Revealed – the key to streamlining the quote-bind-issue experience

Paul Lucas 00:08

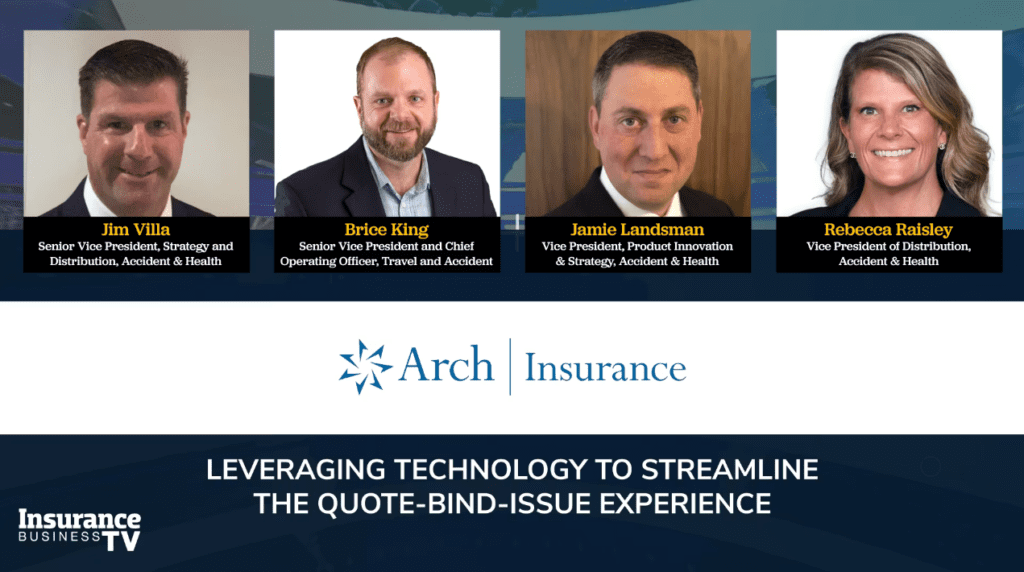

Hello everyone and welcome to the latest edition of insurance business TV a roundtable special brought to you in association with Arch Insurance part of Arch Capital Group and focusing on the accident and health space. But not just that, in this unique episode, we’re going to zoom in on how you can leverage technology to streamline the quote-bind-issue experience. According to statistics from global data, the global personal accident and health insurance market was valued at $1.6 trillion in 2020. Already, an eye-catching figure, but one that is expected to grow at a compound annual growth rate of 6% through 2025. So it’s clearly a space to be keeping an eye on but one that is often seen as overly complex. If you’re looking to grasp the opportunities in the market, then technology may just hold the key with AI in particular having the potential to make business a lot more efficient. But don’t take my word for it today. Thanks to Arch. We have an expert Anil on hand to talk you through the A&H landscape and how you can unlock it. They are Jim Villa, senior vice president strategy and distribution, accident and health, Brice King, Senior Vice President and Chief Operating Officer, travel and accident. Jamie Landsman, Vice President product innovation strategy, accident and health and Rebecca Reyes, the Vice President of distribution, accidents and health. So to kick us off, Jim, tell us a little bit more about Arch.

Jim Villa 01:41

Sure, Arch Insurance is a part of Arch Capital. We’re a global property casualty insurer based in Bermuda with more than 16 billion in capital. We have three divisions, insurance, reinsurance and mortgage. And our area is very much known for our travel brands of Rome rate, and red sky. And we’re taking that success that we’ve done in that space, and building out new to other age type products.

Paul Lucas 02:15

And do you have as well, any sort of specific target markets in the accident and health space?

Jim Villa 02:21

Yeah, so we have three Paul, that we really focus on, or we broke them into three. The first one is the employer-employee market. And the next one is what we call special risks. So that’s cultural travel, sports, amateur sports groups, schools. So it could be inbound outbound coverage, it could be K to 12 coverage, non for profits is also in that special risks, as well as camps and take cares. And the last one is kind of our newest one that we’re doling out is mainly the affinity Consumer Solutions, so to be associations, colleges and university alumni, financial institutions. So a very big space that we’re building to get into.

Paul Lucas 03:09

You’ve obviously got a very expensive proposition. But how do you stand out in the market, Jim, because it is a competitive marketplace? So what value proposition do you bring to your distribution partners?

Jim Villa 03:20

There, Paul is a great question that, you know, right now, our distribution partners are looking for more than just the paper. They’re looking for a total experience. So they’re looking for the, you know, our underwriting talent, the breadth of our products, our marketing, and how to educate our distribution partners, the vertical integration that we can deploy to our partners. And then last but not least, is our technology that is really what we are really good at the ease of doing business. And you know, when you look at that travel space that we’re in today with Rome rate, and Red Sky, that’s what really leads us in that in that space. So we’re taking all of that good stuff and really building it out to the other agents products.

Paul Lucas 04:08

So Brice, if I can bring you in, because I think Jim has given us a really nice segue that tech is obviously a big part of your value proposition. So how does it factor into the future, quote, bind issue process?

Brice King 04:23

Excellent question, Paul. So as Jim mentioned, we started out as a travel insurance business unit. And for those of you that are familiar with that industry, that is one of the original insurtechs. Travel insurance was distributed online as early as 2000 directly to consumer with credit card sales. And when I first got into the space 12 years ago, we’ve been building and evolving our digital distribution tools. Selling travel insurance direct to consumer as well is through travel agents and tour operators. In all these sales are online credit card sales, millions of transactions a year. This technology we’ve evolved in developed over the past decade, selling not only through desktop, a tablet and phone. We are part laying this into our accident health space, we’re developing off-the-shelf, A&H products that have limited benefits and upgrades that we can sell real-time with instantaneous, quote-bind an issue via e check or credit card or invoice. And then we’re also evolving as processing to where you have more complicated cases, you can get a quote process in our portal, and then that quote, will then route directly into a digital workflow for underwriting to generate a proposal, the routes back into the portal for immediate bidet issue.

Paul Lucas 05:31

Yeah, but I imagined Bryson, you’ll know this even better than me. Of course, whenever you mentioned the word technology to brokers, it tends to throw up a few red flags. This is a very relationship-oriented business, of course. So how does your technology make life easier for your partners and for insurance as well? And how do you ensure that you don’t lose that high touch ability?

Brice King 05:57

I think that the benefits of technology bring ease of doing business, the ease of transaction sales, it gives everyone more time in their day, more time to pursue more business more time to collaborate and innovate. So I think it doesn’t detract from the relationship, it actually improves the relationship. The self-service tools allow our partners to do business more effectively and at their leisure anytime a day. Yeah, and

Paul Lucas 06:21

Rebecca, is there anything that you’d like to add?

Rebecca Raisley 06:25

I think your question, I think is, is extremely relevant with what we’re seeing in the marketplace. And it is certainly a relationship business like what we do. But you’d actually be surprised with the number of producers still are saying, you know, that have seen the technology that we’ve put forward and are, are very welcoming to it. So I think, you know, the full end solution, as Jim mentioned, that we are able to bring to the table is something that doesn’t exist currently today, it really is industry-leading and it is very welcomed, much as a time saver, as Brice mentioned, but I think that they’re just looking for your service right now is a challenge in the industry, getting policies issued and getting those things or those items delivered, have been quite challenging. So having that immediate gratification, having the technology at their fingertips, and being able to not only just quote the, quote something, but then, you know, ultimately issue a policy, you know, is extremely exciting and very welcoming, you know, from the least from the brokers that we’ve spoke to so far. So I think it’s really exciting. I think what artists bring to the table here.

Paul Lucas 07:38

Yeah, and of course, when we’re talking about technology, we can’t really have a conversation without mentioning artificial intelligence AI. Of course, it’s seen as having an ability to both disrupt and transform markets. So Brice, I guess I’ll turn this back at you. Do you think AI has a role in the future here?

Brice King 07:57

It absolutely does. And AI is multifaceted set of concepts and tools in Arch has been focused on different AI technologies for several years. We do this cautiously and carefully because we are a regulated industry. And we do deal with a lot of PII and HIPAA information. So we have to be very sensitive to how we use that technology. And I’ll give you a couple of examples where we had a lot of success. A couple of years ago, in our call centre, we realised that we could improve our efficiency by implementing an internal chat bot. And what that means is when we bring in new customer service reps, we train them and get them licenced, and put them on the phones, when they first start taking calls. So inevitably have questions they have to go to their managers for and that involves putting a customer on hold. So we developed a chat bot, that was able to answer the most common couple 1000 questions that customer service rep gets. So anytime a customer service rep needed help, they could actually ask the internal chat bot a question and get an answer faster without interrupting the call. And once we train that chatbot sufficiently, we actually launched that to the public through both our online chat as well as our phone tree using Google’s text to voice feature. So that lets us do is implement a chat bot that a customer can call any time of day with our customer service forms open or closed, and answer most of their questions without actually having to call the customer service rep. We’ve had surprising success with this. Today we’re seeing 60 to 70% of our chat interactions successfully ending without a customer service rep being involved. That means the chat bots able to answer your customer’s question itself. So big time savings, the improvement to customer experience. Another area we focus is in the claim side. And we’ve done two specific initiatives there. One is on fraud detection. And so we’ve developed a set of AI tools that look at the most common indicators of fraud and then they scan or claim files looking for those indicators. So an example might be a policy that was purchased the day before the loss was occurred, or an image that has the same pixel structure and different parts of the image indicating fraudulent manipulated image. So our AI tools will scan the claim files, they’ll look at all these different triggers. And in the wake of that generate a weighted score of a fraud risk. And if the claim reaches a certain level of potential risk it’s elevated to manager exceeds as it’s moved towards our fraud in very, very effective tool that can think better and faster the human being. And then also in the claims adjudication side, we build tools that have AI tools that will let us scan claim files and indicate specific situations where we may be able to auto adjudicate part of the claim or at least guide the examiner on the best way to close the claim. And then you’re the big top of the tower now is chat GPT. And that’s one that we’re putting a lot of effort into trying to figure out how we can leverage that. And some of the most obvious tools implementations for ball route, creating email, a content chat GPD is very good at generating email specifically. So we’re using that to generate default email templates. And we then do have a pastor compliance for years. But it’s an evolving landscape and what we pay very close attention to.

Paul Lucas 10:56

So, Jamie, if I can bring you in, we’re not quite that far down the road with AI. But as you build out your products, what are the products that fit within each of your target markets?

Jamie Landsman 11:08

Right, so we have at Arch been a leader in the travel space for many, many years. And we are now applying those same lessons that we’ve learned in travel to our other targets, which are the affinity space, the employer market, and the individual market, which is not a common or well penetrated, segment within the Amish community from a supplemental health standpoint.

Paul Lucas 11:40

And of course, we heard about Arch at the very top, but just tell us about how Arch fits into this into this marketplace in particular.

Jamie Landsman 11:49

Well, Arch is a very unique company, we’re a specialty company. And a lot of what is done in the accident health community is specialty insurance. And from that standpoint, having a company and overall organisation that understands specialty insurance, is more supportive in some ways than some of the older PNC companies out there that understand PNC and then try and take a PNC lens to accident and health. So from that standpoint, and having had worked in both of those environments, I found Arch to be a lot more in line with what is necessary from a support standpoint for accident and health going forward than some of those other PNC companies.

Paul Lucas 12:41

And for those watching, who maybe just don’t understand the importance of accident and health products, just tell us what value they serve.

Jamie Landsman 12:50

Wow, I mean, everybody who has a health insurance policy out there these days that has had to endure premiums that have been rising for the last few years and High Deductible Health Plans and even low deductibles with high coinsurance amounts. And you get that surprise bill after 60 days understands that supplemental health products and accident health products have an important role in helping to mitigate some of those risks. Our goal is to make the supplemental health segment in the under 65 market just as common as it is for grandma and grandpa.

Paul Lucas 13:36

And elaborate for us as well, if you would in terms of the risks that you’re covering, are there any industry specific concerns that should be considered?

Jamie Landsman 13:45

Sure, I mean, there’s always a when you’re when you’re selling accident and health insurance to the broad market, there’s always the opportunity for to be selected by certain segments that may not be within a risk target market, more dangerous occupations, more hazardous leisure activities. We take a broad approach and try and create a policy form that applies to the largest number of people and helps to mitigate some of those risks associated with the gaps that are inherent to major medical

Paul Lucas 14:24

And are there any complementary products as well that you offer?

Jamie Landsman 14:28

Two major medical where we offer accident medical insurance, which is a fantastic product that is under sold in the market. Many people don’t even know that’s available so that it covers medical for accidental injuries. There’s also hospital coverages where you get paid a certain amount of money for every day that you’re in the hospital. There are specified disease coverages that we offer that had to pay a certain amount if you get a certain named disease. And all of these helped to complement major medical insurance not only by filling in the gaps, but also by helping people who even have traditional major medical insurance. And that doesn’t have a lot of out of pocket with some of the other expenses that you might incur while you’re recovering. So for instance, if you’re out of work, and you maybe had your policy cover those expenses, but then are out of work for a while, and you need a little extra help, though, the cash coverages for being hospitalised and for a specified disease, you can use that money for anything you want not just for health expense, if you need money to buy groceries, or pay the rent this month, or help here with your car payment. All that serves a role, it’s helping people focus on recovering, which is what we try and help people to do with insurance.

Paul Lucas 15:55

And Jim, just to bring you back in let’s talk distribution, when you look at your target markets and products, what distribution channels do you work with?

Jim Villa 16:04

Good question. So you know, I just mentioned about how our products kind of balanced the line between Property and Casualty and employee benefits. So that translates to, obviously the distribution as well. So we focusing on the property casualty distribution space, as well as the employee benefits. But you know, with Brice going through and going through our technology built, you know, we’re starting to open up doors around digital agencies and insurtechs. But then we also have another kind of distribution channel, we call alternative, which is really working with our reinsurance brokers on opportunities. One of our product lines right now is working with a carrier alliance, where we’re providing product to them using their distribution. So it’s really trying to look across all the distribution channels for opportunities, and, you know, we do have a very broad array of products that we do today. And then the ones that we’re building, so there’s a lot of channels that we can go after.

Paul Lucas 17:05

Yeah, so with that in mind, Jim, what are you seeing in terms of market trends for your products?

Jim Villa 17:12

Yeah, so, you know, coming out of COVID, you know, if you look at the business travel space, the, you know, the how people travel on business has, has changed. So, you know, people may not be taking as many trips, but the trips are looking different. So if you think about business travel, that would be you know, you leave, you come back, you take a flight, you know, now it’s, especially in the younger generation, you see a trend where people are blending, they call it please, you’re actually in the market, where it’s a form of the business trip, but then they stay some extra days on the front or back end, where they, they throw in some leisure. And that’s really, because now with the way the environment has changed, or not even just the buyer of the working environment, where people really can work anywhere. So they’re taking advantage when they do go on that business trip that, especially if they go to a place that they’ve never been before, and really extending the stay. So that’s, that’s definitely big in our space that

Paul Lucas 18:18

and, of course, entire business models, employment models have changed in recent years, mostly due to COVID. As you mentioned, can you just give us some more insight into these changes? And what companies need to do to be prepared for the future as well?

Jim Villa 18:31

Yeah, well, you know, I kind of went over some of that. But, you know, again, now with the working environment, people are working from anywhere. Like I said, business travel is looking different, you know, people who used to be full time to me, there’s maybe remote. So what was commutation and maybe not covered by things such as workers comp. Now, those are things where a business travel insurance policy would cover that. So, you know, again, insurance needs to look at, especially specifically by colour business travel, it’s definitely changed, the dynamic of it has changed. So again, that’s a lot of what we’re going to focus on really, as we kind of build into the future and really going at the market from a marketing standpoint. And again, it’s about the awareness of the product. So again, a marketing is very important around that.

Paul Lucas 19:25

Yesterday, with that in mind, Rebecca just to bring you in as well be what impact have you seen COVID Have?

Rebecca Raisley 19:32

Yeah, so interesting. I feel like COVID You know what, I think Jim mentioned earlier that there have been a lot of events that have impacted our industry 9/11 being one COVID being, you know, really most recent and significant impact from a domestic I think from an employee perspective, I think it’s created awareness as to whether you know, is an organisation or should an organisation be looking out or how they should be looking out. for their travelling workforce, whether it be you know, domestic travel, what happens if I get sick? What happens if I can track COVID? What happens if I die? As you know, I think there’s also been, you know, mentioned about how our products respond internationally, out of country, medical coverage, and quarantine coverage and things like that are also of great interest. And I think there’s a heightened awareness around, you know, making sure that if, you know, if somebody gets sick, there’s, there’s someone to call if there’s, if there is any out of pocket expenses incurred, because somebody did incur, or someone did get, you know, get sick on a trip that they, you know, they wouldn’t have to experience any out of pocket expenses. But I think one of the things that Jim actually mentioned that I think is probably I want to really draw attention to is how the environment has changed and what it looks like for a business trip. For instance, I myself, I’m a remote worker, I work I travel into Philadelphia, I travel into New York City, whereas before, that would be my normal commute. Today, when I take that trip, that actually constitutes a business trip, and I think that employees are more keen and more aware. And I believe that risk managers and HR managers should also be very aware that how the dynamics have changed, and what actually constitutes a business trip today. Hence, I think, driving the importance of our product in the market,

Paul Lucas 21:34

The environment is changed massively. Jim, do you think that COVID is going to have a lasting impact on usage of your products?

Jim Villa 21:43

Yeah, you know, unfortunately, sometimes it does take things such as you know, 9/11 COVID, has definitely called out our products, specifically business travel. So, you know, again, when you look at those situations, especially after 9/11, you know, the way he was called out the product, it got some definitely some awareness. And then carriers, you know, really kind of focus in on okay, what event, what was covered, what can we do better. And it’s the same thing with COVID. So these filings are very broad filings. So there are things that we would maybe not use normally. But when you look at what the COVID impact was, you know, now you know us as well as the market kind of re looks at their filings and says, you know, what are things that were not important that are important today?

Paul Lucas 22:36

Yeah, I think it’s made us all adjust our priorities, some fantastic insights from all of our panellists today, my huge thanks to you all and huge thanks as well to Arch the A and HBase clearly developing very rapidly, a lot for brokers to get their heads around. So if you do have any further questions that we’ve not covered today, please do reach out to the Arch team directly, and they’ll be glad to help and we’ll be glad to see you of course, right here. Next time on insurance business TV.