Inequities in exposure to copay accumulator programs

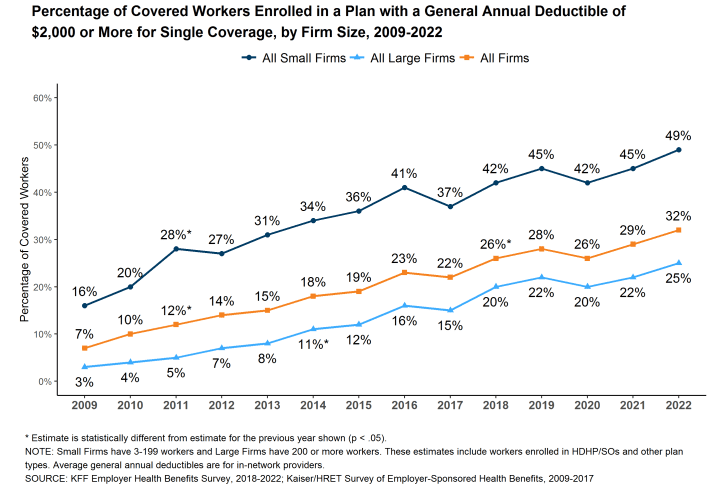

Copay cards are somewhat controversial. These cards or coupons are used to help patients afford copayments and deductible payments patients owe when using pharmaceuticals. On the one hand, these programs are highly beneficial for patients. Patient out-of-pocket costs have risen dramatically in recent years, even among the insured. For instance, whereas only 7% of workers had a deductible of $2000 or more in 2009, now 32% have such a high deductible. Moreover, nearly half of workers in small firms have a deductible of $2000 or more. On the other hand, payers claim that copayment cards increase health care costs by increasing use of pharmaceuticals due to moral hazard.

https://www.kff.org/report-section/ehbs-2022-summary-of-findings/attachment/figure-f-33/

To address the issue, payers have started to implement copay adjustment program (CAP), such as

copay accumulators and copay maximizers.

In accumulator programs, the payments made with copay cards do not count against the patients’ deductibles or the OOP [out-of-pocket] cost maximums. Therefore, these programs may increase the patients’ total cost-sharing burden and potentially lead to unexpected, substantial midyear expenses.

In maximizer programs, the total annual benefit is allowed to increase up to the maximum amount that a manufacturer is willing to reimburse patients for their copay expense. This amount is distributed across a patient’s benefit year to equalize the use of these available funds. These maximizer programs still do not count toward a patient’s deductible or OOP cost maximum within a given year and can delay a patient’s ability to reach this benefit threshold, leaving the patient exposed to further costs related to other medications or illnesses.

One important question is whether (i) copayment card use varies by racial and ethnic group and (ii) whether CAP programs vary by racial and ethnic group. This is exactly the research question Ingham et al. (2023) aim to answer. The authors use 2019-2021 data from the IQVIA Longitudinal Access and Adjudication Data (LAAD) 1:1 matched to Experian Marketing Solutions, LLC consumer data. The former is a claims data source, the latter is consumer data source. Using these data files, the authors find that:

…there were no significant differences in copay card utilization between non-White patients and White patients (odds ratio [OR] = 0.995, 95% CI = 0.99-1.00; P = 0.0964). However, among copay card users, non-White patients were significantly more likely to be exposed to CAPs, as either maximizers (OR = 1.27, 95% CI = 1.22-1.33; P < 0.0001) or accumulators (OR = 1.31, 95% CI = 1.26-1.36; P < 0.0001), compared with White patients.

In other words, non-White patients are about 30% more likely to be exposed to a CAP program than Whites. The full article is available here.