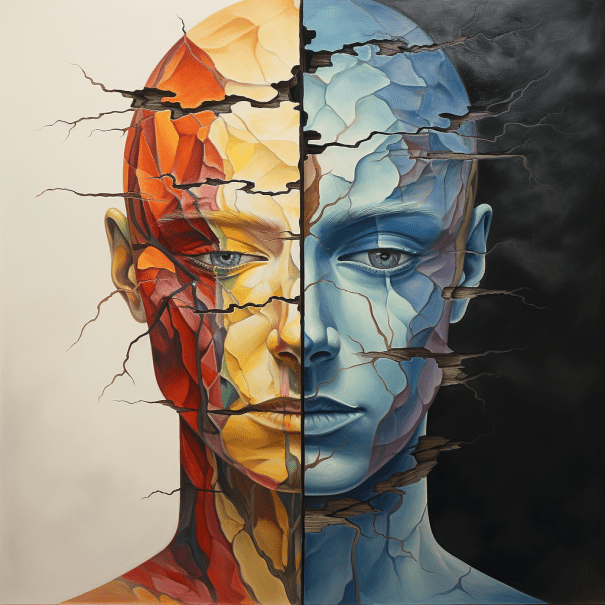

What is Bipolar Disorder?

Bipolar disorder, formerly known as manic depression, can make your mood change dramatically – from feeling very depressed to experiencing what’s called mania. These moods can last a short time, or for months – affecting every part of your life

Unfortunately there are certain stigma and stereotypes surrounding bipolar disorder.

Many people think that people with bipolar are just moody, they don’t consider it an illness. Some people even think people with bipolar disorder are dangerous when the truth is they are vulnerable. People with bipolar disorder can behave in an extreme way at times, but their reckless actions and poor choices make them more of a danger to themselves than others.

Did you know some of the world’s most talented people including Beethoven, Winston Churchill and Mark Twain had bipolar disorder.

Bipolar disorder can affect you at any age, but you’re most likely to be diagnosed when you’re younger.

How does a Life Insurance Company Assess BPD1 and BPD2?

When it comes to getting life insurance with a mental health issue, you may think that the greatest concern of the life insurance company is death by suicide.

Generally people hear the word “bipolar” and immediately think that person is a danger to themselves.

As a result, you might think that someone who has had suicidal thoughts or attempts in the past will be declined for life cover.

For the insurance company it all comes down to how well you manage your condition, be that bipolar, diabetes or any other health issue you may suffer from.

The insurance companies are most concerned when your condition isn’t under control and you have unexpected episodes.

Do you do well for a year and then spend some time in hospital? This is uncontrolled.

How about your medications? Many pills and changed regularly? This is uncontrolled

The more evidence of uncontrolled behaviour the underwriters see, the lower your chances of getting life insurance.

On the positive side, if your condition is stable then you’re in with a good shot of approval, although at a higher rate than somebody with no pre-existing conditions.

So what points to good control?

No lost time from work

Stable job history

Stable home-life

No drinking or drug issues

No recent manic episodes

All these things point to a well controlled condition.

How to get Mortgage Protection Insurance with Bipolar Disorder

Use a reputable, established life insurance broker who works with all the insurance providers in Ireland.

Preferably find one who has expertise in getting cover for clients with mental health issues.

All the underwriting departments at the various insurers treat bipolar differently so you could be wasting your time applying to some of them or end up paying a fortune:

A good broker can guide you towards the most sympathetic insurer for your condition and avoids applying to the wrong insurer which could make matters worse for you.

You see, if you apply to and are declined by Insurer A, you have to disclose this declination in all subsequent applications.

This will put the other underwriters on alert, wondering why the previous insurer declined, making it more difficult for you to get cover.

Will you Need to do a Medical Exam?

No.

The underwriting process looks like this:

You complete an application form

The insurer writes to GP for a medical report including psychiatric reports

Insurer reviews report and makes decision.

The insurers are quick to make underwriting decisions once they have all the necessary medical evidence.

Delays arise when the GP doesn’t have your full medical file including psychiatric reports.

If this is the case, ask your psychiatrist to send all your reports to your GP before you apply, otherwise I suggest you put your comfy socks on and sit back because this could take aaaaaaages.

How much is Life Insurance for Someone with Bipolar Disorder?

The more severe your condition, the higher your premium.

If the normal price is €20 for someone in perfect health, you will pay a loading of 100% increasing your premium to €40.

For severe BPD, your loading could be 300% giving a final premium of €80.

If the insurer feels your condition warrants a loading of >300%, they are likely to refused your application.

If your condition is Mild:

No hospitalisation.

Stable work status.

Medication now ceased.

Diagnosed at age >=35

<= 2 weeks absence from work

GP care only

Last symptoms 1-3 years ago

You will likely pay twice the normal price

Mild/Moderate

No hospitalisation.

Stable work status.

Medication continues.

Onset age >=35

<= 4 weeks absence

GP care

Last symptoms 1-3 years ago

Your premium will be 2.5 times the normal price

Moderate

Single short term hospital stay.

Unstable work status.

Medication continues.

Onset age <35, current age over 35.

>4 weeks absence

Outpatient psychiatric care

Your premium will be 3 times the normal price.

But please take these as guidelines only, your final premium will be based on your own medical history.

Unfortunately, a postponement is likely if you have recently started new treatment or have had a recent episode.

Over to you

If you’re considering an application for life cover or mortgage protection and would like the best chance of cover with the least amount of hassle, please complete this mental health questionnaire.

Knowledge is key here so please allow me to present your application in the best light by disclosing as much as posible about your history of mental health.

It will hinder your application if you don’t mention something now that will show up on your medical or psychiatric report later.

Insurers are suspicious by nature, if they learn something new from your medical report that you should have disclosed, they will wonder what else you’re not telling them.

It goes without saying but all of my discussions with the underwriters will be in strictest confidence

If you’d prefer a quick chat before you complete the questionnaire, I’m on 05793 20836.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆