Alternative capital flat at $100bn high at mid-year 2023: Aon

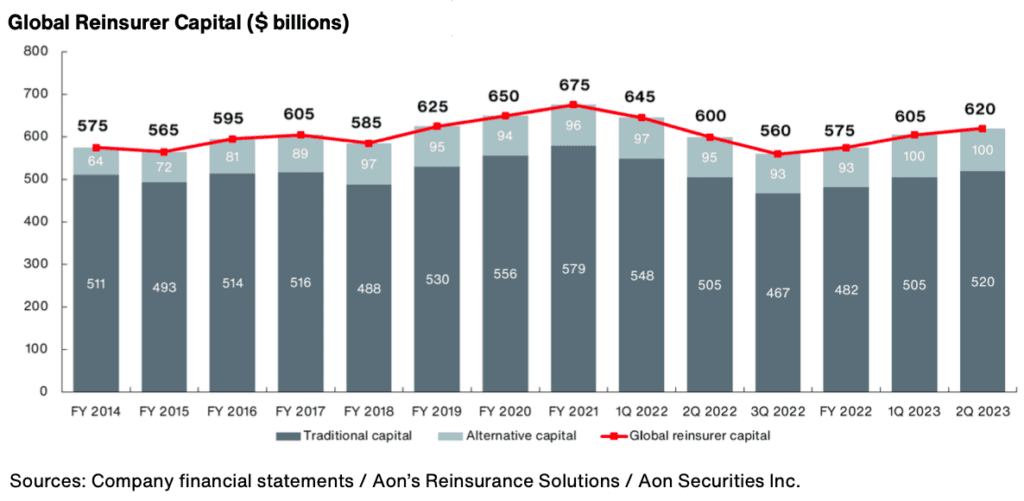

Alternative reinsurance capital, largely deployed in insurance-linked securities (ILS) formats, remained static at its $100 billion at the mid-point of 2023, according to insurance and reinsurance broker Aon.

The latest analysis of global reinsurance capital from Aon’s Reinsurance Solutions division shows no outright growth in the ILS and alternative capital space through the second-quarter, although traditional reinsurance capital continued to recover.

Traditional reinsurance capital added 3% to reach $520 billion over the course of Q2, so when added to the alternative capital sector, the total for global reinsurance capital rose 2.5% to reach $620 billion, as the chart below shows.

Joe Monaghan, Global Growth Leader Reinsurance Solutions at Aon explained, “Aon estimates that global reinsurer capital has increased by 10.7 percent, or $60 billion, to $620 billion since the third quarter of 2022, principally driven by retained earnings, recovering asset values and new inflows to the catastrophe bond market.

“While the trend is encouraging, there is some way to go before previous levels are attained.”

The chart above still shows a roughly $55 billion shortfall in global reinsurance capital since its high-point back at the end of 2021.

Aon Reinsurance Solutions latest report states, “The sector is viewed as well capitalized, relative to the risk currently being assumed, as confirmed by strong regulatory and rating agency capital adequacy ratios.

“However, much more capital will be required if current unmet needs are to be addressed over time.”

“An ideal environment for investors to raise capital,” thanks to heightened spreads, have helped alternative capital in sustaining the record $100 billion level, with an additional $5 billion of assets raised by ILS investment managers part of that, although seemingly almost all in the cat bond market.