S&P 500 Could Crash to 2,000: Grantham

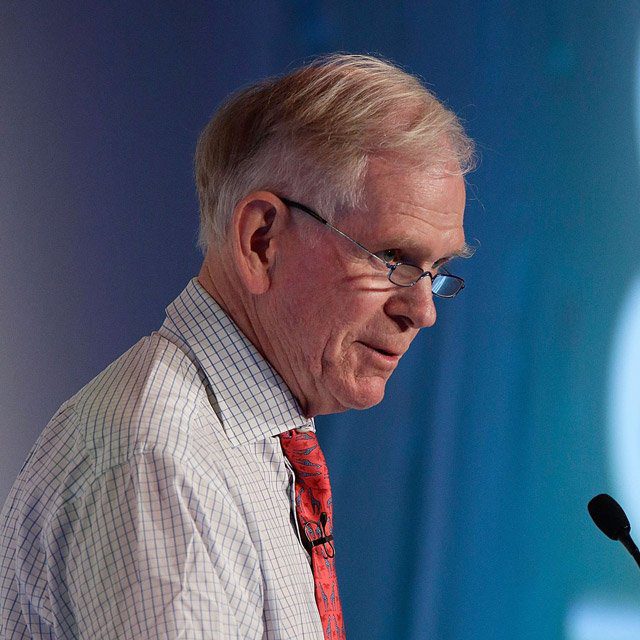

The S&P 500 could plummet to roughly half its current level as the “everything bubble” collapses and sends the economy into a severe recession, according to Jeremy Grantham, investment strategist and co-founder of Grantham, Mayo & van Otterloo.

GMO’s Grantham said in a Rosenberg Research interview last month that surging asset prices during the pandemic set up a likely crash, Insider reported, noting that the strategist cautioned against owning U.S. stocks for now.

Grantham blamed the Federal Reserve for creating “an environment conducive to a chain-linked series of super bubbles that break with outrageously consequential, painful effects,” the publication reported. The “everything bubble” includes stocks, bonds, housing, fine arts and other assets, he noted.

“We may settle for something like 3,000 on the S&P, all being well. If the extra factors bite pretty hard, then the market will go closer to 2,000. The economy is very likely to be quite a bit weaker, and profit margins are very likely to be lower. History is quite clear: There are bubbles, they have always broken, this one is breaking,” he said, according to Insider.

Grantham reiterated those predictions in a recent interview with Citywire. “The best we could hope for is that this market would bottom at about 3,000… and the worst we should fear is more like 2,000,” he told the publication.

Morgan Stanley’s Message

Meanwhile, Morgan Stanley’s Lisa Shallet, chief investment officer for its wealth management unit, cautioned in a note this week that stocks remain vulnerable as investors “ignore mounting risks to the economy and corporate earnings.”