Wanted: Group and Voluntary Products to Boost Employee Engagement & Loyalty

In 2022, quiet quitting was a new term that cropped up in the realm of Human Resources. According to Gallup, quiet quitting is a form of employee disengagement where employees might experience a lack of “clarity of expectations, opportunities to learn and grow, feeling cared about and a connection to the organization’s mission or purpose.”[i] This causes them to stop working hard and they cease to see the need or desire to go the extra mile. Gallup’s research from Q2 2022 found that 50% of employees fell into this category and that only 38% of employees were truly “engaged.”

Why is this trend happening now? One theory is that quiet quitting is, alongside higher job resignations, one of the unintended results of the COVID-19 workplace and work-from-home environment. Quiet quitters became disengaged from their jobs and employers while they were not socially present at the office. Their lack of connection removed their natural desire to go the extra mile — a potential threat to the business. If they are managers, they may do additional damage by ignoring those who report to them.

Businesses must do everything that can to help employees re-engage and increase loyalty. Group and Voluntary insurers are in a unique position to help employers improve engagement and recapture the quiet quitters IF they are willing to enhance and expand their offerings. Majesco has stepped in to help insurers consider all options.

Majesco’s annual SMB customer survey report captures the high-level view of the Group and Voluntary industry along with where it is headed by looking at priorities. Which products are being prioritized? Which services are being considered for launch? Are there particular technologies that insurers are leaning toward? In Majesco’s Thought Leadership reports, Game-Changing Strategic Priorities Redefining Market Leaders, and the upcoming report, Bridging the Customer Expectation Gap: Group & Voluntary Benefits, we give a comprehensive picture of where insurers are focusing transformations and where this aligns with customer desire and sentiment. In today’s blog, we’ll look specifically at priorities. What are group and voluntary insurers preparing and launching to meet SMB customer needs – and the needs of their employees?

Current benefit offerings

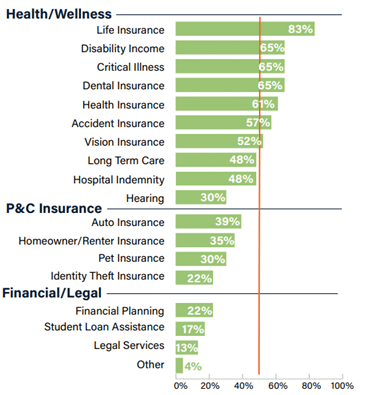

For insurers selling voluntary benefits, traditional Health/Wellness products dominate their offerings as seen in Figure 1. This is no surprise. Life insurance stands out at 83%, followed by the next products ranging from 61% (health) to 65% (disability, critical illness, and dental) — all traditional offerings in benefit plans. The second tier, Accident, Vision, Long Term Care, and Hospital Indemnity range from 57% to 48%, reflecting more specialized options depending on family and lifestyle needs. Hearing sees a significant drop to 30% in the third tier.

Interestingly, Auto, Homeowner/Renter, and Pet insurance reflect new products in that “tier 3” range of benefits. While the other products are offered by insurers between 13% and 22%, they do reflect a growing area of focus and need in the marketplace where employees are looking to meet all their risk needs easily at the same time. These are vital benefits employers need to attract and retain talent, and the low number of insurers in these spaces represents an opportunity for companies that can enter these markets quickly, ahead of other entrants.

Figure 1: Types of voluntary benefits offered

Multi-line vs. Single line priorities

When looking at it from a line of business view, multi-line companies take advantage of their position with a substantial lead in the newer categories, not to mention in nearly every other type of voluntary benefit as seen in Figure 2. Multi-line insurers significantly lead by 75% and 67% in offering auto and homeowner/renter insurance, respectively, and by 64% in health insurance.

These, as well as leads of 16% to 25% in Financial/Legal offerings, give multi-line companies a substantial competitive edge in meeting the needs and expectations of today’s insurance customers. As our latest consumer and SMB research highlights, today’s customers will give preference to companies that can help them meet their holistic needs for financial and health wellness. The wider the offerings, the better.

The holistic view of the employee

For employees to stay loyal and engaged, they must feel that their company cares about them and their lives. That means helping them to simplify their responsibilities outside of the office. Supporting an employee’s life and lifestyle goes beyond the idea of job perks and into the idea of a real-life partnership. Carrying pet insurance, identity theft, and legal services in a benefit plan, shows employees that you don’t want to see their lives disrupted. It also simplifies payment, since most voluntary benefit premiums are paid automatically through paycheck deductions.

Group & Voluntary benefits providers can further assist companies with holistic coverage by unifying and utilizing employee data across benefits. This will require a personalized approach to data that will benefit the insurer in many ways. For example, the ability to give greater granular detail to insurance brokers and SMBs will assist in targeted and personalized marketing. A fringe benefit, however, will be that modern data platforms can help Group & Voluntary insurers achieve real portability in benefits, improving overall retention.

Figure 2: Types of voluntary benefits offered by company type

With the fluid state of employment that is particularly common for Gen Z and Millennials, portability and flexibility of benefits are increasingly crucial for SMB customers as they compete for talent. Majesco’s latest insurance customer research found that SMBs and consumers alike, especially Gen Z and Millennials, are interested in several new, innovative types of benefits. But, as highlighted in Figure 3, most insurers are still in consideration or approaching the planning/piloting phase on these offerings – meaning they could be 1-3 years out, putting them at a competitive disadvantage.

New ways to carry and use benefits

Majesco’s research also looked at portable and “gig-friendly” benefit offerings from the standpoint of Leaders, Followers, and Laggards. Somewhat surprisingly, Followers are showing the most leadership across all four options within a benefit plan shown in Figure 3. In contrast, Leaders are defying their label and acting as Laggards in three of the four offerings. Leaders’ largest gaps to Followers (37%) and Laggards (21%) is for offering individual products that employees can take with them when they leave their employer.

This impressive difference between Laggards and Followers to Leaders demonstrates how insurers can potentially leapfrog Leaders to differentiate themselves in the market while bringing new products, services, and capabilities that customers really want and need.

Figure 3: Benefit plan options being considered by Leaders, Followers, and Laggards

Insurers’ gaps with their customers, especially SMBs, are particularly evident in the last two options. The third option, addressing the Gig worker/independent contractor trend is evident in their low activity in insurance products that can be turned on and off as contracts start and end. The final option, giving employees the latitude to spend a set pool of funds on whatever procedures and with any providers they choose, was among the most popular with SMBs and consumers in our research. However, insurers’ low activity highlights a promising new market opportunity for companies that can create a business model to deliver on this. That type of flexibility is the kind that employees are looking for from their company and their voluntary benefits.

Data sources for personalized pricing

Inflation and finances are top concerns for both consumers and SMBs. Household and business costs are under the microscope. With this increased sensitivity, insurers must demonstrate transparency, fairness, and accuracy in their pricing to maintain trust, a sense of value, and, ultimately retention among their customers. Using new, innovative data sources that provide more personalized pricing can help in a significant way.

Unfortunately, Group and Voluntary benefits insurers are just hovering around consideration rather than action for all but one of the new data sources, reflected in Figure 4. Once again Laggards are showing leadership in most of these data sources, particularly in prescription drug and over-the-counter drug purchase data as compared to Leaders or Followers. While not a heavy focus for most, it is extremely encouraging to see the experimentation in the use of new sources of data to meet customer needs and expectations.

Fitness tracker data is another opportunity area for insurers, given the gaps they have with Gen Z & Millennial customers in using this technology. Some employers already provide benefit incentives to employees through their wellness programs. Any Group or Voluntary provider that can easily integrate fitness tracker data into their products may find that they are a good fit for employer plans that incentivize wellness.

Figure 4: Use of new data sources for group/voluntary benefits by Leaders, Followers, and Laggards

Adding value to the full package through value-added services

As employees live their lives, they find the gaps created when work and life don’t “have it all covered.” For example, just because a company has health benefits and a family leave policy, doesn’t mean they have made it easy for an employee to add a new child to the family and have a worry-free experience. Post-leave child-care benefits may make staying at a company much more valuable to the employee.

Think about any of life’s gaps and a Group and Voluntary insurer may find an opportunity. Elder care benefits, pet sitting, mobile mechanics, and home repair concierge services may all be part of the new wave of voluntary products and services.

Smart technologies may also play a role in providing these services by informing employees that something needs to be done or even by helping them set goals for health or life improvements.

Majesco asked companies about their priorities regarding smart health devices. Discounts on gym/fitness center memberships and an app for setting and tracking health goals are currently getting the most consideration by Leaders, Followers, and Laggards. Leaders are 33% more active in considering offering fitness trackers that could lead to discounts than they are in considering fitness tracker data for pricing (2.4 vs. 1.8).

These options outlined in Figure 5 are just examples of what insurers could offer. Rethinking the value proposition with value-added services will be increasingly crucial to attract and retain customers based on their strong interest indicated in our consumer and SMB research.

Figure 5: Development of value-added services for group/voluntary benefits by Leaders, Followers, and Laggards

Expanding channel options

Traditional channels for distributing Group/Voluntary benefits – insurance company websites and agents/brokers – continue to be the most used options, which aligns with SMB channel preferences noted in our SMB research, with one exception. Medical/Healthcare networks edged both for SMBs’ number one preference, reflecting the strong relationship and trust with their healthcare providers.

While in a slightly different order, the top 7 channels used by insurers in Figure 6 match the top 7 preferences of SMB Group/Voluntary benefits customers. Interest in the remaining channels drops rapidly for Gen X & Boomer SMBs but declines only slightly for Gen Z & Millennial SMBs. Even the High Tech options Google and Amazon were on par with affinity groups, legal services, and digital HR platforms with Gen Z & Millennial SMBs.

Figure 6: Group/voluntary benefits distribution channels used

Multi-channel service is important to on-the-go employees, who are asking, “What can be accomplished while I’m on break at work or while I’m waiting through soccer practice?” Each point of potential service creates an environment where an employee sees the employer as a partner in life and work. Benefits are then seen as a crucial tool to keep life running smoothly.

Group and Voluntary insurers need a customer engagement plan that includes helping companies to retain their employees by effectively promoting their benefits and all that they can do for them.

To accomplish this, however, Group and Voluntary providers need systems and processes that can handle products, data, and services in entirely new ways. The foundation for a new Group and Voluntary strategy will be a core platform in the cloud, supplemented by a Data & Analytics system that is ready for the many new structured and unstructured streams of data supplied through wearables and telematics.

Is your company ready to assist today’s SMB players with employee engagement and the best in benefit products and services? Find out more about Majesco’s market-leading solutions including L&AH Intelligent Core Suite, ClaimVantage IDAM, and Majesco Global IQX Sales and Underwriting solutions that are helping Group and Voluntary insurers improve enrollment digital experiences, innovate with new products, and meet the increasing demands of employers and their employees with 8 of the top 15 insurers today! And be sure to download Majesco’s latest report, Bridging the Customer Expectation Gap: Group & Voluntary Benefit.

[i] Harter, Jim, Is Quite Quitting Real?, Gallup, September 6, 2022, updated May 17, 2023.