Turkey earthquake industry insured loss estimated at $5bn by CRESTA

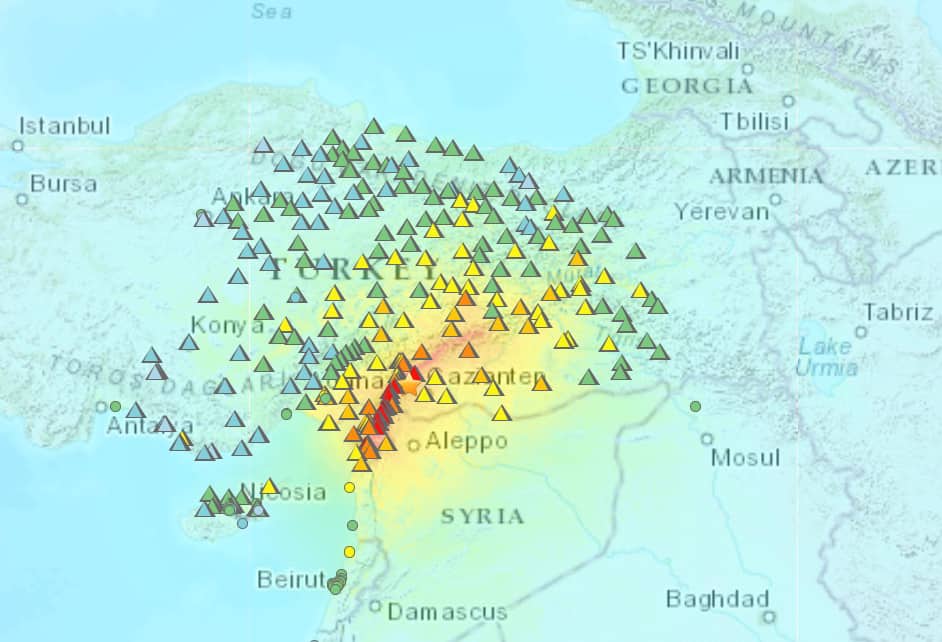

The insurance and reinsurance industry loss estimate for the Kahramanmaras Earthquake Sequence that struck Turkey and Syria in February 2023 has been pegged at $5 billion by CRESTA, making it the largest international insured catastrophe loss event of 2023 so far.

Remember that CRESTA does not cover catastrophe industry losses in the United States, hence recent severe thunderstorm activity is not covered in its latest data release.

But the Turkey earthquakes industry loss estimate is notable, at $5 billion, being higher than the last update from its manager PERILS, which had put the industry loss from the quakes at $4.6 billion back in May.

The new figure still falls slightly short of an estimate made by global reinsurance firm Swiss Re back in May, which put the Turkey earthquakes industry loss at an estimated $5.3 billion.

The majority of industry losses from this sequence of earthquakes have fallen to the reinsurance market, it now seems, with major global players taking a significant share.

CRESTA noted in today’s update that the Kahramanmaras Earthquake Sequence that impacted Turkey and Syria has been the largest international catastrophe insurance loss to date in 2023, with an industry loss of US $5bn.

It is so far followed by the two severe weather events in New Zealand: the North Island Floods of January (US $1.2bn) and Cyclone Gabrielle of February 2023 (US $1.3bn).

CRESTA also commented on the flooding in northern Italy from May, but said it is unlikely that insured losses reach above US $1bn, which would put it below its reporting threshold.

CRESTA is now also investigating a convective storm outbreak in Europe from June 18th to 22nd, which drove hail, water, and wind damage across Western and Central Europe.

Matthias Saenger, Product Manager of CRESTA, said, “Since 2000, we have recorded 14 earthquake events with an industry loss of above USD 1bn on an ‘as-if-today’ basis, giving a frequency of one event every 1.7 years. While such calculations are relatively simplistic, they can help the insurance industry to sense-check the outcome of highly complex Cat models. This is just one of the many applications that are possible with access to a systematic and accurate industry loss database.”