Everything You Need to Know about IoT in Insurance

By Brynne Ramella, Content Marketing Manager, ProNavigator —

Technology is pushing the insurance industry forward.

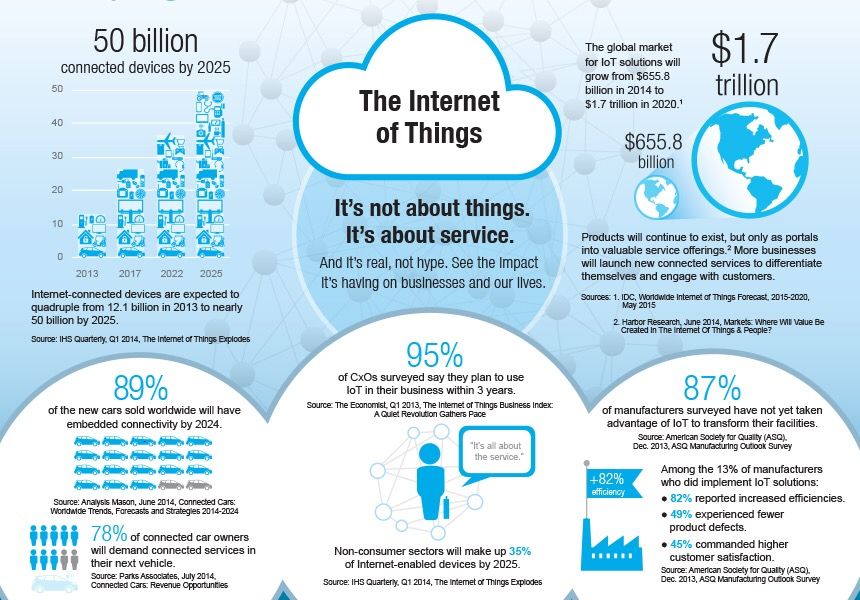

One such advancement is the Internet of Things (IoT). As NAIC says, IoT refers to a network of internet-connected devices transmitting, collecting, and sharing data. The software within these applications analyzes and sends data to cloud servers and large databases. Those platforms analyze the data in order to pull out important data.

The most popular IoT applications involve vehicles connected with telematics, smart home devices, and wearable devices like smartwatches. IoT data is sent back to users through these devices or a connected website. These user analytics have become immensely useful to insurance professionals.

How Has IoT Transformed the Insurance Industry?

Source: The Digital Insurer

Insurance professionals can use the data from IoT devices to improve the understanding of risks. Previously, insurers had to identify the risk of loss for an asset using proxy data, such as administering a survey to customers. But as Purple Slate states, IoT allows insurers access to real-time, individual, and observable data on an asset’s potential loss

Insurers can connect with consumers by adding touchpoints in areas such as acquisitions and claims. By collecting this data from a number of different sources, companies will be able to gain a more complete picture of their customers.

This data can also assist with increased precision in assessing risk and pricing policies, meaning that brokers have the opportunity to provide more personalized offerings to customers. Not only does this mean more targeted policies, but brokers can offer specific discounts based on an insured’s usage data.

Advances in technology always come with increased risk. IoT devices present new opportunities for cybersecurity threats and claims fraud. But the benefits outweigh the risks. For example, NAIC states that IoT could help insurers cut the cost of the claims process by 30% and also lower premiums for consumers. The multiple use cases for the technology have already begun to make it an asset to professionals in the industry.

Benefits of IoT in Insurance

New insurtech products are being released nearly every day. New technology may be overwhelming for traditional companies to keep up with, but IoT is one to keep an eye on. Here are some benefits insurance professionals can expect when implementing IoT devices:

IoT data can be used to design policies that fit an insured’s lifestyle better.

Companies that use IoT can expect reduced costs — AWS reports that IoT in insurance saves businesses $9–$15 billion every year.

This technology can be used to better assess and prevent risk, thanks to alerts from IoT data that advises when and why damage may happen.

Employees will no longer need to visit dangerous sites in person to assess damage or potential loss.

Leverage IoT analytics to curb cybersecurity fraud.

Provide better and more frequent customer service through telematics in IoT devices.

Five Use Cases for IoT in the Insurance Industry

Source: AI Multiple

No matter which line you sell, there’s an IoT use case for your business. These applications can help you improve the insurance customer journey, create highly, proficient teams, and more. Here are some use cases to consider:

Smart houses — Internet-powered home devices, such as smart doorbells, smoke alarms, and security systems are quickly gaining popularity. Insurers would benefit from gaining access to data from these devices, as that information can help avert accidents and allow insurance professionals to provide better service to customers. For example, smart doorbells can help to identify a robbery before it happens, keeping an insured’s home safe from disaster.

Connected cars — Telematics is now being used to connect cars to IoT apps, which is a useful asset for automotive insurance companies. A driver’s routes, speed, acceleration, seat belt detection, and more can now be tracked in real-time. That allows insurers to measure how safe a driver’s journey is, provide predictive maintenance, and reduce fraudulent claims.

Improved healthcare systems — Smart bracelets and watches can access a wearer’s sleep quality, heart rate, blood sugar, and more. These devices sometimes gamify exercise, which will encourage the wearer to lead a healthier lifestyle. Health insurance companies can use this data to personalize policies and offer savings to those customers with a healthier lifestyle.

A more connected construction industry — Insuring the construction industry is challenging. Job sites are often dangerous places and multiple areas in the industry have different products. IoT devices can help keep construction workers a little safer on the job. For one, embedded sensors in the infrastructure of a house can detect smoke, mold, and carbon dioxide and then adjust conditions to prevent a harmful event. Workers can also don a wearable device that could provide a warning if they get to close to a dangerous place.

Improved underwriting process — IoT devices have significantly sped up the underwriting process. Insurers can now create a better client portfolio, analyze risks in advance, reduce losses, and improve overall interactions with policyholders. A quicker underwriting process can help expedite other departments within insurance companies.

How IoT Will Change the Future of the Insurance Industry

The cutting-edge technology powering insurtech startups can be intimidating to traditional companies. But implementing IoT applications can give stalwart organizations a competitive edge against newer companies. Consumers appreciate the speed and efficiency of insurtech companies. They can find that with traditional insurance companies that use IoT devices.

Expect IoT to become commonplace in the industry in the coming years. A recent ACORD survey polled insurance professionals about their outlook on the industry over the next 20 years. Nearly 50% of respondents said that they anticipate that their greatest long-term source of competitive advantage will be how they leverage technological capabilities.

Digital transformation may be a buzzy topic in the industry right now, but that doesn’t mean your team needs to implement all trending software and technology at once. Start small and slowly begin to introduce new pieces of technology to your employees. Once you feel comfortable, work your way up to IoT. It may be a slow process, but you’ll feel the benefits for years to come.

To learn more about how to build out your company’s tech stack, head over to the ProNavigator blog for the latest insights!

About ProNavigator

ProNavigator provides a knowledge-sharing platform, Ask Sage, used by some of the largest insurance organizations in North America to save time, provide superior service, and seize revenue opportunities. The platform leverages the latest advancements in artificial intelligence and natural language understanding to instantly, automatically, and accurately retrieve answers to employees’ questions. For more information, please visit pronavigator.ai.

SOURCE: ProNavigator