Why Collectivfide is buoyant on the mutual model

Why Collectivfide is buoyant on the mutual model | Insurance Business Canada

Mergers & Acquisitions

Why Collectivfide is buoyant on the mutual model

M&A expansion set to continue

Mergers & Acquisitions

By

David Saric

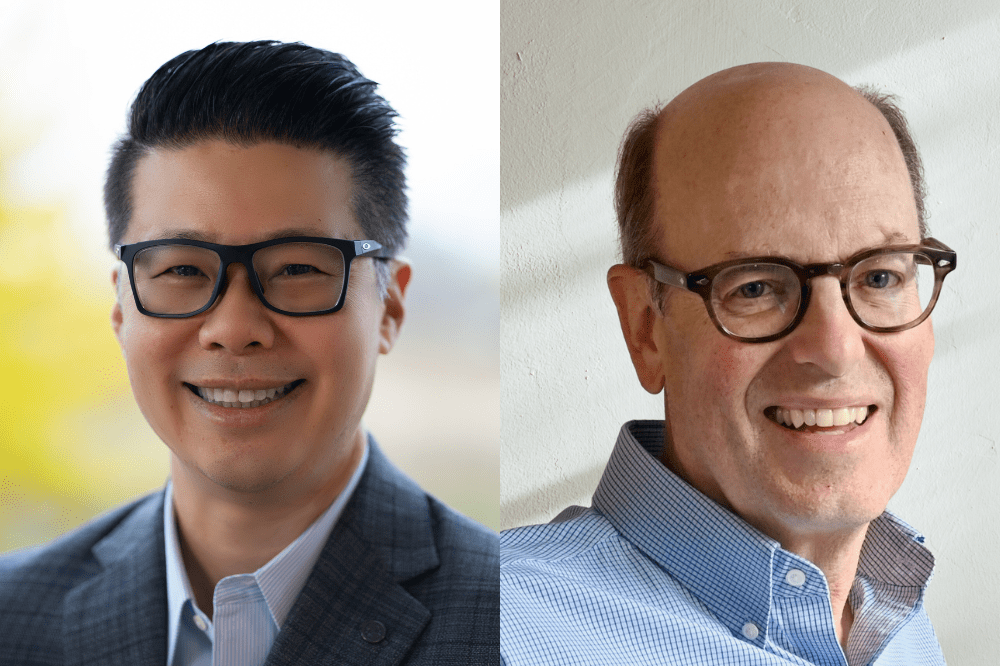

For Collectivfide’s president CEO and president, Tony Ngo (pictured left), the company’s recent acquisitive appetite tends towards the mutual business model.

This is especially true with Collectivfide’s recent acquisition of R.E. Miner Insurance Brokers, a full-service, independent business providing home, auto, farm and commercial services in Comber, Ontario.

Having an insured not just purchase coverage but a stake in the company as part owner ensures that any potential profitability always goes back to them, Ngo noted. This can be particularly resonant in an age of ESG initiatives that are transforming industries across the globe.

“It’s really about the policyholders and not shareholders and profitability, there’s a lot of community and people focus with this model,” he said. “Our mission and culture is backed by that whole mutual, policyholder community base.”

In an interview with Insurance Business, Ngo and Collectivfide’s head of M&A, Eric Walker (pictured right), spoke about why smaller brokerages are looking for greater human resources solutions and what growth looks like for the acquirer.

Why acquisitions can be favourable for smaller businesses

As M&A activity persists, Walker noted how smaller brokerages that may not have considered an acquisition will probably have to in the future to keep up with the competition.

“I think you should think of selling because it’s harder to compete with these entities that have more resources,” he said.

The brokerage community is changing rapidly, especially as better technology and data analytics are giving companies a competitive advantage in areas like risk assessment and policy pricing, according to the duo.

For the mutual model companies that have spoken with Collectivfide about a possible acquisition, Ngo said that many of them are looking to implement technology that has an HR focus to build up a business from the inside.

There are also concerns around the requirements of labour laws, as well as talent recruitment and retention.

“These companies are not as experienced in terms of employee relationships,” he said.

Focusing on organic growth as well

While M&A has allowed Collectivfide to grow in size and geographic scope, another part of its strategy includes conscious organic growth efforts as well.

Smaller businesses may find that their market breadth may not be large enough, so being able to connect these brokerages with potential clients can be important, according to Ngo.

Conceptualizing and implementing marketing and promotional strategies are also key, so the brokerages have an ability to get in the consciousness of more potential clients.

“We’ve got the data analytics department helping them identify target clients, so they can grow as a group,” Walker said.

Lastly, Collectivfide is actively working on creating a network of specialty brokers that can spread their resources and knowledge into other companies that may be lacking the resources to be able to make that sale otherwise.

“Part of the organic growth is getting to scale,” Ngo said.

“The bigger you get, the more profitable you get, and the more expenses or economies and skills that you realize.”

Ngo and Walker agreed that being able to carry out effective organic growth partly comes down to rigorous training initiatives and education that helps individuals level up their skills.

What is next on the agenda?

Elsewhere, on the M&A front, for the rest of 2023 and 2024, Collectivfide is planning on an aggressive expansion throughout the country.

With the acquisition of R. E. Miner, located in Southwestern Ontario, Collectivfide wanted carve out a presence in an area with an ample farming industry— the company’s bread and butter according to Ngo.

“We will definitely be pursuing growing in the specialty and commercial markets and diversification,” Ngo said.

“However, personal lines are definitely not out of the question.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!