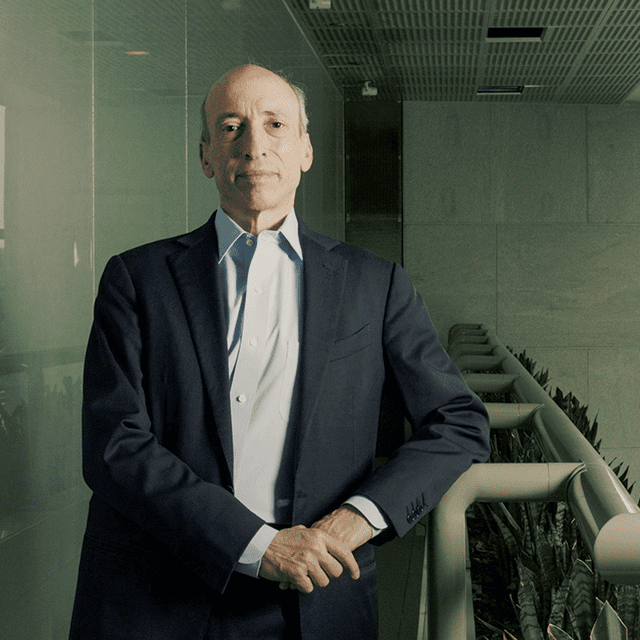

House GOP Seeks to Remove SEC Chair Gensler, Restructure Commission

Two House Republicans introduced legislation this week aimed at removing U.S. Securities and Exchange Commission Chair Gary Gensler and restructuring the agency to ensure equal representation of Republicans and Democrats.

The proposed SEC Stabilization Act would restructure the commission to include a sixth member, create an executive director position to oversee the agency’s daily operations and increase the commissioners’ terms from five to six years.

But GOP Reps. Warren Davidson of Ohio and Tom Emmer of Minnesota said a goal of their legislation is also the removal of Gensler, whom they said has engaged in “a long series of abuses.”

“U.S. capital markets must be protected from a tyrannical chairman, including the current one,” Davidson said in a press release. “That’s why I’m introducing legislation to fix the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come. It’s time for real reform and to fire Gary Gensler as chair of the SEC.”

Davidson added during a social media news conference Tuesday that Gensler has engaged in a “whole period of activism” and has “put inappropriately short public comment periods because, yes, he doesn’t care what anyone thinks.”

“He doesn’t even care what the impact on the market is,” Davidson added during the Twitter space conversation. “He’s got an agenda, and he’s very anxious to implement it.”

Davidson and Emmer serve on the Republican-led House Financial Services Committee.

The SEC declined to comment Tuesday on the proposed legislation and the lawmakers’ comments.

Jim Cox, a Duke University professor specializing in corporate and security law, said he is surprised at how long it took lawmakers to push legislation to remove Gensler.

“If you were looking for somebody who’s a hero in today’s regulatory culture, it would be Gary Gensler, the chairman of the SEC,” Cox said.

The addition of a sixth commissioner “would automatically make it actually more political,” he added.