What is electrician insurance and why do I need it?

3 minute read

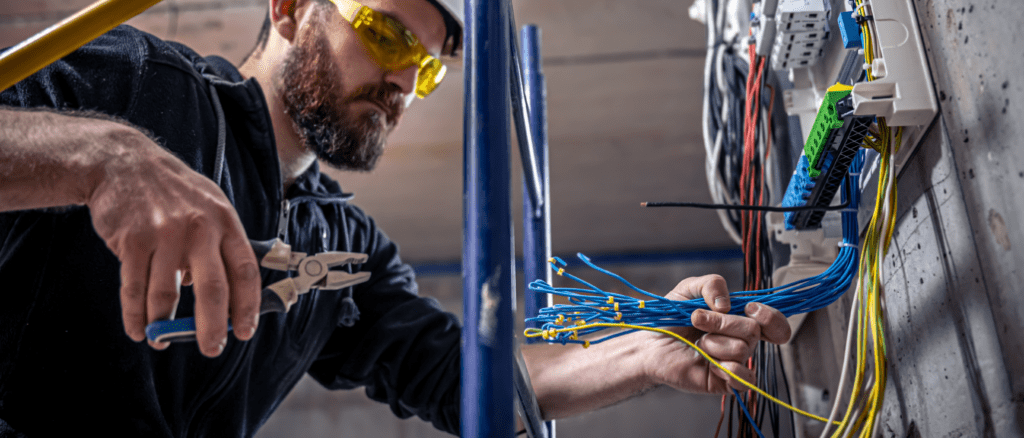

If you’re an electrician, you’re familiar with the risks of your job. You work with electrical wiring and high voltages, so you’re at risk of electrical shock and burns, as well as slips, trips, and falls. You might work at heights or in enclosed spaces, and you often work long hours or shifts.

But you also work in clients’ homes and businesses, so you could be found liable if a third party is injured on your jobsite or you inadvertently cause damage to their property. What happens if a tool falls off a ladder and injures your client? What if a circuit breaker malfunctions and causes a fire on the jobsite? What if your expensive copper wiring is stolen out of your truck?

If you work with electricity, you need insurance —whether you’re a self-employed electrical contractor or technician, or you work for a residential, commercial, industrial or construction company. In fact, it’s usually a requirement when applying for a business licence. But electrician insurance should go beyond basic coverage; it’s important to get the right mix of coverages for your unique business and the risks you face.

It’s also a good business practice. Having proof of insurance can help you gain the trust of new customers and enhance your reputation. After all, clients are letting you into their home or business, so building trust can help you build your business.

What are the most common risks electricians face?

Due to the dangerous nature of your work, you could be injured on the job. But if a third party is injured — even if it’s not your fault — you could face hefty legal fees. For example, if a client trips and falls on your jobsite, the client could sue your company for damages, including medical bills.

There’s also the risk of property damage. When you’re working with electricity, accidents can happen, including electrical fires that cause widespread damage. Even after the work has been completed, you’re still at risk. A customer could claim the electrical work was faulty and contributed to bodily injury or property damage.

Since you own or work with expensive hand and power tools — and you rely on those specialized tools to get the job done — you’re also exposed to the risk of theft. What would you do if those tools were stolen from your shop or out of your truck? In the same vein, if you deal with personal client information and/or credit card numbers, cyber theft should be on your radar.

These risks could result in lawsuits and legal fees, even if you’re not at fault. They can also cause reputational damage and force you to put business on hold, further impacting your finances.

What type of insurance do you need?

Electrician insurance should be customized to meet your unique needs, whether you work alone or have employees. Factors that affect your rate include the location of your business, annual revenue, and claims history.

Here are some coverages to consider:

Commercial general liability insurance: In cases of bodily injury or property damage to a third party, CGL insurance can help to cover damages that your business is found legally liable for.

Errors and omissions liability insurance: Even an experienced electrician can make an honest mistake. Contractors’ errors and omissions (E&O) coverage is designed to protect small business owners against claims where errors or omissions in completed work resulted in contract specifications not being met.

Property insurance: What would happen if your shop — and everything inside of it — was damaged in a fire, flood, windstorm, or other natural disaster? What if your specialized tools were stolen during a break-and-enter? Property insurance can help you protect and replace items that are damaged or stolen, including tools, equipment, furniture, and computers.

Mobile Equipment: What would happen if some or all of your tools were stolen from a temporary jobsite, or were damaged while driving to or from that site? In such instances, contractors’ equipment coverage can help to cover the costs of replacing your equipment.

Commercial auto insurance: Electricians need to get to and from customer properties, making commercial auto insurance a must. Unlike a personal auto policy, commercial auto insurance is designed to protect the business vehicle, the employees who are driving it, and any passengers who may be inside.

Cyber risk insurance: If you manage your operations online, you’re exposed to cyber threats. Cyber risk insurance can help protect your business from the costs incurred as a direct result of a cyber incident or privacy incident.

Protect yourself with electrician’s insurance

While insurance can protect you if an incident occurs, prevention is always the best approach. That means identifying potential hazards before you begin a new job and putting controls in place to mitigate risk. It also means using appropriate personal protective equipment (PPE), taking frequent breaks to avoid repetitive motions, keeping work areas tidy, and ensuring tools are in good working order.

But, if the unexpected happens, having electrician insurance can help you recoup your losses and get back to business faster. Find out how TruShield can help here.