Do Property Insurer Priorities Match the Risk or the Customer Expectations?

Published on

June 29, 2023

Pressure is creating a climate for change in the restaurant industry. Coming out of a difficult few years, pundits would have expected restaurants to be in significant trouble. All of the same factors that are affecting insurers are similarly impacting restaurants. Talent is in high demand and not easy to find. Increased inflation is causing a re-ordering of customer priorities. At the same time, inflation is impacting supply costs for restaurants — both in food and food packaging. Ordering technology is shifting. Customers are even shifting the time of day they like to dine out.

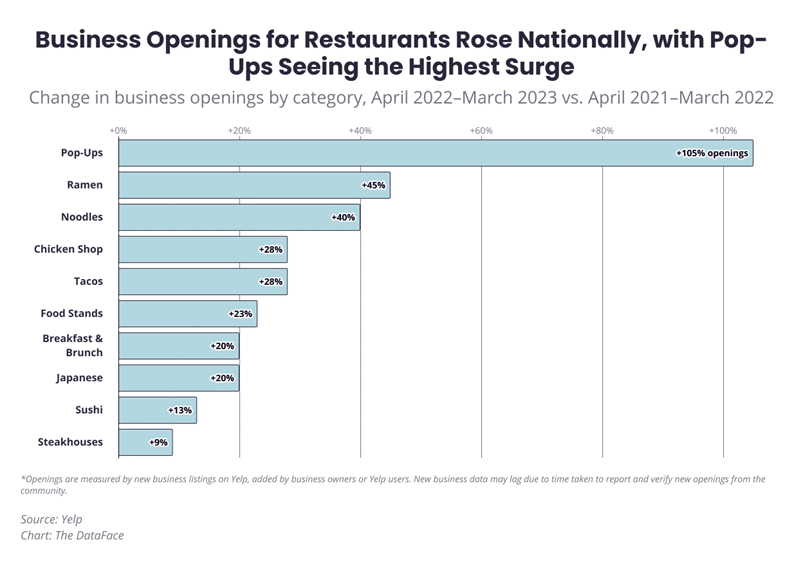

But the pressure isn’t causing restaurants to go away; it’s just causing them to change. In fact, according to Yelp’s 2023 State of the Restaurant Industry report, business openings for restaurants rose nationally in April 2022-March 2023, over the previous year.[i] Shopping and beauty care are industries in decline, but consumer spending on dining is continuing to rise.

The real evidence of customer and business change in the industry, however, comes from viewing the types of restaurants that are opening and growing. (See Fig. 1). Pop-ups are by far the greatest growth sector, a sign that people are continually looking for new and original options in dining. Their needs are met by agile, entrepreneurial chefs and investors who have their fingers on the pulse of culture and cuisine.

Pressured by costs, talent, inflation, and changing customer preferences, the industry’s new leaders are those who moved quickly to create new concepts. Restaurants used to be known for their consistency, but the new restaurant culture is one where the only consistency is steady innovation.

Figure 1: Changes in restaurant business openings

Where are today’s industry pressures pushing the insurance industry?

To find out where the insurance industry is focused, Majesco surveyed consumers, SMBs, and insurers. Insurer surveys can give us insights into how “in touch” they are with their customers, market and technology trends, and how quickly they are reprioritizing and executing these changes. Increasing risks have the potential to intersect and significantly disrupt businesses and people. Increased extreme weather events, natural disasters, cyber, crime, and more have an increasingly significant impact. For insurers, that means higher claims and lower profitability, but it also means greater need and opportunity. Are insurers creating a path for themselves that will drive better risk assessment, profitability, and reduce claims while growing market share through product and service innovation? Majesco documented some of these findings in our thought-leadership report, Game Changing Strategic Priorities Redefining Market Leaders.

Are insurers looking negatively at the complications of change or are they optimistically seeing the opportunities that change creates?

For example, an insurance gap is currently growing in part because of one high-level factor — property value escalation. The rapid rise in property prices means that most people and commercial businesses lack enough coverage and they don’t even realize it. In November 2021, it was reported that the median price of single-family existing homes rose in 99% of the 183 markets tracked by the National Association of Realtors in the third quarter, with double-digit price increases seen in 78% of the markets.[ii] Over the last couple of years, property prices have risen from 15% to over 30% on average, with some markets even higher. Due to the competitive housing market, many properties didn’t get inspected, leaving unidentified risks for both the insured and insurer. The result is the likelihood that many property owners are underinsured given the rising costs to repair or rebuild, posing a potential challenge for insurers.

The impact of this lack of coverage is a huge concern for insurers – from a customer satisfaction, reinsurance, and profitability perspective. Insurers need to look at their broader property portfolio and find new, innovative ways like digital loss control and new data sources to assess risk, predict the impact, and initiate loss prevention strategies more accurately and precisely – all areas Majesco is focused on with our solutions – Loss Control and Property Intelligence. Likewise, these are things that insurers should be doing regardless of the pressure of change. There are two sides to the insurance opportunity — operational optimization and market innovation. Both will utilize improved and new technologies.

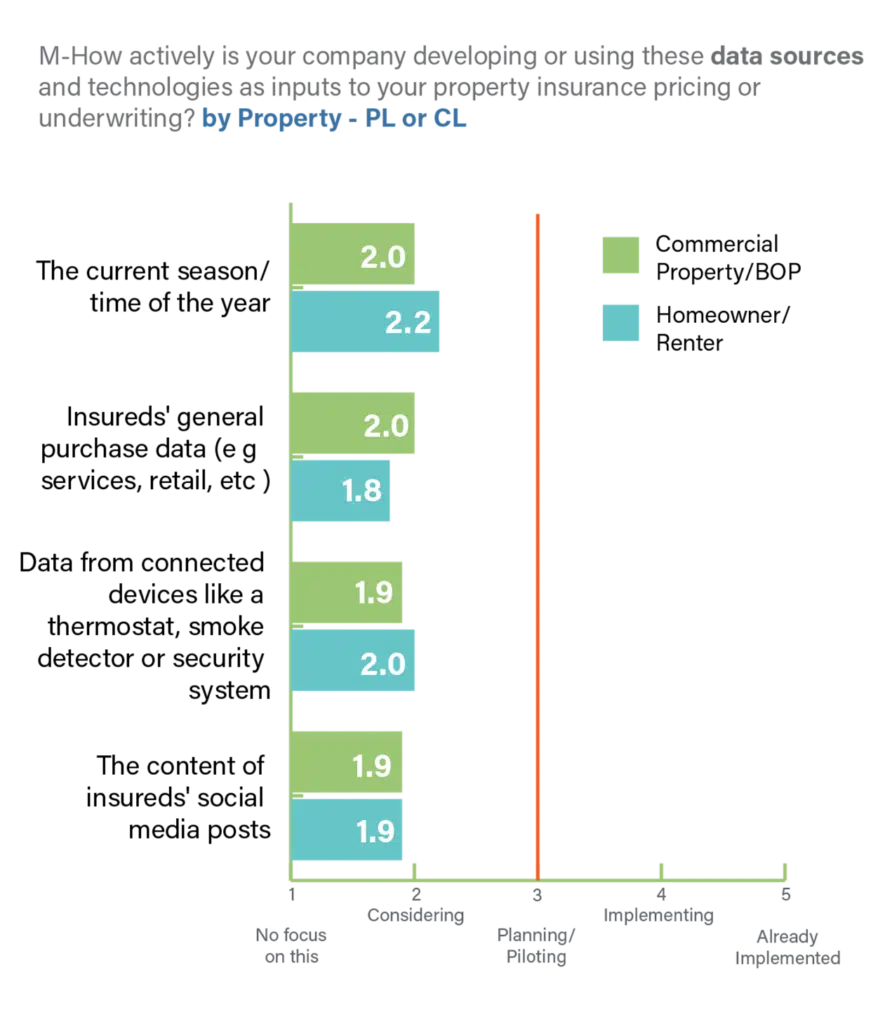

Personalized Pricing with Data

Based on insurers’ survey responses, there is currently very little innovation in the use of new data sources for either personal or commercial property insurance, as shown in Figure 2. This highlights a major disconnect between Gen Z and Millennial consumers and SMBs who have a high interest in these options. Likewise, Gen X and Boomers had high interest in the IoT-based option of using data from connected devices in their buildings/facilities and consumers were very interested in seasonally adjusted pricing and using data from connected devices in the home.

This highlights a major opportunity for insurers. Given the growing gap in coverage due to the rapid rise in property prices, insurers can close the gap by using loss control assessments and new data sources to identify opportunities for increasing coverage and addressing a potential lack of appropriate reinsurance coverage for the books of business.

Figure 2: Use of new data sources for commercial and personal property insurance

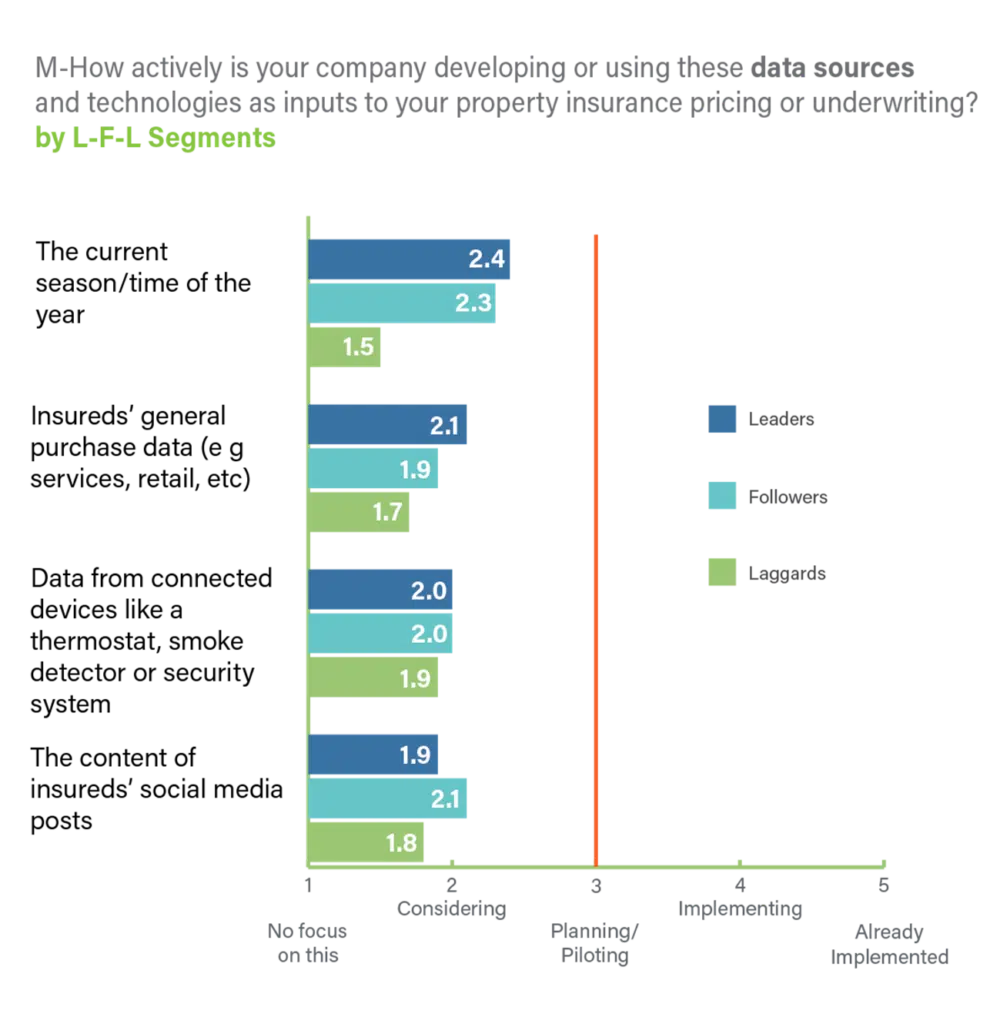

Looking at innovation trending for Leaders, Followers and Laggards

This pattern of limited innovation in using new data sources for property pricing continues even among Leaders, as seen in Figure 3. While Leaders and Followers are more actively considering seasonal-based pricing, it is still not to the Planning/Piloting stage, and the other three options are only at the Considering stage.

Further property valuations and insurance rate hikes are expected in 2023 due to a confluence of factors – exasperating an already undervalued property portfolio. With catastrophe-exposed, loss-hit accounts bearing the brunt of tightening capacity, difficult reinsurance renewals, and increased ratesof 25% or higher,[iii] there is an urgent need for innovation in property insurance regardless of if you are a Leader, Follower or Laggard.

Insurers who move to execute these options have an opportunity to separate themselves from the competition in this hardened market. They can solidly establish themselves as front-runners in the sector, no different than Progressive did 10 years ago in auto insurance.

Figure 3: Use of new data sources for property insurance by Leaders, Followers, and Laggards

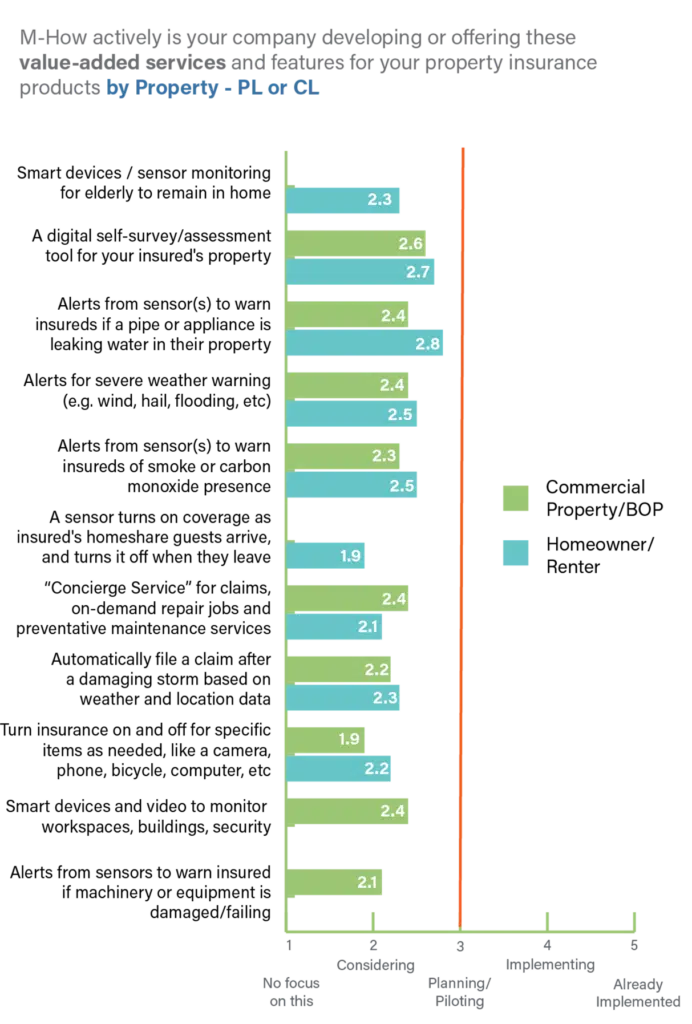

Innovation in value-added services

Compared to new data sources, personal and commercial property insurers show slightly more innovative thinking in value-added services. Several options are very close to the Planning/Piloting phase, particularly sensor and data-based alerts as shown in Figure 4.

Alerts and monitoring devices/services like smoke/CO2, water leak, equipment failure sensors, or alerts for severe weather and workplace/home threats promote safety and provide the ability for insurers to eliminate or reduce the risk and subsequent claims costs. If insurers did more loss control surveys – digitally this would provide a risk assessment for their customers to help guide them in what they can do to reduce risk. This is something Pennsylvania Lumbermen’s Mutual Insurance Company has done as discussed in a podcast with Erin Selfe. Customers appreciate any service that can give them peace of mind or crucial information about their property risks.

All these options are highly desired by consumers and SMBs, providing insurers an opportunity to proactively meet customer needs and expectations and create loyalty while helping to manage and avoid risk that can help overall profitability more effectively.

Figure 4: Development of value-added services for commercial and personal property insurance

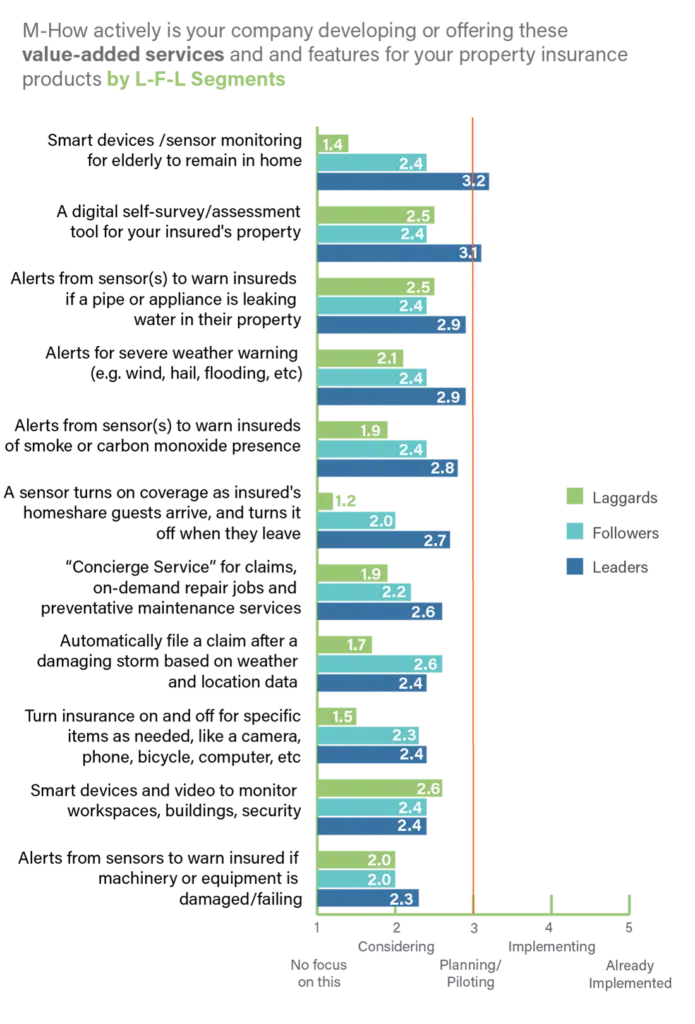

Leaders, Followers and Laggards approach to value-added services

Once again, Leaders stand out in their pursuit of value-added services to complement their core risk product, with seven of the eleven (64%) options above or within just a few points of the Planning/Piloting phase as seen in Figure 5. In contrast, Followers and Laggards are significantly behind which, like auto insurance, hurts their ability to create value and differentiate their offerings beyond a low-price focus.

Today’s increased catastrophes, market environment, and pressure on profitability demand a greater focus on preventable losses and better outcomes through underwriting profitability, proactive risk mitigation to minimize or eliminate claims, and expanded value-added services that help with risk management and enhance the customer experience.

Figure 5: Development of value-added services for property insurance by Leaders, Followers, and Laggards

Charting new courses

So, the question remains…is today’s level of innovation and investment enough for insurers to attract and retain today’s customers? Where are today’s Pop-up opportunities in the realm of products and services? Which companies are doing something truly original and innovative, using the full capacity of data and analytics?

The data suggests that most insurers would like to meet customer expectations and appetites for new products and services, and they are considering using data and technology to a greater degree to optimize risk assessment and prevent claims — but their strategic priorities aren’t necessarily aligned to make it happen. Where is your company on these issues?

Most need a plan and a partner to give them the momentum to compete.

Which gaps are you ready to fill?

Insurers looking to proactively reduce claims and improve prevention should be quick to take advantage of loss control technologies such as Majesco’s Loss Control, data and analytics with Majesco Property Intelligence or Majesco’s widely-acclaimed Intelligent Policy for P&C. Insurers across all tiers and segments are leveraging Majesco solutions and commitment to relentless innovation to optimize their operation but also innovate. Our research provides insight into our R&D and priorities to help our customers stay at the leading edge.

“Majesco continues its market leadership position with their recognition as a Luminary in the Technical Capability Matrix for Majesco Policy for P&C,” said Karlyn Carnahan, Head of Insurance, North America at Celent. “The Luminary Award recognizes those solutions which excel at both Advanced Technology and Breadth of Functionality.

Carnahan adds, “Majesco Policy for P&C is recognized as a leader in this category as a strong cloud SaaS solution, with extensive capabilities for personal, commercial and specialty lines, rich API catalog, a “customer panoramic view” which incorporates information about an existing policyholder’s billing record and claim experience, open to a broad ecosystem of third-party data and functionality partners, and pre-integration with Majesco’s “property intelligence score” (providing multiple measures of risks) and loss control survey capabilities.”

For more information on how Majesco is helping clients to grow more competitive every day, contact us. To review how your strategic priorities align with other insurers’ strategic priorities, be sure to download Game Changing Strategic Priorities Redefining Market Leaders.

[i] Yelp Data Reveals Nationwide Splurging on Restaurants and a Rising Interest in Fine Dining as New Restaurant Openings Increase, YelpEconomicAverage.com, June 21, 2023

[ii] “Home Prices Spiked In Nearly All Metro Areas In 3Q 2021,” National Mortgage Professional, NOV 12, 2021, https://nationalmortgageprofessional.com/news/home-prices-spiked-nearly-all-metro-areas-3q-2021

[iii] Wilkinson, Claire, “Property insurance rates to keep surging in 2023,” Business Insurance, January 10, 2023, https://www.businessinsurance.com/article/20230110/NEWS06/912354781/Property-insurance-rates-to-keep-surging-in-2023