Cancelling Your Amalgamated Life Insurance Company Life Insurance Policy

Life insurance policies provide financial protection for individuals and their loved ones in the event of death. However, there may come a time when you need to cancel your policy. Whether it’s due to changing financial circumstances, policy performance concerns, or simply finding a better deal elsewhere, understanding the process of cancelling your Amalgamated Life Insurance Company life insurance policy is crucial. In this article, we will explore the key features of your policy, reasons to consider cancellation, the cancellation process, and alternatives to cancelling your policy.

Understanding Your Amalgamated Life Insurance Policy

Before making any decisions regarding cancellation, it is important to have a clear understanding of your Amalgamated Life Insurance Company policy. Take the time to familiarize yourself with the key features and benefits it offers. This will help you make an informed decision.

Amalgamated Life Insurance Company is committed to providing comprehensive coverage and financial security for policyholders. Their policies are designed to offer a range of benefits that cater to the unique needs of individuals and families.

One of the key features of your Amalgamated Life Insurance policy is the death benefit. This benefit ensures that your loved ones will receive a lump sum payment upon your passing, providing them with financial stability during a difficult time. It can help cover funeral expenses, outstanding debts, and provide ongoing support for your dependents.

In addition to the death benefit, your policy may also include cash value accumulation. This feature allows your policy to grow in value over time, providing you with a potential source of funds in the future. The cash value can be accessed through policy loans or withdrawals, offering you financial flexibility when you need it most.

When considering cancellation, it is crucial to read the fine print of your policy. Understanding any limitations, exclusions, or restrictions that may apply is essential for making an informed decision. The fine print will outline the specific circumstances under which cancellation is allowed and any associated fees or penalties.

Amalgamated Life Insurance Company believes in transparency and strives to provide policyholders with all the necessary information to make informed decisions. They understand that circumstances can change, and policyholders may need to cancel their policies for various reasons.

By carefully reviewing your policy, you will gain a comprehensive understanding of its features and benefits. This knowledge will empower you to make the right decision regarding cancellation, ensuring that you are well-informed and confident in your choices.

Key Features of Your Policy

Your Amalgamated Life Insurance policy likely includes features such as a death benefit, cash value accumulation, and the ability to borrow against the policy. Understanding these features will give you a clearer picture of the value your policy provides.

The death benefit is a crucial aspect of your policy, as it provides financial protection for your loved ones in the event of your passing. It offers peace of mind, knowing that your family will be taken care of financially during a challenging time.

The cash value accumulation feature is another important aspect of your policy. As you make premium payments, a portion of the funds go towards building the cash value of your policy. Over time, this cash value grows, providing you with a potential source of funds that can be accessed through policy loans or withdrawals.

Borrowing against your policy can be a helpful option in times of financial need. Whether it’s for unexpected medical expenses, education costs, or home repairs, having the ability to borrow against your policy can provide you with the necessary funds without having to go through a lengthy loan application process.

It is important to note that borrowing against your policy may have implications on the death benefit and cash value accumulation. It is advisable to consult with an Amalgamated Life Insurance representative to fully understand the impact of borrowing against your policy and explore alternative options if necessary.

Reading the Fine Print

It’s essential to carefully read the fine print of your policy to understand any limitations, exclusions, or restrictions that may apply to cancellation. This information will help you navigate the process more effectively and avoid unexpected surprises.

The fine print of your Amalgamated Life Insurance policy contains important details about the cancellation process. It will outline the specific steps you need to take, any required documentation, and any applicable deadlines. By familiarizing yourself with these details, you can ensure a smooth cancellation process.

Additionally, the fine print will provide information on any fees or penalties associated with cancellation. Understanding these financial implications will help you make an informed decision and assess whether cancellation is the right choice for your current situation.

Amalgamated Life Insurance Company is committed to providing transparency and clarity to policyholders. They understand that cancellation may be a necessary step for some individuals, and they aim to make the process as straightforward as possible.

By reading the fine print, you can gain a comprehensive understanding of the terms and conditions of your policy, ensuring that you are well-informed before making any decisions regarding cancellation.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

Reasons to Consider Cancelling Your Policy

While life insurance provides important protection, there are several reasons why you might consider cancelling your Amalgamated Life Insurance policy.

Life insurance is a valuable financial tool that offers peace of mind and protection for your loved ones in the event of your passing. However, there are circumstances in which cancelling your policy may be a wise decision. Let’s explore some of these reasons in more detail.

Financial Changes

If you are experiencing significant financial changes, such as a decrease in income, you may find it difficult to continue paying premiums. Life is full of unexpected twists and turns, and sometimes our financial situation takes a hit. In such cases, cancelling your policy can provide immediate relief from the financial burden.

For example, if you have recently lost your job or experienced a pay cut, it may be necessary to reevaluate your expenses and prioritize your financial obligations. While life insurance is important, it’s essential to ensure that you can meet your basic needs and maintain a stable financial foundation. Cancelling your policy during this challenging time can help alleviate some of the financial strain.

Policy Performance

If your policy’s performance hasn’t met your expectations, it might be worth considering cancellation. Life insurance policies come in different forms, such as term life insurance and whole life insurance, each with its own advantages and disadvantages.

When assessing the performance of your policy, it’s important to evaluate various factors. Start by examining the returns on your policy. Has it generated the expected growth over time? Additionally, consider the cash value growth and whether it aligns with your financial goals. If you find that your policy is not meeting your expectations or is not providing the desired financial benefits, cancelling it may be a reasonable choice.

Finding a Better Deal

Insurance companies regularly update their policies and pricing structures to stay competitive in the market. As a policyholder, it’s important to periodically review your options and compare them with your current policy. This allows you to ensure that you have the best coverage at the most affordable price.

Take the time to research and explore the offerings of other insurance companies. Look for policies that provide similar or enhanced benefits compared to your current policy but at a lower cost. If you find a better deal with another company, cancelling your policy and switching to the new one may be a sensible choice.

However, it’s crucial to carefully analyze the terms and conditions of the new policy to ensure that it meets your specific needs. Consider factors such as coverage amount, policy duration, and any additional riders or benefits that may be important to you and your family.

In conclusion, while life insurance is a valuable asset, there are situations in which cancelling your policy may be a practical decision. Financial changes, policy performance, and finding a better deal are all valid reasons to consider cancelling your Amalgamated Life Insurance policy. Remember to carefully evaluate your circumstances and consult with a financial advisor or insurance professional to make an informed decision.

The Process of Cancelling Your Amalgamated Life Insurance Policy

When you decide to cancel your Amalgamated Life Insurance policy, follow these steps to ensure a smooth and efficient process.

Canceling an insurance policy can be a significant decision, and it’s essential to understand the process involved. By contacting Amalgamated Life Insurance Company’s customer service department, you can receive guidance and support throughout the cancellation process.

Contacting Amalgamated Life Insurance Company

Start by contacting Amalgamated Life Insurance Company’s customer service department. They will guide you through the cancellation process and provide you with the necessary instructions and documentation.

When reaching out to the customer service department, you’ll be connected with a knowledgeable representative who will address your concerns and answer any questions you may have. They understand that canceling a policy can be a complex decision, and they are there to assist you every step of the way.

Necessary Documentation for Cancellation

Prepare any required documentation for cancellation, such as a written request, policy information, and identification documents. The customer service representative will inform you of specific requirements.

Having the necessary documentation ready will expedite the cancellation process. It’s crucial to provide accurate information and ensure that all required documents are complete. This will help avoid any delays or complications during the cancellation process.

Understanding the Cancellation Fees

Before canceling your policy, make sure you understand any cancellation fees or penalties that may apply. Read the terms and conditions carefully or consult with a representative to avoid any unexpected financial obligations.

Insurance policies often have specific terms and conditions regarding cancellations. It’s essential to review these details to understand any potential financial implications. By having a clear understanding of the cancellation fees or penalties, you can make an informed decision that aligns with your financial goals.

During your conversation with the customer service representative, don’t hesitate to ask for clarification on any fees or penalties mentioned in the policy. They will provide you with a comprehensive explanation, ensuring that you have all the necessary information to proceed with confidence.

Alternatives to Cancelling Your Policy

If cancelling your Amalgamated Life Insurance policy is not your preferred option, there are alternatives worth considering.

When it comes to life insurance, it’s important to carefully evaluate your options before making a decision. Cancelling a policy may seem like the easiest solution, but there are other avenues to explore that can provide you with the coverage and financial stability you need. Let’s take a closer look at some alternatives:

Policy Conversion Options

Some life insurance policies offer conversion options, allowing you to change your policy into a different type of insurance, such as whole life to term life. This can be a valuable option if your needs have changed over time. For example, if you initially purchased a whole life policy to provide financial security for your family, but now find yourself in a more stable financial position, converting to a term life policy may be a more cost-effective choice. Exploring these options with your insurer can help you find a solution that better suits your current needs.

Selling Your Life Insurance Policy

In certain situations, you can sell your life insurance policy to a third party for a lump sum payment. This option, known as a life settlement, can provide you with a financial solution without completely cancelling your coverage. Life settlements are typically available to policyholders who are over the age of 65 and have a policy with a face value of at least $100,000. By selling your policy, you can unlock the value of your coverage and use the funds for other purposes, such as paying off debt or funding retirement.

Reducing Your Coverage

If your premium payments are straining your budget, you may consider reducing your coverage amount. This allows you to maintain some level of coverage while reducing your financial obligations. For example, if you initially purchased a $500,000 policy but find that you no longer need that level of coverage, you can work with your insurer to adjust the policy to a lower amount. This can help you save on premiums while still providing a safety net for your loved ones.

Before making any decisions, it’s crucial to carefully assess your reasons for considering cancellation. Are you facing financial difficulties, or are there other factors at play? Understanding your policy and its terms is essential in order to make an informed decision. Additionally, consulting with a financial advisor or insurance professional can provide valuable insights and guidance tailored to your specific situation.

Cancelling your Amalgamated Life Insurance Company life insurance policy is a decision that should be carefully considered. Understanding your policy, assessing reasons for cancellation, and exploring alternative options will ultimately lead you to the best course of action. Make sure to consult with a financial advisor or insurance professional to ensure your decision aligns with your long-term financial goals and protection needs.

Frequently Asked Questions

How do I cancel my Amalgamated Life Insurance Company life insurance policy?

To cancel your Amalgamated Life Insurance Company life insurance policy, you will need to contact the company directly. You can find their contact information on their website or on your policy documents.

What is the process for cancelling a life insurance policy?

The process for cancelling a life insurance policy typically involves contacting the insurance company, either through phone or email, and requesting cancellation. They may require you to fill out a cancellation form or provide certain documentation. It is important to review your policy terms and conditions for any specific cancellation procedures.

Will I receive a refund if I cancel my Amalgamated Life Insurance Company life insurance policy?

Whether you will receive a refund upon cancelling your Amalgamated Life Insurance Company life insurance policy depends on the terms of your policy. Some policies may have a surrender value, which means you could receive a partial refund. However, it is best to check with the insurance company directly to understand their refund policy.

Are there any fees or penalties for cancelling a life insurance policy?

There may be fees or penalties associated with cancelling a life insurance policy, depending on the terms and conditions of your specific policy. These fees could include surrender charges or administrative fees. It is important to review your policy documents or contact the insurance company to understand any potential costs involved in cancellation.

Can I cancel my Amalgamated Life Insurance Company life insurance policy at any time?

In most cases, you have the right to cancel your Amalgamated Life Insurance Company life insurance policy at any time. However, it is recommended to review your policy terms and conditions, as there may be certain restrictions or waiting periods before cancellation is allowed. Contacting the insurance company directly will provide you with the most accurate information regarding cancellation timelines.

What alternatives are there to cancelling my life insurance policy?

If you are considering cancelling your life insurance policy, it is important to explore alternative options before making a final decision. Some alternatives may include reducing the coverage amount, adjusting the premium payments, or exploring other policy options offered by the insurance company. It is advisable to discuss your specific needs and concerns with the insurance company to explore the best alternatives for your situation.

Enter your ZIP code below to compare cheap life insurance rates.

Secured with SHA-256 Encryption

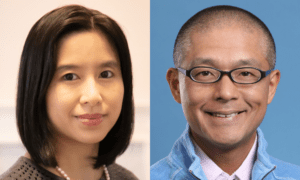

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina.

He has also earned an MFA in screenwriting from Chapman Univer…

Benjamin Carr

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs.

Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times…

Former State Farm Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.