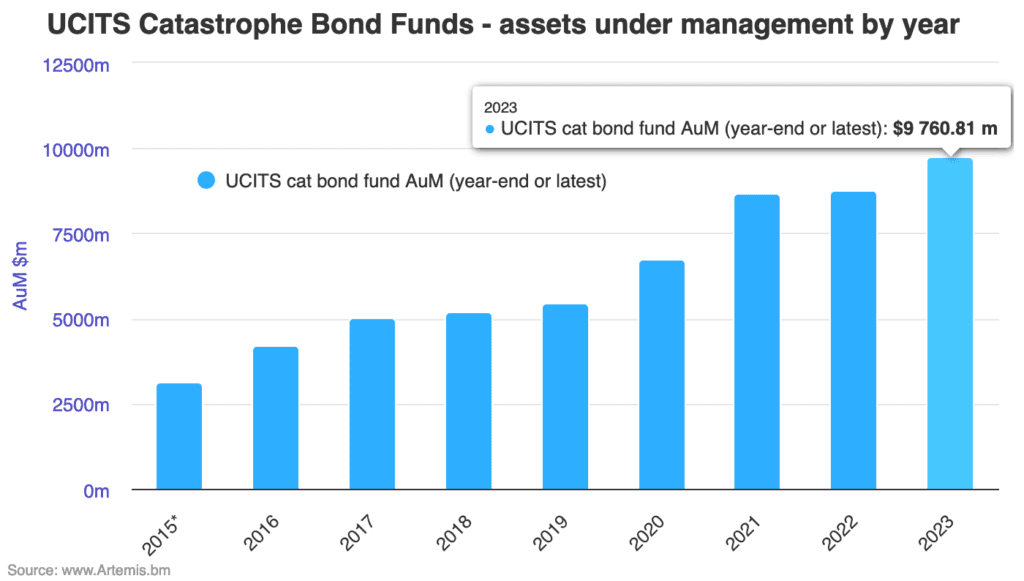

UCITS cat bond fund assets rise 4% to almost $9.8bn by end of May

Catastrophe bond funds in the UCITS format are rapidly approaching a combined $10 billion of assets under management (AUM), with another $372 million added in just the last two months.

The last time we reported on UCITS cat bond fund assets under management, at the end of the first-quarter, the total stood at $9.37 billion, since updated to just under $9.39 billion as of the end of March 2023.

Growth in the overall assets under management (AuM) of the main UCITS catastrophe bond funds has continued, with more inflows adding to the cat bond investment market’s capacity to take on new issuances.

This despite the cat bond market having experienced significant maturities as well, meaning that capital has been recycled and this freshly raised capital put to work in the last two months as well.

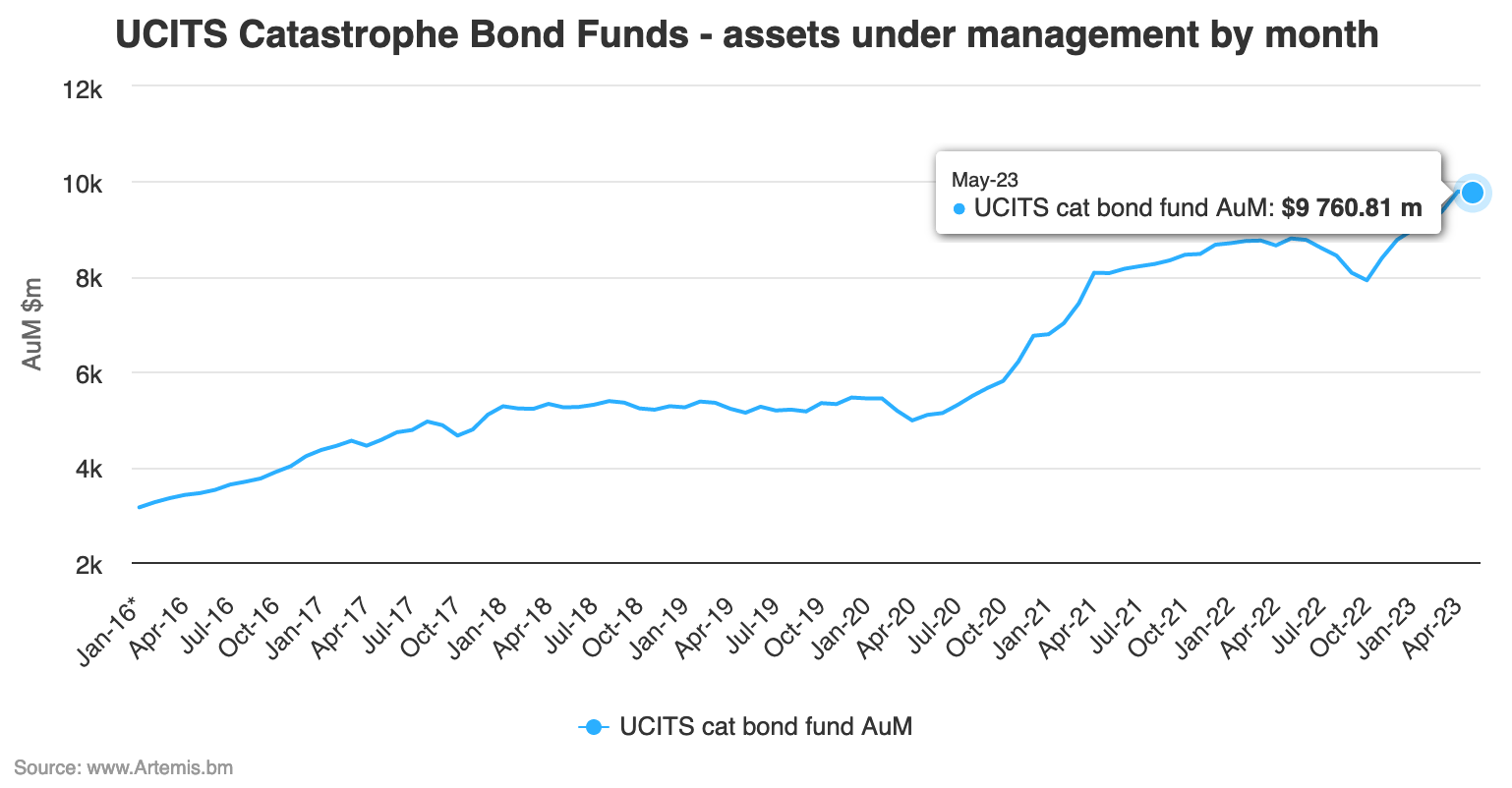

The chart below shows UCITS cat bond fund AUM up to the end of May 2023. Click on the chart to view an interactive version.

In terms of where the growth has been seen since the end of Q1, the fund that has added the most in assets is the Fermat Capital Management run GAM Star Cat Bond Fund in adding almost $107 million, while the Leadenhall Capital Management UCITS ILS Fund added almost $75 million.

Twelve Capital Management and LGT ILS Partners both added close to $42 million each, while Plenum Investments flagship UCITS cat bond fund was up $31 million and Schroders Capital’s GAIA Cat Bond Fund was up by $16 million for the two month period.

Plenum Investments also added nearly $27 million to its Cat Bond Dynamic Fund as well, which is a higher risk and return strategy operated by this manager.

There was a slight dip in May, as the combined assets under management of all of these UCITS cat bond funds as a group had reached just over $9.79 billion, but then fell slightly to $9.76 billion by the end of May, as the chart featuring assets by month below shows.

The three largest UCITS cat bond funds now account for roughly 78% of the overall assets, with the nearly $2.78 billion GAM Star CAT Bond Fund managed by Fermat still the largest, the $2.44 billion Schroder GAIA CAT Bond Fund second, and the Twelve Capital Cat Bond Fund third at just under $2.44 billion.

However, some of the much smaller cat bond funds are currently growing faster, in percentage terms. Reflecting the attractive investment environment and the fact a fresh allocation can make a significant difference to a smaller strategy.

It will be interesting to see how the US mutual funds compare, in terms of growth, when they next report their portfolios after the recent heavy cat bond issuance period.

Of course, with the cat bond market having far more in assets outstanding, there are a significant amount of cat bonds held in closed and private insurance-linked securities (ILS) funds, both pure cat bond focused and those that co-mingle cat bonds alongside other ILS and reinsurance-linked assets.

We’ll update you again on the assets under management of the leading UCITS catastrophe bond funds once the mid-year data is available.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.