ICHRA affordability and premium tax credits

Looking for information on ICHRA affordability and premium tax credits? This is one of the most commonly confused nuances of the individual coverage HRA. We’re here to help.

What is a Premium Tax Credit?

Premium tax credits are tax credits that help individuals and their families purchase health insurance coverage through the Exchange. The premium tax credit is not available to plans purchased outside of the Exchange. The credit is calculated from annual income and reduces the out of pocket expense for qualified individuals.

When individuals enroll in an Exchange plan, the Exchange will ask if the individual is offered any coverage through their employer. This includes coverage through the Individual Coverage HRA. Employees will be required to give notice to the Exchange of their ICHRA offering.

→ ICHRA 2023 Affordability Threshold rates were just announced!

How do ICHRAs (Individual Coverage HRAs) work with Premium Tax Credits?

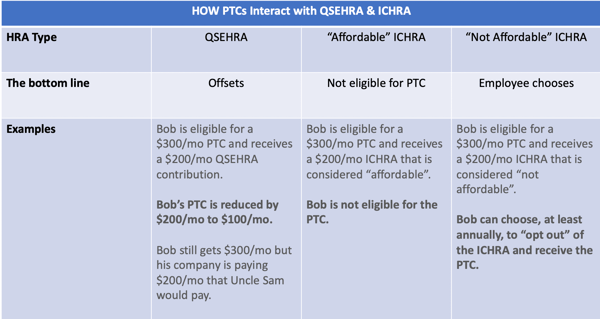

Employees can choose to participate in ICHRA or receive a PTC. They cannot do both.

A nice feature of individual coverage HRA is that employees have the option to participate in ICHRA or opt-out annually through the opt-out provision. This is different then ICHRA’s predecessor, QSEHRA, which does not allow employees to opt-out.

If the employee accepts the Individual Coverage HRA they cannot claim any premium tax credits for the year for either themselves or any family members.

→ Learn more about how ICHRA affects premium tax credits.

Can an employee opt-out of an ICHRA?

If the employee opts-out of the Individual Coverage HRA for the year they may be able to claim premium tax credits.

The Exchange will then determine if the ICHRA offered is deemed affordable or unaffordable for the employee.

In cases where the employee has opted out of ICHRA and the HRA is considered unaffordable the employee is allowed to claim premium tax credits for themselves and dependents.

In cases where the employee has opted out of ICHRA and the coverage is deemed affordable the employee may not claim any premium tax credits for themselves or dependents.

What is ICHRA affordability?

ICHRA affordability is a calculation that changes slightly every year to ensure that an employer health insurance offer is, in fact, affordable and helpful for an employee.

How is ICHRA affordability calculated?

ICHRA is considered affordable if the remaining amount an employee must pay for a self-only silver plan on the exchange does not exceed 9.61% of their household income for 2022 (9.12% for 2023).

What is the lowest cost silver plan?

lowest cost silver plan in a certain area is determined by the employee’s primary residence. It’s the least expensive health plan that falls within the silver metal tier.

How is employee household income is calculated?

Determining the employee household income is based on information provided on Box 1 of the employee’s W-2 form. The rate of pay is determined with the assumption that the employee works at least 130 hours per month. Lastly, if it is affordable at the Federal Poverty Level, then the plan is affordable.

Can we help with ICHRA affordability and PTC questions?

Does this sound confusing, expensive or both? Don’t worry. We are here to make your life easier.

One of the major factors when deciding whether or not to use a small business HRA (like QSEHRA or ICHRA) for your company is how the HRA interacts with the premium tax credit (PTC) of the employees.

Do you need to check affordability for you company? We’ve created a new affordability calculator that can walk you through it. Piece of cake!

Want to learn more? Check out our brand new ICHRA guide or chat with one of our HRA experts online to guide you through our new ICHRA Administration platform. We’d be happy to help!

This post was originally written in 2019 and has been updated in 2023 with all the latest 2023 ICHRA info.