Maker of $777,000 flying motorbike prepares for IPO in Japan

A former Merrill Lynch derivatives trader with a passion for Star Wars is preparing to take his flying motorbike startup public in Japan.

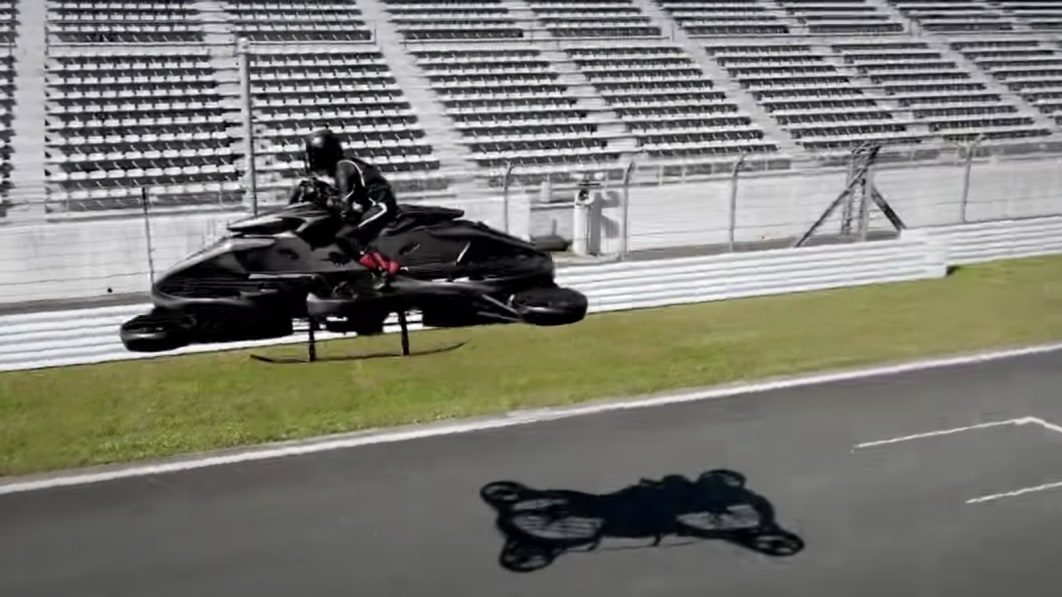

Tokyo-based ALI Technologies Inc. was founded by Shuhei Komatsu as a drone maker in 2016 before moving on to more ambitious ventures, opening sales of its Xturismo Limited bike in October. The $777,000 single-person transporter can hit a max speed of 80kmh (50mph) and travel up to 40 minutes per charge, according to the company. The bike has so far largely figured as a curio at public events such as a recent baseball game, but ALI President Daisuke Katano says there’s strong interest in it from Middle Eastern nations.

“The need for these bikes will be higher in places with desert or other difficult terrain,” Katano said in an interview. “The vehicle will enable people to travel where roads are bad and inaccessible to cars, as well as across bodies of water.”

The company has selected lead underwriters for an initial public offering on Tokyo’s Mothers market for startups in what will be the country’s first debut of its kind. It’s presently engaged in discussions with the Tokyo Stock Exchange, Katano said, declining to specify an estimated valuation or a timeline for the offering.

Flying personal vehicles have been the stuff of science fiction for decades before Star Wars, which featured a famous racing scene with pods zooming along close to ground level. Electric-air transportation is now moving closer to reality as the first wave of designs by startups like Joby Aviation Inc. reach maturity and developers tap investors for funding. Billions of dollars flowed into the sector in 2021, as well as an impressive number of orders, mostly from commercial airlines. The next 18 months will be pivotal for the fledgling industry, as manufacturers run vital test flights and finalize plans for so-called vertiports and regulators consider how best to guarantee safety.

The ALI bike is not intended to fly far up in the air, primarily helping to traverse inhospitable terrain. It’s built like an enlarged drone with a traditional motorcycle seat and steering on top.

Founder Komatsu has described his aim as realizing an “air mobility society,” where cars, bikes and other vehicles can transport people in the sky.

No, Really, Flying Taxis Are Getting Closer to Giving You Rides

ALI has attracted investment from several well-known Japanese firms, including Sega Sammy Holdings Inc., Nagoya Railroad Co., Nakanihon Air Service Co., Kyocera Corp. and Mitsubishi Electric Corp. Soccer star Keisuke Honda, who played for the national team at the 2018 World Cup, is also a backer. ALI’s drones were the first thing to attract investors, but the startup is also developing capabilities in artificial intelligence and blockchain tech, a Nagoya Railroad spokesman said.

“There are expectations for growth, so once products like these make it to the headlines, the company’s stock could be bought up, getting a boost from retail investors,” said Tomoichiro Kubota, a senior market analyst at Matsui Securities Co. “But the company is not yet at a level where people could talk about a detailed earnings outlook, which makes it hard to pin an appropriate valuation figure.”

While a successful IPO will make ALI the only listed company in Japan that specializes in next-generation air mobility, several peers are already trading on New York exchanges. This includes Joby, Archer Aviation Inc., Lilium NV and Vertical Aerospace Ltd.

Joby, which has a market capitalization of more than $3 billion, is close to commercializing what the industry calls eVTOLs, or electric vertical takeoff and landing aircraft. These flying taxis are battery-powered and, the companies say, destined to fly without a pilot once regulations allow.

How Do the Leading Flying Taxi Companies Compare?

“Air mobility companies listed in the U.S. have pretty sizable market caps,” Katano said. “If you consider our company to be of a similar kind, I think we’ll be able to win the understanding of investors for a decent valuation.”

ALI will aim for a unicorn valuation — $1 billion or more — over the long term, Katano added. But the company has yet to decide on the best way to categorize its vehicle, which will depend on discussions with local regulators where the product is sold.

“We think our aircraft could be categorized differently to existing airplanes,” Katano said. “It doesn’t travel on the ground, but still flies closer to land and at low altitudes.”

Related video: