Why Buying Life Insurance from a Bank is a Bad Idea

It’s very easy to think that bankers are wan…bad guys.

Sure wasn’t it the bank’s fault that the Boom collapsed so badly?

Younger readers might be thinking what boom, it was waaaaaaaaay back in 2008 afterall.

Between massive loans and inflated prices, it was all a bit of a disaster.

Now we’ve sort of returned to a middle ground where the banks aren’t such bad guys after all.

Or have we?

When it comes to Life Insurance, that’s definitely not the case.

Why?

Let’s take a look at why buying insurance with a bank will hit you square in the pocket.

Should you buy Mortgage Cover from your Bank?

If you’re looking for financial advice, your bank may seem like a safe bet.

You probably already trust them with your wages– unless you’re one of those people who keeps all their cash in a shoebox buried in their shed.

And you’ll use your bank to get a mortgage when you join the rat race and buy your first home.

Although this could change as the Credit Union plans to shake up the market (paywall)

So I understand why your bank makes sense as your choice for Life Insurance (or Income Protection or Mortgage Protection). You wander into your local branch, stand around for a few minutes, talk to someone, and get started on the process.

Most of the time, the bank will offer you cover there and then.

They will only turn you down if they think the chances of you claiming are too high.

The insurers (and banks) want to make money and the best way to do that is by betting on people who will outlive their policy. The safest bet is someone young and healthy, so if you fit that category your policy application will fly through.

However, if you have an underlying condition, it gets more complicated and is determined by underwriters, who calculate your risk.

If you’re turned down by your bank, that doesn’t mean you’re an insurance black zone where nothing can prosper.

You may just need to take your trade elsewhere.

Even if you’re accepted by your bank, you should take your trade elsewhere too.

Why?

I’ll let you in on a little secret: there are seven insurers in Ireland and the banks only work with two of them.

If you do the maths on that, you can see why you’re probably not getting the best deal.

Enter stage left: the broker.

Reasons for Using a Broker

Let’s get this out of the way: I’m a broker.

I’m obviously biased but – and this is the big one – I work with five of the seven insurers (we don’t work with Laya or Acorn)

Straight out of the gates, I have a better chance of getting you a better deal becuase we deal with more providers than the bank.

Which leads nicely round to impartiality. I don’t have any particular favourites when it comes to insurers.

And, if you’ve got a chronic illness, I’m your best bet as I can match you with the insurer who is most sympathetic to your illness.

If you’ve got a chronic illness and you go to a bank for insurance…well, you may end up with the least sympathetic insurance provider and a letter of decline in the post or you might get hit with a massive loading.

As well as getting you covered at the lowest price, a broker can also advise on the best insurer for each type of cover.

Let’s say you go to a bank: they’ll offer you Mortgage Protection from Irish Life, Serious Illness Cover from Irish Life, Life Insurance from Irish Life, and you guessed it…Income Protection from Irish Life.

Why?

Because, as I mentioned, most banks only deal with Irish Life.

(Bank of Ireland only deal with Bank of Ireland Life.)

So if you go with your bank, you’re missing out on valuable benefits such as:

Finally, here’s the kicker, if you add Serious Illness Cover to your Mortgage Protection policy, the bank will get the pay-out.

I’ll bet the bank didn’t tell you that.

Dealing with an insurance broker means you’ll clearly understand exactly what you’re getting, any risks involved, and what’s actually covered in your policy.

Of course, there’s also the option of going directly to the insurance companies themselves but I guarantee that you’ll get ripped off.

Let’s do a little comparison.

Susan is 40. She doesn’t smoke and is in good health.

She’d like a 30-year term on €500,000 cover with the option of extending the cover when she’s older without having to answer health questions.

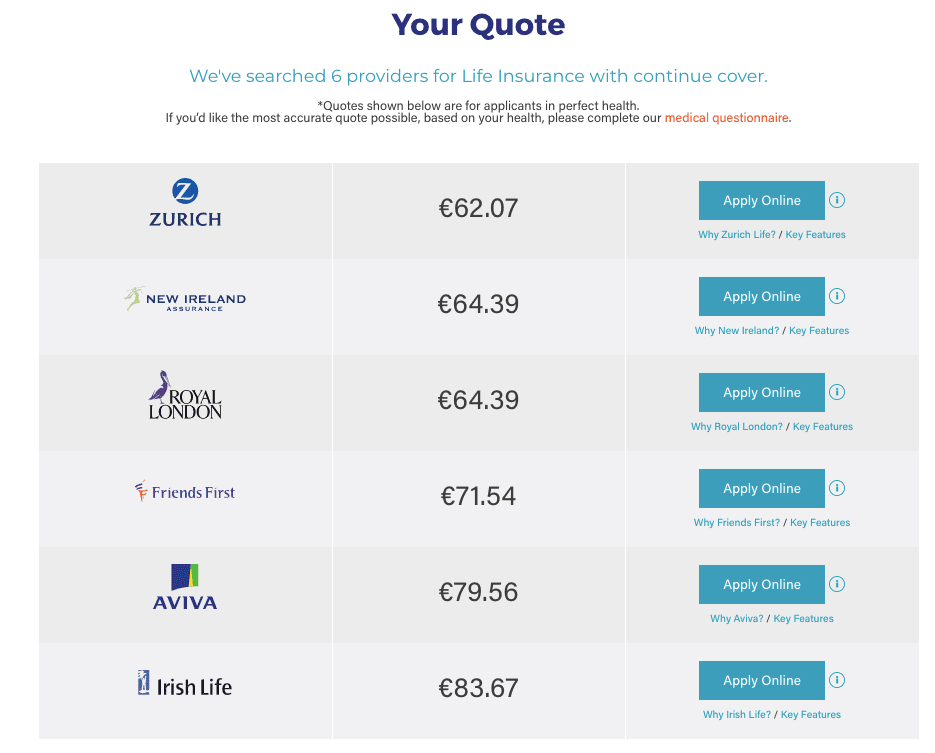

Her quote looks like this:

She’ll probably choose Zurich.

If she’d gone to the banks, she’d only be given one option, Irish Life.

Over 30 years, this would cost her €7,776 more in premiums!

Over to you…

Using a broker can provide you with more choice, personalised advice, and dedicated support throughout the process.

On the other hand, getting life insurance through a bank might be more convenient if you prefer managing all your financial products in one place, but it will come with fewer options and higher premiums.

Ultimately though, the crucial aspect is to choose someone you can trust, whether it’s a broker or a banker.

There are shyster brokers and shyster bankers so be on your toes.

Be sure to compare policies, understand the terms and conditions, and select a policy that protects you and your family from the bad stuff life can throw at you.

If you’d like me to help, complete this questionnaire, and I’ll be right back.

You can trust us.

Thanks for reading,

Nick

lion.ie | Protection Broker of the Year 🏆