Dual or Joint Life Insurance – Which is best?

Single Life Insurance, Joint Life Insurance, Dual Life Insurance…it’s like the insurers are trying to confuse you.

Probably because they are, to be fair.

Insurance is a business.

They make their money by keeping yours.

Which might sound like one big scam, but here’s the thing: the insurers pay around 98 percent of all death claims (or 100 percent of all valid claims as they like to say).

So, as much as it might seem a bit dodgy, it is a great way to protect your family if you die.

Which leads around to why you’re on this blog.

You want Life Insurance.

You’ve done your basic research.

You know what it is.

But just in case you’ve forgotten: Life Insurance pays out a big wedge of spondoolies if you or your other escapes to the Great Beyond off during the term of your policy.

It conjures up money from nothing (and chicks from free?) just when your family needs it most.

With that in mind, let’s start with a quick refresher if you’re not quite sure about the different types of Life Insurance policies.

Term Life vs Whole of Life

Term Life

To the tune of ‘Parklife’, if you’re so inclined.

The clue here is in the name:

Term Life insures you for a certain term, e.g. 30 years.

Choose a 30-year term policy and you’re covered for 30 years – pretty self-explanatory, really.

If you were to pass away during your term, the policy pays out. If you outlive your term, there’s no pay-out.

Think of it as a bet between you and the insurer.

Weirdly you’re betting that you’ll die during the term while the insurance company is praying you don’t.

🙌 Pro-tip: Bolt a conversion option onto your policy so that you’ll have the opportunity to extend your cover at any time without having to do a medical or getting tripped up in medical history. Without a conversion, any future health issues may prevent you getting cover when you’re older at an affordable price.

Insurers can be cheeky feckers, but knowledge is your power to beating them at their own game.

Whole of Life Assurance

We’re looking at two types of Whole of Life:

Reviewable (DANGER! AVOID! NOOOOOO…).

Guaranteed.

Don’t get Reviewable Whole of Life.

JUST DON’T DO IT.

Reviewable is a head-wreck of a policy that gives your insurer the power to review your policy every few years until you can no longer afford the premiums.

Expect price hikes every decade.

Guaranteed, on the other hand, covers your whole life at a fixed price, so no sting of unexpected price hikes. It’s much more expensive than Term cover (15x), but it’s also guaranteed to payout, so…y’know, could be worth it.

And even better, you can get whole of life assurance that pays for itself or that you can cash in!

That’s fairly straightforward, but what type of Life Insurance cover should you get for you and your (hopefully) beloved?

Single, Dual, or Joint?

Should you choose Single, Dual or Joint Life Insurance?

Single cover insures one person only. If that person dies, the policy pays out, then ends.

Joint life cover insures two people but a claim is paid out on the first death only. Cover ends when the first person dies.

Dual Life Insurance also insures two people but a claim can be paid on both deaths. If one person dies, the policy continues in the name of the survivor.

When it comes to Dual or Joint Life Insurance, I always recommend Dual.

It’s slightly more expensive but dual offers twice as much cover as joint.

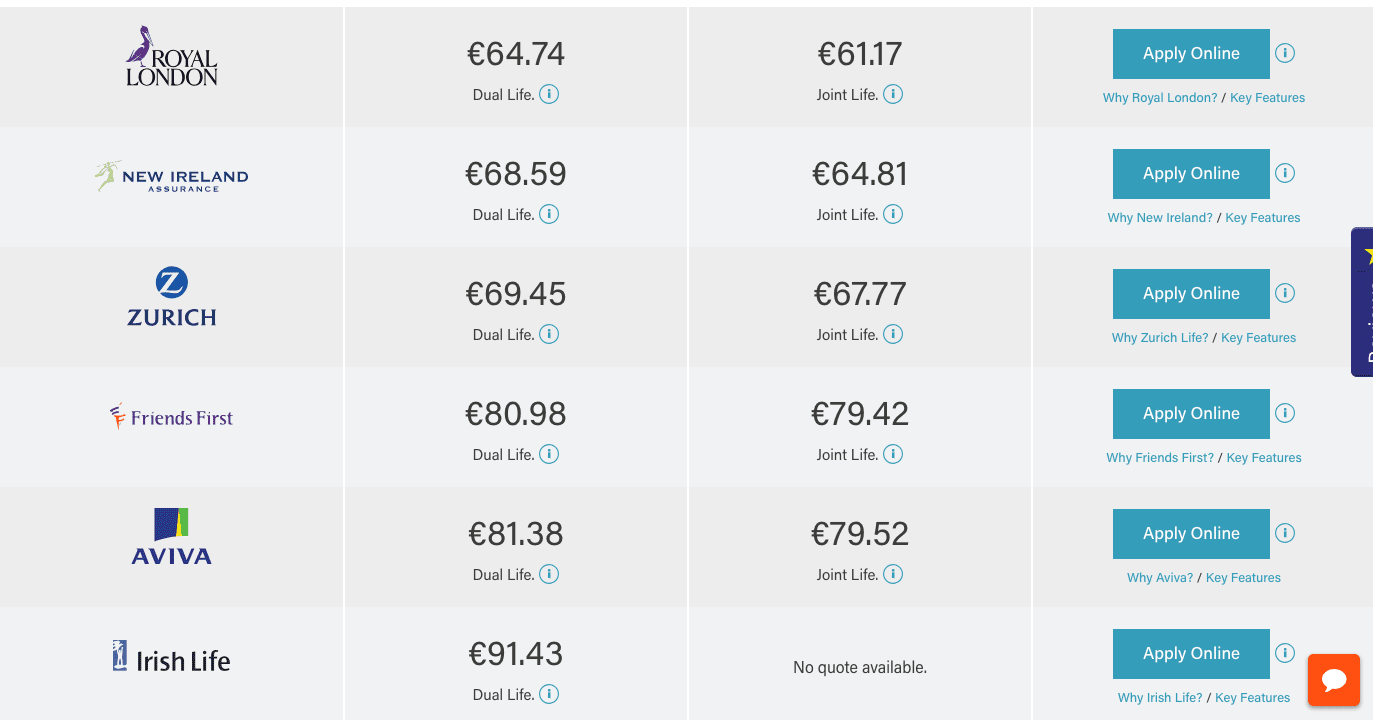

How much does Dual Life Insurance cost?

You pay a little extra every month…but you get twice the amount of cover (did I say that already)

Let’s compare two quotes:

Sarah: Non-Smoker, born on 26/01/1977.

John: Non-Smoker, born on 26/01/1977 (what a coincidence they were born on the same day; it’s all a bit Lannister!).

Life Insurance: Joint cover of €500,000, over 25 years, paying monthly.

Serious Illness: No cover

Conversion option: Yes.

The price on the left is for Dual Life, while the price on the right is for Joint Life.

Presuming you’re both in reasonably good health, you’d be bananas to get joint cover when Dual Life is literally €2 more expensive.

Imagine how cushy your future offspring’s life will be because of that monthly €2.

You’ll probably have the best obituary ever 🙈

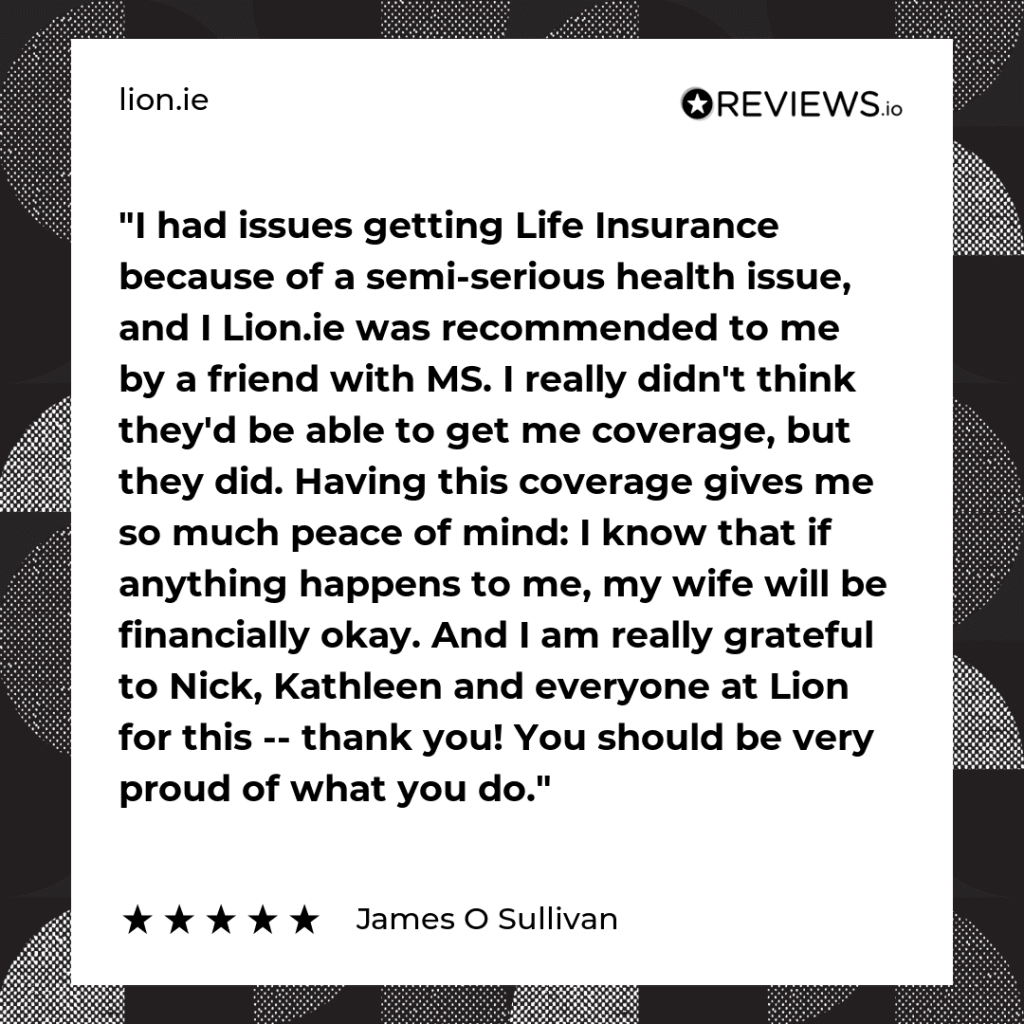

But what if one of us has health issues

This could mean anything from one of you being chronically ill to the other one having a dangerous job (bomb detonator, anyone?) or a flurry of dangerous hobbies.

It could even be as simple as one of you being a smoker while the other isn’t.

Applicants are underwritten individually whether it’s on a Single or Dual basis.

So let’s say Sarah is overweight. If she applied for a single application, she’d face a premium increase.

Same goes for a dual application, though her partner would get the regular price.

Dual will still be better value than two single applications.

Look, with Dual, you’ll pay a couple of euros extra for twice the amount of Life Insurance – it’s a no brainer.

Unless you’re not married – that opens a whole new can of worms.

So either get married asap or read this blog.(I’d recommend marriage)

Over to you…

As you can see, you pay just a little extra for twice the amount of cover when you choose Dual Life insurance instead of Joint.

We no longer quote for joint life insurance on our Life Insurance quote calculator – that’s how strongly we feel that dual is the best choice. We force you to buy it!

Deciding how to structure your policy is important but it’s only one piece of a really annoying jigsaw.

If you’d like to cheat and get me to complete said jigsaw for you, complete this questionnaire and I’ll get back to you asap.

Or even better give us a call on 05793 20836.

Thanks for reading

Nick

lion.ie | Protection Broker of The Year 🏆

Editor’s note. We first publised this blog in 2017 and have regularly updated it.