Wealth Building Opportunity

Podcast: Play in new window | Download

While most financial advice is heavily focused on maximizing return while minimizing fees (and this perhaps is one of the reasons so many people fail long term in their financial plan) I’m going to take time today to introduce a concept that is by no means new, but one of those golden little nuggets that could dramatically change the way you look at financial matters through the lens of your personal self worth.

Because SOPA and PIPA went down a ball of flames I’ll post the following picture to illustrate what today’s post will be all about. Not, of course, before acknowledging that it’s not my original work and noting that you can purchase it directly from despair.com (I haven’t started selling ad space; I’m not getting paid for this, FYI)

Now that you’re all depressed and thinking about all the things you likely won’t accomplish, let’s have an uplifting conversation about all of the money you are pissing away each year. We’re going to start from the very simply building blocks on this one. It’s going to seem almost childish, but trust me, like an artist sketch, this will get better by the end.

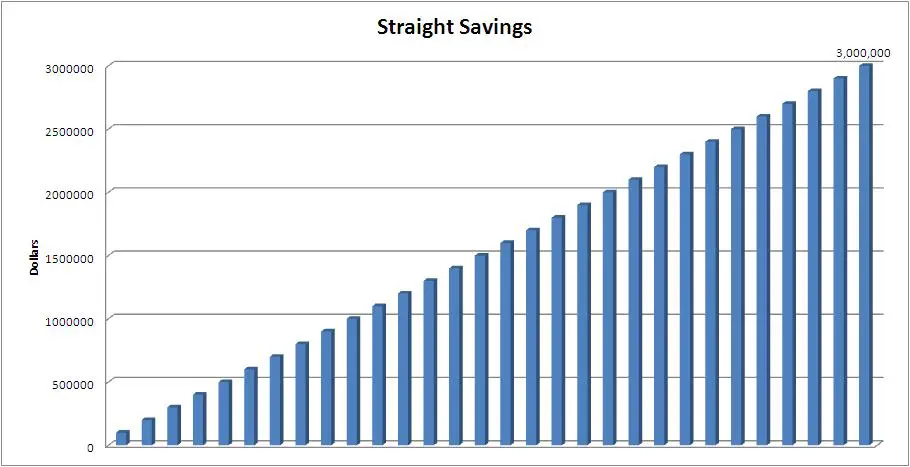

We’ll start with a hypothetical guy (I was going to say guy or gal, but decided not to because I’d be typing “him/her” a lot, sorry ladies I’ll remember to use a hypothetical female next time, promise) who earns $100,000/year and has 30 years left before he mails it in and heads south to become a professional shuffleboard player. If this individual could save every dollar earned over the course of the next 30 years he’d have $3 million in his possession. Graphically (and I’ve got a lot this time) it looks like this:

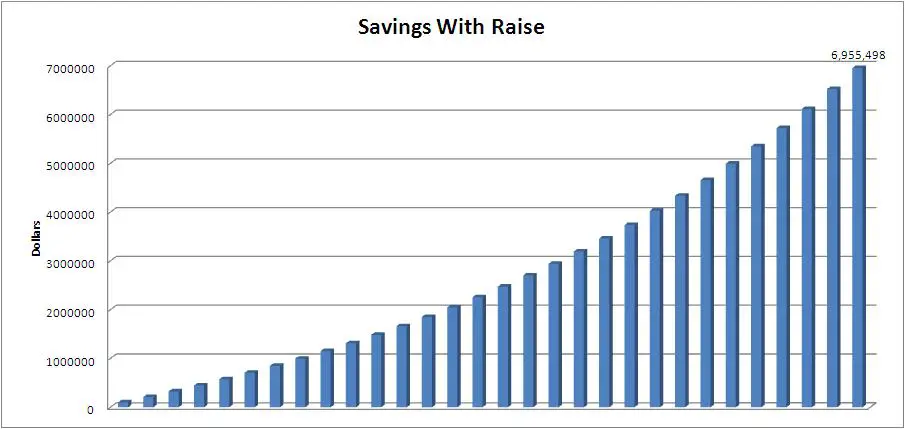

Now, lets add to our model an example where our friend is now receiving a raise. He’s an up and coming young professional commanding a 5%/year raise, total savings jumps to just under $7 million:

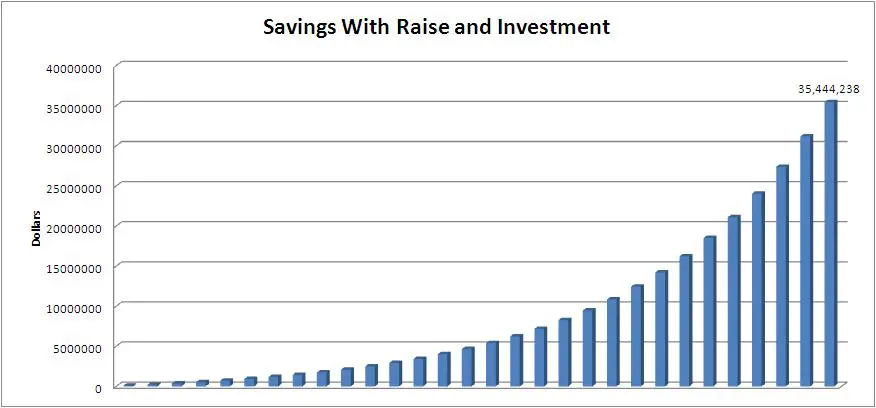

Now, let’s take a look at what happens when we take out income, get a raise, and invest it at some hypothetical interest rate. I’ll assume 8% because everyone else does.

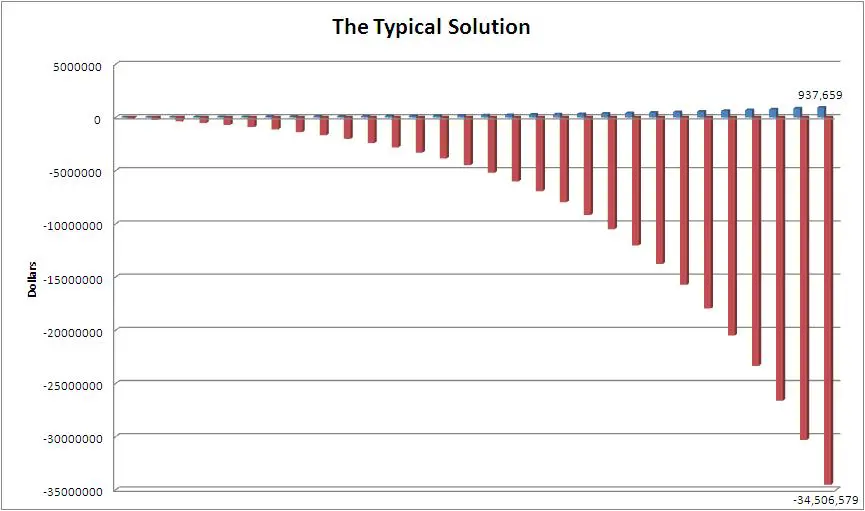

There you have it, some $35 million dollars our friend has the potential to amass. If you sitting here thinking “I make half of what he does,” divide everything by two, and if you make double this…well if you can’t figure out what to do I’m wondering how you managed to get to where you are. But what happens when we introduce reality. We know that no one gets to save every dollar they earn, if nothing more than paying taxes, there are expenses that need to be internalized, and here’s what it looks like:

And now our $35 million fortune has sunk to not much more than a pathetic half million dollars. That’s a lot of scary red. But most people motor through life without even giving it a second thought. In large part because they can’t see the red, or rather it’s masked by utility derived from the conspicuous consumption of bigger houses, faster cars, shinier do-dads/gadgets, etc. This red portion is real, and it represents what you’ve given up as a consequence of your decisions. What’s worse is that traditionally financial planners, and investment advisors have no plan of attack for addressing this issue. Instead they live and die by the sword of rate of return. They call you in with the promise of smarter, more complete investing advice that increases your rate of return. But what does a 2% bump in rate of return get us? It gets us this:

All that stress of higher risk exposure for about and extra $300,000 or roughly .009% of your overall wealth building potential. And we already know that a 10% rate of return (talking compound annual growth rate) is pretty unlikely.

So what to do? Sit back and complain that the system is against you. No. Time to be a little more strategic. A little more finance savvy. A little more grown up, perhaps, and realize that the math behind this concept is pretty far reaching and everything you do has consequences. Time to internalize the true cost of all those Venti Frappaccinos and choosing the 528i over the 328i. But perhaps time to realize that when I say you can accumulate cash inside whole life insurance, and then access it while still earning money, you have a way to prevent yourself from giving up all of this potential wealth.

Since you’ll never have control over rate of return, it makes little sense to spend significant amounts of time worrying about it. Remember the old rule, assuming less is more, if I assume 5 and get 8 I’m in awesome territory, if I assume 8 and get 5, I’m screwed. Instead, build a plan that put more focus on what you do have control over, the amount of money you actually save. Remember, there’s a financial tool that will let you save money spend the money, and then put the money back, and the money continues to grow even while you’re spending it. How’s that for turning red bars into blue bars? So kicking up the savings, doesn’t mean you absolutely have to give up your problem with conspicuous consumption (thought it would probably help if you cut back a little) it just means you have to shake up the time line a little bit. What happens when we focus on savings rate, here’s the depiction of a good starting point:

I got here by doubling my savings rate from the live situation. Now, you don’t get here with a financial guy who is worried about being a good stock picker. Those conversations are fun for a weekend outing, and by all means a little play money on the side to see if you can show up Jim Cramer is certainly not something we frown upon. But the true path to this point is a prudent approach to employing your resources. Picking the wrong mortgage, letting a car dealership beat you up, putting all you faith in tax deductible qualified plans, not being able to say no when you walk by the store window and the item of your dreams is nicely displayed in all it’s glory, giving the U.S. treasury a large portion of your money to hold onto until the Spring all the while paying you absolutely no interest on it…I could do this all day but won’t.

Hopefully by now I have you thinking about the finite nature of your resources and who you are. You can blow the money, or you can try to hang onto every last dollar. Keep this question in mind: How many paychecks do you have remaining before retirement? If you’ve never thought about this, now would be a good time to start. Because it’s these remaining paychecks that you’re going to create your retirement and overall legacy.