Aon: Higher cat bond returns fuel investor appetite, record year expected

Insurance-linked securities (ILS) investor appetite is being fuelled by the higher returns available, which has driven significant new inflows to catastrophe bonds and sees the market well on-track to reach record issuance levels in 2023, according to Aon Securities.

In its latest ILS market report, the Aon Securities team outline the potential for record-breaking catastrophe bond issuance, while investors are already benefiting from double-digit returns in 2023.

Richard Pennay, CEO of Insurance-Linked Securities at Aon Securities, the capital markets unit of the insurance and reinsurance broker, said that, “2023 to date has proven to be a much better year for both investors and issuing companies.”

Pennay went on to explain, “Investors have benefited from catastrophe bond returns greater than anything experienced in over 20 years. Secondary spreads tightened as the principal losses associated with Hurricane Ian failed to materialize in a significant way, resulting in mark-to-market gains.

“Wider issuance spreads and a material increase in collateral returns, which in some cases are now yielding a per annum return of greater than 5%, have further increased catastrophe bond returns this year.”

Pennay said that some investors had already generated double-digit returns from catastrophe bond investments just in the first-half of 2023.

Going on to highlight that these higher returns are also helping to attract new capital from investors as well.

“Higher returns have fueled further capital inflows, helping to absorb the rising demand for catastrophe bond capacity from sponsors,” Pennay explained.

The Aon Securities ILS market report points that that this resulted in “an ideal environment for investors to raise capital.”

In fact, Aon Securities estimates that more than $5 billion in investor AUM has now been raised since year-end 2022, up to the middle of 2023.

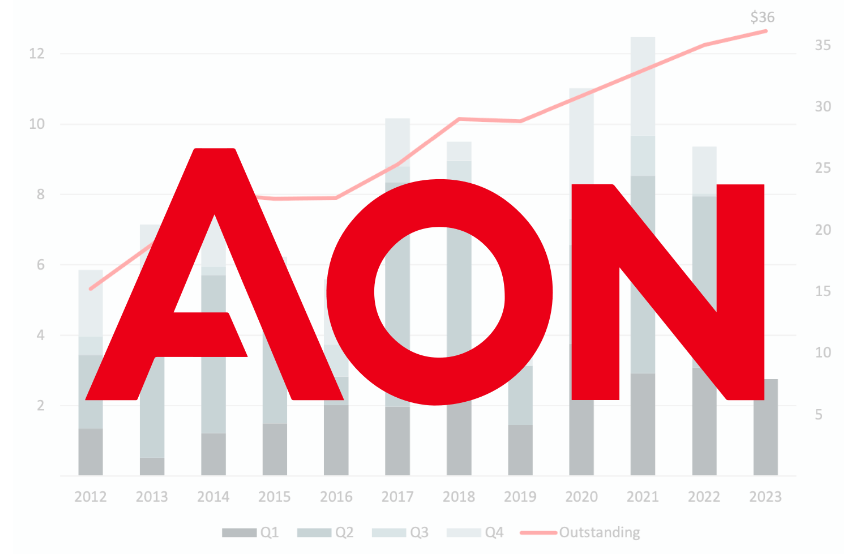

This has helped to expand the catastrophe bond market by $3.6 billion of cat bond market up to June 30th 2023, by Aon Securities’ measure, which is says represented an approximate 10% increase in outstanding cat bond market size from year-end 2022.

Pennay said, “To date in 2023, the ILS market has executed over $10 billion of new issuance, with the market well on track to be the largest issuance year on record.”

There is more capital available both from successful raises of new capital, plus the reinvested premium earned on outstanding issuance in this higher returning environment, which Aon Securities believes is “poised to result in record-breaking issuance volume for 2023.”

Pennay concluded, “The catastrophe bond market’s growth in 2023 has been welcomed by insurers, reinsurers and governments who have sought to complement their risk transfer program with ILS.

“With the ILS market now in its third decade, its ability to bounce back and grow during a time of economic uncertainty and increasing natural catastrophe frequency, is a true testament to its resiliency and overall value proposition to all stakeholders.”

Cat bond returns continue to track at record levels in 2023, despite some softening of catastrophe bond spreads during the second quarter, which you can see evidence of in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by year and quarter.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature.