Insurance for leased car vs. owned car: what’s the difference?

Insurance for leased car vs. owned car: what’s the difference? | Insurance Business America

Guides

Insurance for leased car vs. owned car: what’s the difference?

Signing a lease can be a less costly option if you plan on changing vehicles often – but is it the same with insurance for a leased car? Find out in this guide

Car leasing can be an attractive option if you like driving a new vehicle every few years but don’t want the long-term financial commitment that an auto loan entails. Regardless of whether you choose to lease or buy your own vehicle, car insurance is mandatory for you to operate it on US roads.

This begs the question: does car insurance for leased cars work the same as that for financed and owned vehicles?

In this article, Insurance Business discusses the similarities and differences between the policies designed for leased cars and those for vehicles under financing and owned outright.

If you want to learn more about how coverage works when leasing a vehicle, then you’ve come to the right place. Read on and find out how you can get the most out of insurance for leased cars in this guide.

Each state imposes its own requirements when it comes to car coverage which applies to all types of vehicles, regardless of whether these are leased, financed, or owned.

Liability car insurance is mandated in all states if you’re taking out coverage, although the minimum limits vary. This type of policy comes in two forms:

1. Bodily liability insurance

Bodily injury liability insurance, also called BIL, helps pay for the medical expenses another person incurs because of an accident you caused. It also covers the legal costs if you’re sued due to the accident.

Some policies also pay out for lost time if the other person is unable to work and funeral expenses if they die from their injuries.

BIL insurance is compulsory in almost all states, except Florida. If you want to know how car insurance works in the state and which insurers offer the best coverage, our guide to Florida car insurance can prove useful.

2. Property damage liability insurance

Also called PDL coverage, property damage liability insurance compensates the other driver for the damage and losses you caused in an accident. It also covers the legal and settlement expenses arising from a lawsuit.

This type of coverage is mandatory in all states. Even in New Hampshire and Virginia, where car insurance is not compulsory, you’re required to take out this policy if you choose to get coverage.

The general minimum requirement for liability car coverage is 15/30/5. This means:

$15,000 in bodily injury coverage per person

$30,000 in bodily injury coverage per accident

$5,000 in property damage coverage

The minimum limits vary depending on the state. Car leasing companies, however, impose significantly higher liability limits. Insurance for leased car is often required to carry at least:

$100,000 in bodily injury liability coverage per person

$300,000 in bodily injury liability coverage per accident

$50,000 in property damage liability coverage

The table below lists the minimum liability coverage requirements for insurance for leased cars from some of the country’s top lease transfer companies.

Insurance for leased car – Minimum liability coverage limits from top vehicle brands

MINIMUM LIABILITY CAR INSURANCE REQUIREMENTS

TOP CAR LEASING COMPANIES

Company

Minimum coverage limits

Chrysler

BIL: State minimum

PDL: State minimum

GM

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per person, $500,000 per accident

Honda

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per accident

Hyundai

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per accident

Kia

BIL: State minimum

PDL: State minimum

Mercedes-Benz

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per accident

Nissan

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per accident

Subaru

BIL: $100,000 per person, $200,000 per accident

PDL: $50,000 per accident

Tesla

BIL: $100,000 per person, $300,000 per accident

PDL: $50,000 per accident

Toyota

BIL: State minimum

PDL: State minimum

Car leasing companies, however, will require you to take out additional coverage to protect the vehicle from loss or physical damage. Often, they will ask for proof of full car insurance coverage before leasing their vehicles to you. This means you will need to purchase the following policies:

1. Collision coverage

Collision insurance covers the cost of repairing or replacing the leased car if it collides with another vehicle or object. It also pays out for damage caused by potholes or if the vehicle rolls over. Collision coverage, however, doesn’t cover mechanical failure and normal wear and tear.

2. Comprehensive coverage

Comprehensive car insurance pays the cost of repairing or replacing the leased car if it is lost or damaged in a non-collision accident. This means that it covers everything that collision insurance doesn’t. These include man-made incidents such as explosions, fire, theft, and vandalism, and natural disasters like floods, hailstorms, and hurricanes.

3. Gap insurance

Short for guaranteed auto protection insurance, gap insurance is designed to protect car owners – in this case, your leasing company – if their vehicle is totaled or stolen. It covers the difference between the actual value of the vehicle and the outstanding balance in the car loan.

Most car leasing firms automatically include this type of coverage in your leasing payments, according to the Insurance Information Institute (Triple-I). But there are some that will require you to purchase coverage as part of your leased car insurance.

The table below lists the additional coverages that the top car leasing firms will require you to take out.

Insurance for leased car – additional coverage requirements from top vehicle brands

ADDITIONAL CAR INSURANCE REQUIREMENTS

TOP CAR LEASING COMPANIES

Company

Minimum coverage limits

Chrysler

Collision and comprehensive coverage

GM

Collision and comprehensive coverage, with maximum deductible of $1,000 for each

Honda

Physical loss or damage coverage, with maximum deductible of $1,000

Hyundai

Collision and comprehensive coverage, with maximum deductible of $1,000 for each

Kia

Collision and comprehensive coverage, with maximum deductible of $1,000 for each

Mercedes-Benz

Collision and comprehensive coverage, with maximum deductible of $2,500 for each

Nissan

Collision and comprehensive coverage, with maximum deductible of $1,000 for each

Subaru

Collision and comprehensive coverage, with maximum deductible of $500 for each

Tesla

Physical damage coverage for the vehicle’s full value, with maximum deductible of $2,500

Toyota

Collision and comprehensive coverage, with maximum deductible of $1,000 for each

The following coverages, meanwhile, may be required inclusions under your insurance for leased car, depending on the state:

1. Personal injury protection (PIP) coverage

This covers the medical expenses you and your passengers incur because of an accident, regardless of who is at fault. It may also cover lost income if you’re unable to work and the cost of household services if you can’t perform certain daily tasks. Some policies pay out a death benefit, which can cover funeral and burial costs.

PIP is a term used exclusively in no-fault states. Outside of these states, this type of policy is called medical payments coverage or MedPay.

2. Uninsured/underinsured motorist coverage

UM and UIM insurance for leased cars are typically packaged together as they work almost the same. These policies are designed to fill the gap between the costs you incur and the at-fault driver’s ability to pay.

UM and UIM insurance pay out for the injuries and property damage you and your passengers suffer after being hit by an uninsured or underinsured motorist. Coverage also applies to hit-and-run accidents.

Just like in insurance for leased cars, you are required to take out collision and comprehensive coverage, apart from the state-mandated policies, for your financed vehicle. These are often set by car dealerships, banks, and other lenders as a condition for your car loan.

But while the leasing firms retain ownership of the vehicle after the lease term – unless you buy it – ownership of a financed car is transferred to you once you have paid off your auto loan. Once you own the vehicle, you can adjust your coverage accordingly.

Car owners are not required to take out collision and comprehensive policies, unlike those who lease vehicles. While not mandatory, it is still advisable for you to purchase these types of coverage, so that you can protect your vehicle against unexpected damage and losses.

If your car is brand new, it is also recommended that you get an auto insurance policy that includes new car replacement. This helps ensure that you have sufficient funding to buy a vehicle of a similar make and model if your brand-new car is totaled.

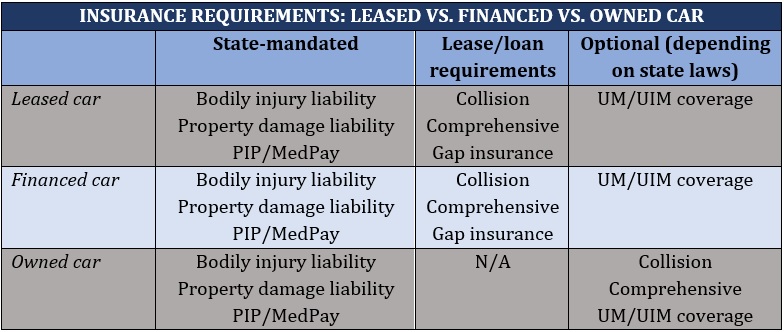

The table below provides a side-by-side comparison of how insurance works for a leased, financed, and owned vehicle.

Insurance for leased cars is generally more expensive than that for financed and owned vehicles. That’s because leasing firms impose higher coverage limits and require additional policies.

Some leased car policies also come with a maximum deductible limit, which can impact the amount you can slash off your premiums.

All told, lease payments typically cost less than car loan repayments because you’re not paying for the entire value of the vehicle. This means that the higher insurance costs are simply a trade-off.

To get an idea of coverage costs for the country’s largest auto insurers, you can check out this car insurance comparison that we prepared.

The answer to this question depends on your personal preferences and financial situation. If you’re looking to change vehicles more frequently, leasing may be an affordable short-term option. This also gives you a level of flexibility as you won’t be tied down to costly loan repayments.

But because you don’t have ownership of the vehicle, you’re restricted as to what modifications you can make. Most car leasing companies also limit the amount of mileage you can put on the vehicle. Such restrictions are not present if you own the vehicle.

Signing a car lease means that you have agreed to meet the insurance requirements that the leasing company has set for the duration of the contract. Below are seven simple steps to ensure that you can find the right insurance for your leased car:

Pick the car that best suits you.

Confirm with the leasing company what the minimum coverage requirements are.

Verify if GAP insurance is rolled into the lease payments or if you need to buy separate coverage.

Shop around and compare car insurance quotes.

Purchase coverage and get proof of insurance. You can buy car insurance online to save costs or with an experienced insurance agent or broker if you prefer a more personal touch.

Submit the proof of insurance to your car leasing company.

Sign the lease and enjoy your new car!

Still, the best way to make sure you’re getting the coverage you need is to understand what types of policies are available and the kind of protection they offer. You can learn more about how car insurance works in this comprehensive guide.

Do you have additional tips on how to get the most out of insurance for leased cars? Do you think signing a car lease is better than purchasing your own vehicle? Feel free to share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!