BC summer wildfires is costliest insured event in province’s history

BC summer wildfires is costliest insured event in province’s history | Insurance Business Canada

Catastrophe & Flood

BC summer wildfires is costliest insured event in province’s history

The fires tore through Shuswap and Okanagan last August

Catastrophe & Flood

By

Mika Pangilinan

The summer wildfires that ravaged the Shuswap and Okanagan regions of British Columbia this year have made it the costliest insured event in the province’s history, with initial estimates placing losses at over $720 million.

“This year’s wildfire season has broken all records in terms of the amount of land burned, and damage caused to homes and businesses in BC,” said Aaron Sutherland, Pacific and Wester vice president at the Insurance Bureau of Canada (IBC).

Citing data from Catastrophe Indices and Quantification Inc. (CatIQ), IBC revealed that the blaze that tore through North Shuswap communities caused more than $240 million in insured damage.

The fire was confirmed to have destroyed over 270 structures, with substantial damage to public infrastructure. Roughly 3,500 properties had also been subject to evacuation orders.

Meanwhile, the wildfires that ignited in the central Okanagan Valley led to over $480 million in insured damage.

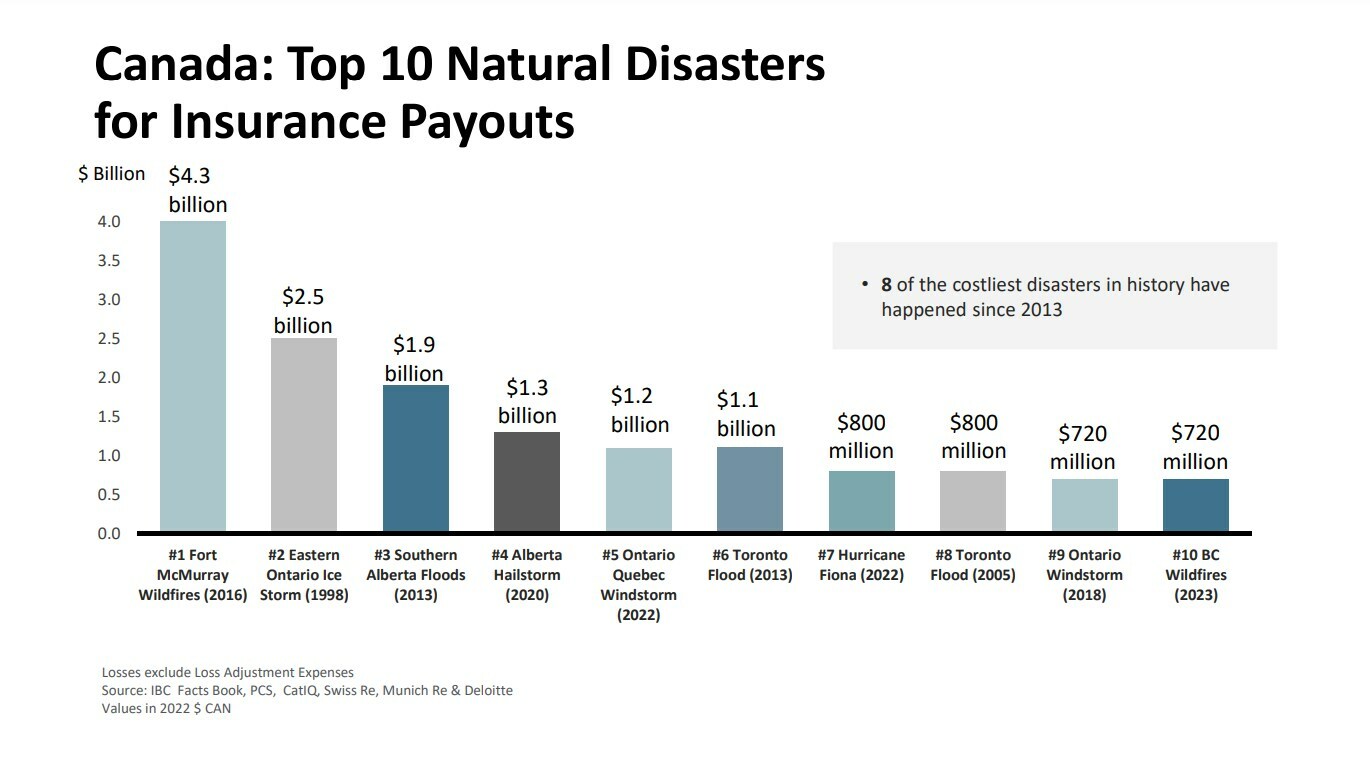

The recent BC fires rank tenth among the country’s costliest natural disasters for insurance payouts. Seven other events included in the list occurred in the last 10 years.

The losses seen in Shuswap and Okanagan have also surpassed the last major wildfire that hit the region in 2003, which led to insured damages amounting to $200 million.

“Our hearts go out to every individual and family who has been impacted by these wildfires, and to the firefighters who lost their lives helping to protect our communities,” Sutherland said further. “The wildfires’ impact is another tragic reminder of the risk BC residents face due to climate change and the increasing frequency of natural catastrophes.”

What are your thoughts on this story? Feel free to comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!