Sneak Peek: Venture Into The Covered California 2024 Rates

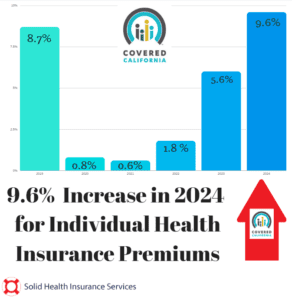

Covered California just released the rates and new benefit structure for 2024. Health insurance rates will climb an average of 9.6% statewide in 2024 for consumers who buy their coverage through Covered California, according to the agency. However, by switching insurance carriers, Californians may avoid that steep increase.

This rate change can be attributed to multiple factors. Not only due to the persistent surge in health care utilization post-pandemic, but also higher pharmacy expenses and inflationary impacts within the health care sector, such as escalating costs of care, labor shortages, and salary and wage raises.

With the extension of the enhanced federal subsidies provided by the Inflation Reduction Act and the new financial support provided by the California legislature, a significant number of enrollees will experience no alteration in their monthly coverage expenses in 2024. Moreover, with the new financial state cost-sharing program individuals and families with a lower than 250 % Federal Poverty Level, may either witness no change or even a reduction in their monthly premiums if they decide to remain with the same carrier within their current region.

California Individual Market Rate Changes by Carrier

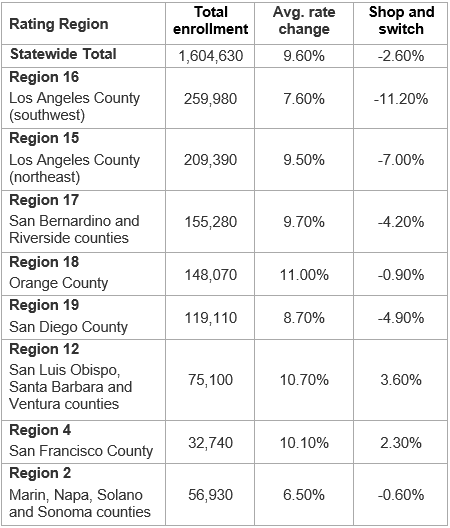

Covered California Individual Market Rate Changes by Rating Region

Read all the details for other regions in the full article here

Introducing the 2024 New-State-Enhanced-Cost Sharing Reduction Program

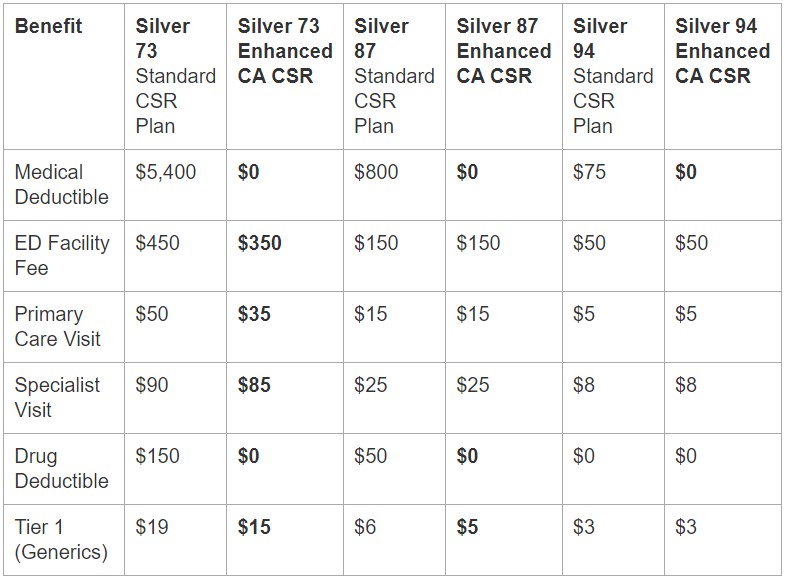

Covered California offers Californians whose incomes are no more than 250% of the federal poverty level to be eligible for three silver plans that will require no deductible in 2024. These are household earnings of at least $33,975 for an individual and $69,375 for families of four.

The new state-enhanced cost-sharing reduction (CSR) program plans will increase the value of the Silver 73 plans to approximate the Gold level of coverage and the Silver 87 plans to approximate the Platinum level of coverage. Silver 94 plans already exceed Platinum-level coverage. Over 650,000 enrollees will be eligible for these cost-sharing reduction benefits.

Deductibles will be eliminated entirely in all three Silver CSR plans, removing a possible financial barrier to accessing health care and simplifying the process of shopping for a plan. In addition, other benefits will vary by plan but will include a reduction in generic drug costs and copays for primary care, emergency care, and specialist visits, and a lowering of the maximum out-of-pocket cost.

Comparison of Silver CSR Plans with State-Enhanced Cost-Sharing Reductions

Although health care expenses are on the rise this year, Covered California’s market is steady and keeps offering consumers more options, according to Jessica Altman, executive director of the organization. She also added that despite this year’s hikes, Californians will have more assistance paying for their plan than ever thanks to the continuance of enhanced federal subsidies through the Inflation Reduction Act and extra financial support from the state. In fact, a lot of consumers who receive financial aid won’t see any change in their monthly bills, and some will even have their deductibles eliminated. Read our blog for more information about the CSR program.

In 2024, with twelve carriers providing coverage across the state, all Californians will have 2 or more health plans to choose from. With this, 92 % of Californians will have 4 carriers and more to choose from .

Changes to this year’s carriers include:

Inland Empire Health Plan is one of the 10 largest Medicaid health plans in the nation that serves more than 1.6 million residents. It will join Covered California and begin offering coverage in Riverside and San Bernardino counties.

Aetna CVS Health which joined Covered California in 2023 will expand into Contra Costa and Alameda counties next year.

Health Net will expand into Imperial County and will be offering an additional HMO plan.

Oscar Health which serves just over 31,000 enrollees in California recently announced that it will be withdrawing from California in 2024. Enrollees will be given the opportunity to choose a new plan or to move to the carrier with the lowest-cost plan in the same metal tier.

Read all the details in the full press release here

We at Solid Health Insurance will be here if you want to know more information about Covered California or if you have any questions about your health insurance for individuals, families, and small businesses. You may call us at 310-909-6135 or visit our website.