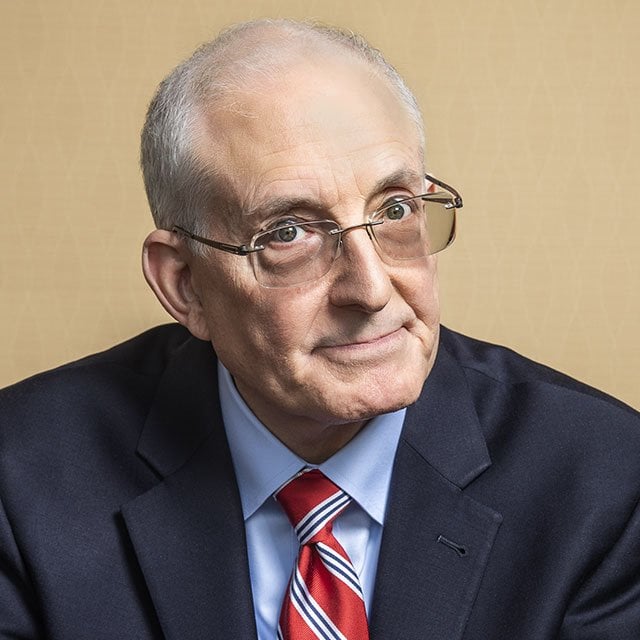

Ed Slott: Advisors Are Still Confused About IRAs

However, he said, “I’m not a big fan of that because tax deductions … aren’t worth a lot when rates are low.”

Said Slott: “A lot of people think a tax deduction is great when it comes to making a contribution to an IRA, but if they looked at it in reality what a tax deduction is … a tax deduction is really a loan you’re taking from the government that you have to pay back — at the worst possible time, in retirement.”

Plus, Slott added, “all the earnings it created may be [taxed] at higher rates.”

More advice for advisors: Counsel clients to “try to move more to Roth 401(k)s if they’re available,” he said. “A lot more companies have them now. It’s so critical to start building tax-free savings to hedge against what future higher rates can do to retirement savings. Advisors are supposed to create wealth for the long term, not to give people a sugar high for now with a tax deduction that they pay for later.”

As for Secure 2.0 …

Remember, the required minimum distribution age is 73 in 2023, not 75, Slott said. It doesn’t hit 75 “for 10 years.”

To figure out your RMD age, Slott said, “all you have to know is the year you were born.”

Another change in Secure 2.0 that’s effective now applies to qualified longevity annuity contracts, or QLACs, which Slott said have been expanded “tremendously” under Secure 2.0.

“When I poll the advisors almost nobody is using them” in their IRAs, Slott said. “I think maybe they should take a second look.”

Tax experts Robert Bloink and William Byrnes explained that under the original rules governing QLACs, taxpayers were limited to purchasing a QLAC with an annuity premium value equal to the lesser of:

25% of their account value, or

$145,000 (as adjusted for inflation in 2022).

The 25% limit was applied separately to separate employer plans, but in aggregate when it came to IRAs, according to two tax experts.

Secure 2.0 “eliminated the rule that previously limited the value of a QLAC to 25% of the account’s value. Further, the law modified the previous rule that limited the value of the QLAC to $125,000 by raising the cap to $200,000 (the $200,000 limit will be indexed for inflation in future years),”

QLACs “kick in generally at age 85,” Slott said.