How much do independent insurance agents make?

How much do independent insurance agents make? | Insurance Business America

Guides

How much do independent insurance agents make?

How much do independent insurance agents make? Do they earn more than captive insurance agents?

Unlike captive insurance agents who sell policies exclusively for an insurer, independent agents can offer a wider selection of insurance products from different carriers. But how much do independent insurance agents make? Do they earn more than their captive counterparts?

To shed light on these matters, Insurance Business will discuss everything you need to know about an independent insurance agent’s earning potential in this article. We will touch on the different salary ranges, pay structures, and the factors impacting pay. Insurance professionals can use this piece as a handy guide to help them compare their earnings with industry averages. Curious consumers, meanwhile, can get an idea of how much agents earn and think about if they want to start down this career path.

Different employment websites provide varying salary ranges for independent insurance agents, with entry-level positions earning an annual average of $20,000 to $26,000, while the top-earners make more than $200,000 per year.

The table below shows the percentile wage estimates for independent insurance agents across the US based on data gathered by this website.

How much do independent insurance agents make – salary ranges from lowest to highest

PERCENTILE WAGE ESTIMATES (INDEPENDENT INSURANCE AGENTS)

Percentile

Annual wage

Monthly wage

Weekly wage

Hourly wage

10th

$28,750

$2,396

$553

$14

25th

$48,000

$4,000

$923

$23

Average

$89,745

$7,478

$1,725

$43

75th

$109,500

$9,125

$2,105

$53

Top earners

$200,000

$16,666

$3,846

$96

According to the website, the majority of independent insurance agent annual salaries fall between the 25th and 75th percentiles, or between $48,000 and $109,000. Those who are earning above this range are considered outliers.

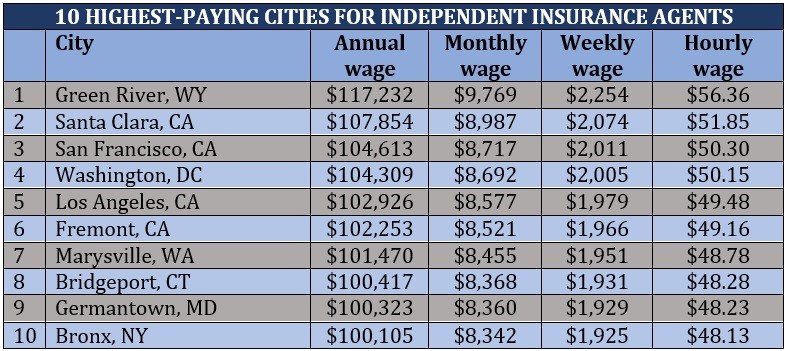

The place where an independent agent sells insurance policies has a major impact on their earning potential. This is because each state implements different laws regarding how insurance products are sold and who can sell them. The table below ranks the highest-paying cities in the country for independent insurance agents.

There are several ways independent insurance agents get paid. These include one or a combination of the following:

Salary

Commissions

Bonuses or profit sharing

Most independent insurance agents earn income through commissions, which are often influenced by the type and quantity of insurance policies they have sold. Whether the policies are new or renewals also impact how much commission they receive.

For personal lines coverages such as car and home insurance, independent agents can earn a commission equivalent to up to 15% of the annual premiums for new policies and from 2% to 15% for renewals, although the industry average is between 2% and 5%. This means that for every auto insurance policy worth $1,500, an independent agent can make $225 for a new client and about $30 to $75 for the succeeding years that the policy is active.

Independent life insurance agents, meanwhile, can earn front-loaded commissions of 40% to up to 115% of the policy’s first-year premiums. The rate, however, nosedives to about 1% or 2% for renewals. There are also agents who stop receiving commissions after the third year. This article explains everything you need to know about how much life insurance agents make.

Many independent insurance agents also work full-time as salaried employees for insurance agencies or even run their own businesses. Depending on the agreed-upon pay structure, they may earn a fixed wage or commissions on top of their salaries. Some insurance agencies also provide employees bonuses if the company reaches a certain profit target.

Generally, independent insurance agents earn higher commissions than their captive counterparts. This increases their earning potential. For example, captive agents typically receive about 5% to 10% commission for new auto and home insurance policies, while independent agents can earn up to 15%.

The higher commission rates, however, come with a caveat – independent agents are responsible for their own business expenses such as office leases, office supplies, and marketing and advertising costs.

Another benefit of being an independent agent that can push up their earnings is their access to a wider range of policies. Because they can offer products from multiple insurers, independent agents also have more options when it comes to providing clients with the best coverage that matches their needs. At the end of the day, this can lead to satisfied customers who are more likely to give referrals.

Apart from commission rates, the biggest difference between an independent insurance agent and a captive agent is the number of insurers they are contracted to work with.

Captive agents serve just one carrier, selling policies only for this particular insurer. Some of the industry’s biggest names employ captive agents to distribute their products. These include State Farm, Allstate, and Farmers, which are among the largest home insurance providers, as well as the top car insurance companies in the US.

Captive agents can be a good option for first-time insurance buyers who are not sure of how much coverage they need to purchase. Going with these agents can make the process simpler as there are also fewer policies to choose from. But since captive agents are experts in the product offerings of just one insurer, they can also give buyers a rundown of the different discounts and add-ons an insurance company offers.

Independent agents, on the other hand, hold partnerships with several insurers, enabling them to offer a more diverse range of policies. This means that clients are not locked into purchasing from a limited number of products that may be too costly or do not entirely fit their coverage needs. By providing customers with more choices, they can be sure that clients find policies that cater to their unique needs, which can lead to greater customer satisfaction.

Apart from commission rates and whether they are captive or independent agents, there are two other factors that have a major influence on how much insurance agents make. These are:

1. Type of policy

Insurance agents can typically choose a line or two to specialize in. This can include home, auto, health, life, and commercial insurance. Generally, commission rates are higher for new life and health plans, although the amount drops significantly after renewal. For car and home insurance policies, the rates do not change much after the first year.

2. Location

The cost of living, employment rates, proximity to public services, general safety and accident rates, and accessibility to public services all play a crucial role in how much insurance agents make in a particular state or city. Bigger cities have higher populations and, therefore, yield plenty of opportunities for agents to sell insurance than small towns with fewer residents.

Both insurance agents and insurance brokers act as intermediaries between the buyers and insurers, so they can easily be confused with one another. An insurance agent and an insurance broker sport several differences.

The biggest difference is who they serve. Unlike agents who are contracted to sell policies for their partner insurers, brokers are not obligated to sell products of specific insurance companies and are instead required to act in the best interest of the consumers, meaning they represent the insurance buyers.

Because agents represent insurance companies, the coverage options they provide are often limited to those offered by their partner carriers. In addition, agents have contracts with insurance providers, detailing what policies they are allowed to sell and the commission they can expect to make from selling these policies.

Another major difference is that agents have the power to bind coverage because of their links to insurance companies, something that most brokers are not permitted to do. The table below sums up the key differences between an insurance agent and an insurance broker.

Insurance agent vs. insurance broker – what’s the difference?

Insurance agent and insurance broker: Key differences

Insurance agent

Insurance broker

Represents one or several insurance companies

Represents insurance buyers

Sells insurance products of their partner insurers

Finds insurance policies that best fit the needs and goals of their clients

Limited selection of insurance coverages

Not restricted in the insurance products they offer; can provide more coverage options

Has the power to bind coverage on insurer’s behalf

Cannot bind coverage on behalf of insurers

If you think representing insurance buyers is a better career option and want to know how you can be a broker instead, this step-by-step guide on how to become an insurance broker can help jumpstart your career.

Pursuing a career as an independent insurance agent comes with several advantages. These include:

Minimal entry barriers: Being an independent insurance agent does not require a college degree, although there may be insurance companies that prefer candidates with one. Generally, insurers offer agents training programs where they can learn how to perform their jobs. All insurance agents, however, must comply with their state’s licensing requirements.

Strong earning potential: Independent agents earn higher commission rates, which allow them to generate more income, depending on how well they build relationships with insurance buyers.

Flexible work hours: One of the perks of being an independent agent is having the freedom to set their own work schedules. Depending on their time-management skills, they can have plenty of opportunities to maintain work-life balance.

Opportunity to make a positive impact: Insurance agents are presented with several chances to change people’s lives for the better. By serving as an expert resource person, agents can help buyers make informed decisions about what types of coverage provides them with the best financial protection. This is one of the reasons why being an insurance agent can be a rewarding career.

Being an independent insurance agent, however, also has its share of disadvantages. These include:

Earnings can be hard to predict: Since an insurance agent’s income is based primarily on the quantity of successful sales, it can be challenging to predict how much their next paycheck will be like. An agent’s earnings often reflect how hard they push themselves to make a sale.

Limited paid time off: Independent agents usually don’t have access to a full range of employee benefits, unlike many captive agents do. This means they also have limited paid time off, especially if they are the ones running the business. Taking time off also entails them spending time away from looking for leads and establishing client relationships, which can cost them part of their earnings.

Experiencing rejection: Apart from having strong people skills, insurance agents need to possess an impervious nature as they may experience a lot of rejection before making a sale. They may also encounter people who harbor disdain and disrespect for what they do, so it is crucial that they know how to deal with people like them.

Another benefit of choosing a career as an insurance agent is job security. As long as people are in need of financial protection – including for their cars, homes, businesses, health, and loved ones – there will always be high demand for insurance. Do a quick online search and you can find hundreds, if not thousands, of openings for independent insurance agents.

Were you surprised to find out how much independent insurance agents make? Do you think this career path is worth pursuing? Feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!