Fitch Ratings on why its global reinsurance sector outlook has been revised

Fitch Ratings on why its global reinsurance sector outlook has been revised | Insurance Business America

Risk Management News

Fitch Ratings on why its global reinsurance sector outlook has been revised

“Certain events might be too much for the private markets to bear”

Risk Management News

By

Mia Wallace

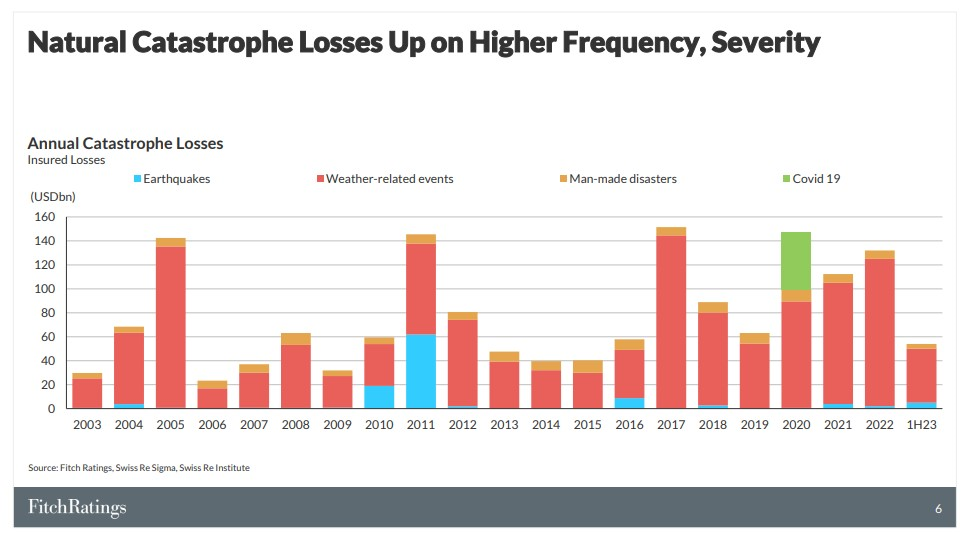

Among the reinsurance results recorded by the sector in H1 2023, non-life net premiums written rose to US$77,597 million from US$72,241 million last year while its combined ratio hit a healthy 88%, compared to H1 2022’s 89.4%. Discussing the results at a Press briefing, Fitch director Robert Mazzuoli offered further detail on natural catastrophe losses, which are up in terms of both frequency and severity.

“And we certainly observed, and still do observe, and will probably continue to observe, an increasing trend in insured claims,” he said. “Part of that is due to climate change, but also part of that is due to insured values that are increasing. So economic wealth creation also has some impact on those numbers reported [below].

“Last year was again, a very costly year. So, we had first and foremost, Hurricane Ian but then we also had a lot of secondary current events that added to the bill. And we had, again, total insured losses of more than US$100 billion last year. And probably that is the new normal for the industry.”

H1 2023 was further proof of this trend, he said, yielding over US$40 billion in insurance claims already. The earthquake in Turkey and Syria was one example but the sector also weathered a series of storms in the US which were mid-sized events costing from US$5-7 billion per event which added to quite a significant amount in aggregate.

What impact is this having on the reinsurance sector, Mazzuoli asked? The answer is reflected in the half-year results recorded by players across the market and reveals that the impact of these natural catastrophe insured losses is less than it has been in former years. A key reason for this is the hard market conditions existing in property catastrophe lines which means the balance of power has shifted to the reinsurers allowing them to push through price increases and, crucially, to change terms and conditions in their favour.

“Reinsurers, in particular, have basically stopped selling aggregate loss covers,” he said. “So, when you had a series of mid-size cat events, in the past those were on the reinsurers’ bill. Now it remains to a large extent with the cedents. So, this is a big change and reinsurers have now moved back and said ‘we will give you protection on your capital so if there are big, outsized cat events we are there and we will give you coverage’.

“’But if there are mid-sized events that only have an impact on your earnings, then we are sorry, that is more of your problem than ours’. That is one important change that we should keep in mind.”

Examining what this means in the context of the global protection gap, which has been highlighted by recent reports as a growing concern, Mazzuoli noted that the bridge between this increased exposure and reduced coverage comes down to a matter of price and capital. The conditions necessary to close the insurance gap are those in which the right price can be charged, he said, which can be socially difficult to push through because, in some regions, this would be an incredibly high price – not only in emerging markets but also in developed markets.

“And on the other side, the question of capital,” he said. “The reinsurance industry has a limited amount of capital. Certainly with the alternative capital market, we have institutional investors who can also take part of the burden but then we probably also have to talk about public schemes which we see, for example, in Florida [and] France.

“So that means that the taxpayer also needs to be involved at some point… reinsurers are certainly willing to provide protection or to arrange and price certain risks. But if they do not get the right price for that, they will not accept it on their own balance sheet. And certain events might be too much for the private markets to bear.”

What are your thoughts on this story? Feel free to share them in the comment box below.

Keep up with the latest news and events

Join our mailing list, it’s free!