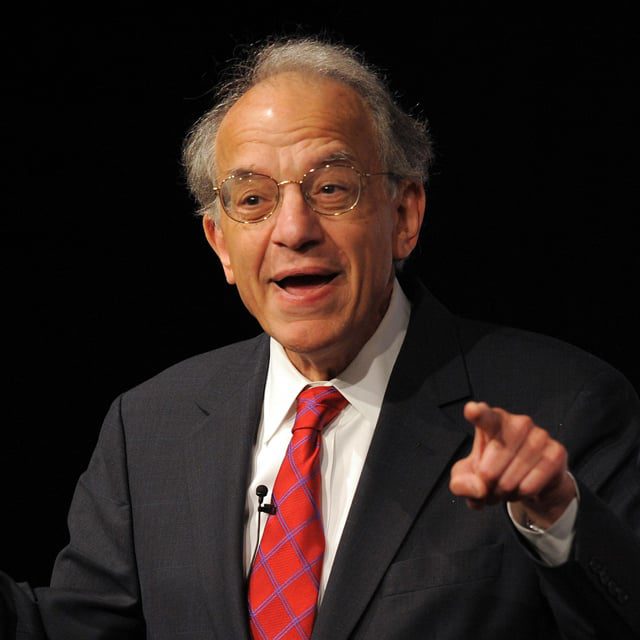

Stocks Set for New Highs: Jeremy Siegel

While Siegel previously was concerned the Fed was looking only at lagged economic data, “I think now the Fed gets that, and they realize that there are a lot of lags in that system and that they have to look at … forward-looking [indicators], so I’m less worried about that now that I was three or even six months ago,” he said.

The economist also said he sees no significant overvaluation in the stock market.

The S&P 500 is at 20 times next-12-months earnings, which is “about average,” he said. Tech stocks are at 30 times, and value stocks at an “extremely reasonable” 14 to 16 times range, he noted. One could argue that tech stocks may be a bit over their skis, and Siegel prefers value stocks, but he doesn’t see the market overall as significantly overvalued.

Lower Recession Odds

In his column today, Siegel said he had lowered his view on the likelihood for recession. While the currently upward trending economic indicators don’t guarantee there won’t be a downturn, he’s lowered his outlook on the chance of a recession to below 50%.

“If forced to give a probability, perhaps I would say 30%,” he wrote.

“There’s some weakness in the manufacturing sector, but consumer sentiment is still very strong,” he said. “We don’t have a runaway booming economy, but the recent reports indicate a strong economy.

“Summarizing: All this economic view is good for stocks and earnings. The strength reduces recession probabilities, which was the greatest fear for the markets. It leaves value stocks very well priced because they were basically priced for recession and declining earnings.”

Tech stocks are expensive and could react to the higher interest rates, but it’s a momentum trade and “earnings certainly have come in very well this quarter,” he added.

Photo: Bloomberg