How much does State Farm’s CEO earn?

How much does State Farm’s CEO earn? | Insurance Business America

Insurance News

How much does State Farm’s CEO earn?

State Farm CEO salary is among the property and casualty insurance sector’s highest. Find out where it ranks among industry peers in this article

Insurance News

By

Mark Rosanes

Michael L. Tipsord runs one of the largest insurance companies in America – but how much compensation does he receive for such a Herculean task?

Insurance Business crunches the numbers behind State Farm CEO’s salary in the previous financial years to find out where Tipsord’s earnings rank among his industry peers. We will also compare these figures with those for insurance industry chief executives in general.

If you’re curious to know how much the head honcho of the insurer that prides itself on providing service “like a good neighbor” earns, you’ve come to the right place. Find out how much State Farm pays its president and CEO in this article.

Tipsord earned $2.4 million in salary in the latest financial year, according to a filing obtained by the news outlet Crain’s Chicago Business from the Nebraska Department of Insurance. The amount is 14% higher than the State Farm CEO salary of $2.1 million the year before.

Overall, Tipsord received a total of $24.4 million in compensation in 2022, almost equivalent to the $24.5 million he earned in the previous year. This includes a $21.9 million bonus, a slight drop from $22.4 million in 2021.

Tipsord has seen his yearly earnings soar over the years. In 2017, his total compensation was about $8.6 million, with a base salary of $1.6 million. At that time, this was lower compared to what most of his peers were earning. In 2019, Tipsord earned around $10 million. The amount doubled to about $20 million the following year, before his record-setting State Farm CEO salary in 2021.

One of the reasons for the rise, according to the news outlet, is the nature of State Farm’s business. As a mutual insurer, the Bloomington, Illinois-headquartered company is technically owned by its policyholders. Therefore, it doesn’t have publicly traded shares to pay its executives. To provide competitive compensation, State Farm has instead “dramatically increased” cash payouts to the members of its leadership team.

Tipsord’s pay ranks among the highest for property and casualty insurance CEOs in the latest financial year. The table below shows a side-by-side comparison of how much the leaders of the country’s largest P&C insurers earned in the last three financial years.

The data comes from filings from the Securities and Exchange Commission (SEC) that Insurance Business and consumer rights non-profit Consumer Federation of America (CFA) gathered. The list is ranked by 2022 total compensation.

State Farm CEO salary side-by-side comparison with other P&C executives

Insurer

CEO

2020 compensation

2021 compensation

2022 compensation

Chubb

Evan Greenburg

$20.3 million

$23.2 million

$25.2 million

State Farm

Michael Tipsord

$20.0 million

$24.4 million

$24.5 million

Travelers

Alan Schnitzer

$18.3 million

$19.8 million

$21.1 million

Liberty Mutual

David Long

$11.6 million

$12.2 million

$15.4 million

Allstate

Thomas Wilson

$18.0 million

$18.3 million

$15.0 million

GEICO

Todd Combs

$9.7 million

$13.6 million

$13.6 million

Progressive

Susan Griffith

$15.2 million

$14.5 million

$12.7 million

Jeff Dailey

Farmers

$7.1 million

$8.0 million

$8.0 million

American Family

Jack Salzwedel /

Bill Westrate

$12.4 million

$6.8 million

$6.7 million

Based on the data we gathered, Tipsord’s 2022 pay ranks second only to Chubb’s Evan Greenburg, who has seen his annual compensation rise 9% from 2021.

Almost all CEOs in the list experienced a jump in payout in the past three financial years, except for Progressive’s Susan Griffith and Allstate’s Thomas Wilson. Griffith’s yearly compensation has steadily decreased during the period, while Wilson’s pay dropped last year after slightly increasing from 2020 to 2021.

American Family’s Bill Westrate, who took on the reins from Jack Salzwedel at the start of 2022, received the lowest annual pay in our list.

Liberty Mutual’s David Long and Farmers’ Jeff Dailey have stepped down from their posts and turned over their leadership roles to Timothy Sweeney and Raul Vargas, respectively. Sweeney and Vargas began their tenure as CEOs in January 2023.

Michael L. Tipsord, State Farm

Michael Tipsord (pictured above) began his tenure as State Farm’s chief executive officer in September 2015, replacing Edward B. Rust, Jr. Tipsord was also elected as the company’s chair of the board almost a year later. Prior to becoming CEO, he served as the firm’s chief operating officer and president, a position he still holds.

Tipsord started his career in the company in 1988. He served in a variety of leadership roles before being named as vice-chairman and chief financial officer in 2004. In 2011, he was appointed as State Farm’s COO.

Tipsord earned his Chartered Property Casualty Underwriter (CPCU) designation in 1995 and Chartered Life Underwriter (CLU) designation in 1991. He is also a Certified Public Accountant (CPA).

Tipsord is a native of Illinois. He earned his bachelor’s degree from Illinois Wesleyan University in Bloomington and his law degree from the University of Illinois at Urbana-Champaign. Tipsord is a member of the dean’s advisory board for the University of Illinois College of Law.

While CEOs of the industry’s largest names earn millions in base salaries, these are far from the industry average. The latest data from the US Bureau of Labor Statistics (BLS) shows that chief executives of insurance carriers are paid around $386,550 in annual wages.

Still, the insurance industry ranks among the highest-paying sectors for chief executives along with the following:

Motion picture and video: $498,970 in average annual salary

Media streaming & social networks: $435,630 in average annual salary

Agents and managers for public figures: $360,580 in average annual salary

Lessors of non-financial assets: $307,800 in average annual salary

The CEO is the highest-ranking executive of an insurance company. They are responsible for setting the company’s strategic direction, which involves making major corporate decisions and managing its overall operations. CEOs also serve as the main point of communication between the board of directors and the executive team.

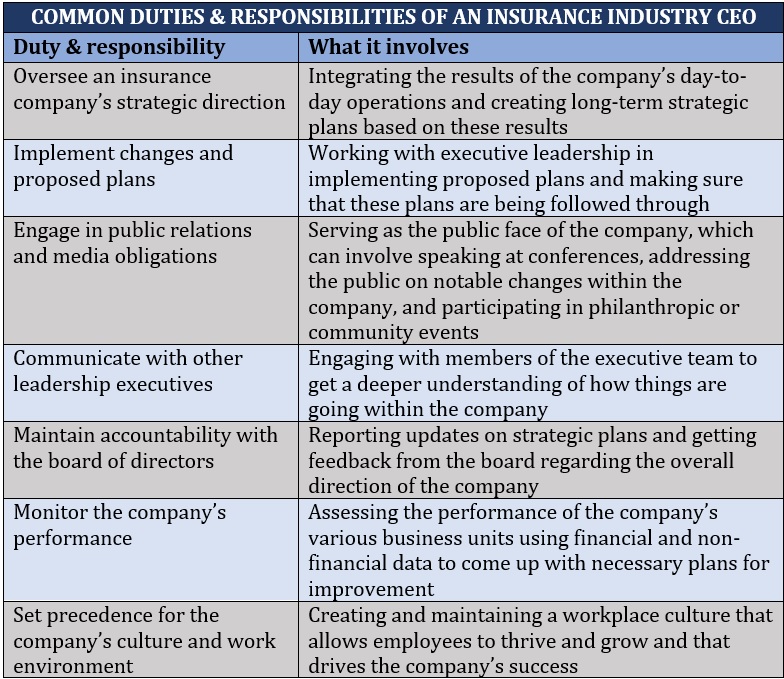

The table below lists some of the typical duties and responsibilities of an insurance industry chief executive.

Most CEOs boast decades of experience in the insurance industry, which typically include stints in various senior leadership roles. This kind of experience is important as CEOs are expected to guide the company to success and profitability.

Additionally, a CEO’s role may vary depending on a range of factors, including an insurance company’s culture, size, and corporate structure.

Chief executives in large multinational insurers, for instance, often deal with high-level strategic decisions that drive the company’s overall growth. Leaders of smaller insurance companies, meanwhile, typically take a more hands-on approach and are actively involved with day-to-day functions.

Starting your own insurance company entails doing many of the CEO tasks listed above. If you want to get tips on how to run an insurance brokerage, this step-by-step guide can help.

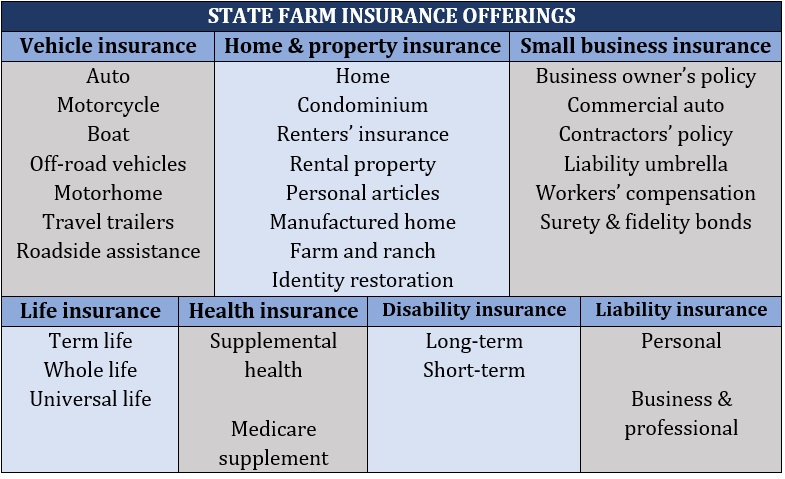

State Farm remains the largest provider of property and casualty insurance in the country, underwriting $78.6 billion worth of premiums in the latest financial year. This figure accounts for almost a tenth of the market.

The table below lists the different types of insurance policies State Farm offers.

State Farm also provides a range of home and auto insurance discounts, and pet medical coverage. The company offers banking and investment services as well.

State Farm’s policies can be accessed directly or through its nationwide network of 19,000 agents. Policyholders can also turn to these insurance professionals in times of need – just like a good neighbor.

The mutual insurer is known for offering competitive auto insurance rates. It also consistently scores above the industry average when it comes to customer satisfaction.

State Farm is a Fortune 500 company, generating more than $89 billion in revenue in the latest financial year. This figure is the largest of any P&C insurer in the country, which can partly explain the huge State Farm CEO salary Tipsord received.

However, the company’s car insurance segment took a significant hit primarily due to inflation, which pushed up the cost of auto parts. In its latest financials, State Farm disclosed that it has incurred around $13.2 billion in underwriting losses. This prompted the insurer to increase rates for some policyholders across the US.

State Farm’s insurance agents play an important role in driving the company’s success. If you want to know how much State Farm agents make, you can check out this guide to find out.

How do you find the State Farm CEO salary? Do you think insurance industry chief executives deserve such huge compensation? Feel free to share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!