Getting Ahead of Submission Overload: The Need for Systematic Prioritization in Commercial Lines Underwriting

This post is part of a series sponsored by Insurance Quantified.

“I Know, You Don’t Have Time to Read This. You’re Drowning in Submissions.”

I’ve had the opportunity to spend part of my career helping insurance carriers and their underwriting teams to increase their submission flow in the face of failing premiums and a seemingly bottomless pit of capacity. At that time, with premiums and thus commissions on the lower side, it made a lot of sense for carriers to focus on client acquisitions. It was a natural opportunity to really focus on building out distribution networks and deepening relationships.

Today, the market dynamics have changed for several markets, likely due to the current hard market, and I instead hear regularly from underwriting teams that are drowning in submissions.

These instances of submission overload seem to be most common in those products and industries hit hardest by the firming market, especially in Excess & Surplus (E&S), where the market has grown by 20%. I’ve heard tales of shared submission email inboxes that are overflowing with submissions that haven’t been touched or responded to, not to mention those sitting in underwriters’ personal inboxes. At first blush, this may sound like a nice problem to have, but is it really?

Success in the insurance industry is rooted in relationships, particularly for underwriters, who spend their careers cultivating partnerships. Underwriting teams must be responsive in order to maintain their relationships and grow their distribution networks. If submissions are falling through the cracks, some savvy brokers will take steps to get your attention so that their clients can get quotes, but others will just write you off.

The business benefits of responding to all submissions go beyond cementing a reputation for being timely and responsive. It also unlocks the opportunity to quote more business and thus write more premium, as innovations like easier access to data and smoother workflows facilitate a more scalable underwriting process overall.

The Business Case for Systematic Prioritization

When I talk with underwriting teams, I often ask them what their submission-to-quote ratio is. Some can answer that question, but those who are truly drowning in submissions usually have no idea. How could they, when they don’t fully understand the scope of their submission inflow? However, what almost every underwriting team does know is their quote-to-bind ratio, which is a key factor in discussing why underwriting teams need to regain control of the overflowing submission inbox.

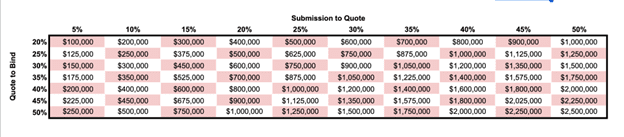

To help illustrate this, I’ve provided a table that looks at the economic impact of changes in a carrier’s quote rate. This basic example looks at an average policy size of $10,000 with 1,000 submissions per month.

Let’s examine the quote-to-bind ratio of 20%. With every 5% increase in submission-to-quote, this firm realizes an additional $100,000 in premium a month or $1.2 million a year. But if the quote-to-bind ratio increases to 50%, a 5% improvement in submission-to-quote yields $250,000 a month in premium or $3 million a year. The 5% increase is a basic benchmark figure, but this grows with the ability to quote more business, assuming the quote-to-bind ratio remains consistent as the volume increases.

One of the counterarguments to this could be that not all of those submissions would fall into your appetite, so how could you quote them? This is certainly true, but it’s also the case that knowing more about all those submissions that you are currently missing enables you to better work with your distribution partners to understand your appetite and perhaps create new product offerings better aligned with your distribution.

By now, hopefully you agree that it makes good economic sense to find a way to address all those untouched submissions in your inbox. After all, this business cycle will eventually move on and reduce these volumes, so now is the time to make the most of them and not squander important relationships. The key question: how will you suddenly find the time to address all these submissions?

Key Tech Capabilities for Underwriting Prioritization

Fortunately, there’s technology for that. Finding the right solution comes down to assembling the right set of capabilities to meet your business requirements. In this particular use case, companies that are inundated with submissions can benefit tremendously from finding a solution that will not only complete the intake process in a timely, accurate manner, but can also apply rules that help prioritize and ultimately surface the best opportunities for underwriters to focus on. As you are evaluating technology solutions, here are some core capabilities to look for:

#1: Turning the mass of submissions into actionable data for underwriting

One of the key pain points we hear is around getting data out of the inbox and into a usable format for underwriting. Surprisingly, this is still a highly manual process, with people often forced to enter data multiple times, which takes time and increases potential for human error. Ingestion technology leverages AI and machine learning methodologies to extract the key data needed to evaluate submissions and convert them into a consistent, usable format.

#2: Validating and enhancing the ingested data through verified, third-party sources

Extracting information is important, but even nicely formatted data frequently has gaps and needs verifying before you can call it complete and ready for an underwriter. This is where enrichment as a capability comes in. By layering third-party data sources on top of your ingested data, you can fill information gaps, reducing back-and-forth with your broker while also building in checks and balances to validate the quality of the information and reduce potential risk to your business.

#3: Taking the newly acquired data asset and overlaying your business requirements

With this newly complete data asset at your fingertips, the last step in the process is applying some type of logic to help quickly surface the best opportunities. There are workflow tools that enable you to set rules specifically for your business requirements that are then automatically applied to all completed submissions. The end result is a total application score applied to your entire submission pipeline that you can use to easily prioritize areas of focus and make informed, efficient decisions.

Topics

Commercial Lines

Business Insurance

Underwriting