Why Are Auto Insurance Premiums Going Up and What Can I Do About It?

If you’re like most people, you’re probably asking yourself:

Why are car insurance rates go up?

Is there anything I can do to lower my auto insurance rate?

In this article, we’ll discuss factors affecting the market, ways to help lower your auto insurance rate and explain how optional coverage packages could help reduce out-of-pocket expenses in the event of a claim.

Why Are Car Insurance Rates Going Up?

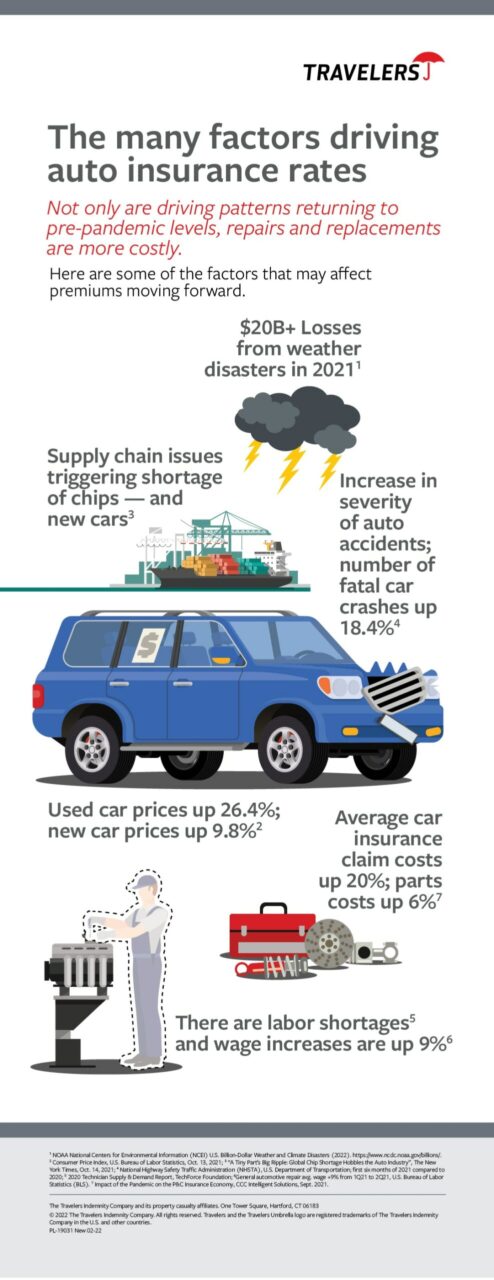

There are many reasons for the current auto insurance rate increases across the market. Here are some of the notable ones:

Pandemic and Post-Pandemic Driving Habits

Starting in early 2020, people began staying home because of the pandemic. They were generally driving less, which resulted in fewer accidents. During 2021, people started returning to pre-pandemic behaviors such as driving more often. More cars on the road generally means the likelihood of more accidents. There has also been an increase in the severity of automobile accidents.1

Increased Vehicle Value

Another contributor affecting the auto insurance market: The value of most vehicles — both new and used — is going up. In fact, used car prices are up 26.4%; new car prices are up 9.8%.2

What’s causing this? Like many of the other price increases happening in the United States and around the world today, there has been a rise in the demand for cars, SUVs and trucks — and their parts — at a time when supply is going down.

People still want new vehicles for the reasons they always have:

Replacing cars that are aging out.

Expanding families.

Indulging passions for cars.

On top of this, many of the people who moved out of cities and into the suburbs and rural areas during the pandemic now need cars for transportation. This has created a novel form of demand in addition to the typical reasons individuals buy new cars.

Vehicle supply is down in large part because key materials like semiconductors, which are needed for the computers found in cars today, experienced a manufacturing interruption during the pandemic. Although manufacturing has resumed, the current supply still runs short of existing and pent-up demand. Also, like many other products imported into the United States, countless new cars, and components to build them are sitting on ships and docks, waiting to be trucked to dealerships and factories across the United States.3

More expensive cars and parts also make repairs and replacements costlier. As of October 2021, average car insurance claim costs were up 20% and the cost of parts were up 6%.4 This is another factor affecting the auto insurance market.

Additional Factors That Could Impact Auto Insurance Rates

There are other factors not related to national and global events that could increase your auto insurance rates:

If you’ve made claims on your policy in the last year.

If you or anyone on your policy received a speeding ticket or other driving citations.

A higher number of claims in the area you live in indicates that there may be more accidents related to weather changes, higher theft rates, more incidents of vandalism or other issues that the insurer must cover.

If you moved to a higher risk area than you previously lived in.

You may have taken advantage of insurance discounts in the past that you no longer qualify for.

What You Can Do to Reduce Your Insurance Rates

While some insurance price increases are out of your control, there are things you can do to help get them in check.

Practice safe and sound driving habits. Make sure everyone on your policy follows all the rules of the road and drives carefully, especially in difficult conditions and bad weather. This will help avoid tickets and accidents that could up your premium prices.

Sign up for telematics. If you and the people on your policy drive safely and carefully, why not use it to save money? Telematics collects information about your driving habits in real time. By enrolling in a telematics program like IntelliDrive® from Travelers, you could save on your car insurance policy’s first term. At renewal, safe driving habits can lead to savings, though riskier driving habits may result in a higher premium.**

Change your preferences to be a digital customer. There can be a reduction in premiums for customers who engage digitally. These savings are given to customers who enroll in paperless and register with the carrier’s application. Travelers offers a Digital Auto Discount† for customers who have paperless, register on their application and enroll in IntelliDrive®.***

Review coverage. If you haven’t checked your auto insurance and other coverage lately, review it with your insurance agent or a Travelers representative. They may find that you’re carrying duplicative or unnecessary protection. Additionally, they might be able to offer some ideas on how you can make your coverage more affordable.

Raise your deductible. Often, increasing your deductible can help lower premiums. However, remember that you will be responsible for the deductible out-of-pocket and must always have enough cash on hand to cover your deductible if you need to make a claim.

Look for discounts. Check to see if you are eligible for discounts like multi-policy, EFT (Electronic Funds Transfer)† or Good Student. Your independent agent or Travelers representative can help you find ways to save.

Get the Most Out of Your Auto Coverage

In addition to typical coverage, find out if your carrier can provide you with added advantages for safe drivers. For example, Travelers offers:

Premier Responsible Driver Plan® can lower your deductible by $50 per month and up to $500 for every six months you drive without an accident or major violation, along with accident forgiveness, which allows you to have a single accident within a certain period of time without an increase in insurance costs.‡

Premier New Car Replacement® can cover the cost to replace your new vehicle with a brand-new vehicle of the same make and model if yours is totaled in the first five years of ownership.

Premier Roadside Assistance® can provide added roadside benefits if you have car issues, such as a dead battery, and find yourself stranded.§

Loyalty benefits. Travelers provides auto loyalty benefits, such as incident leniency, youthful driver leniency and longevity credits.

The Bottom Line

Talk to your local Bolder Insurance Advisor to learn more about car insurance and money saving discounts.

Sources

1https://www.nhtsa.gov/press-releases/traffic-fatalities-estimates-jan-sept-2021

2https://www.bls.gov/news.release/archives/cpi_10132021.htm

3https://www.nytimes.com/2021/04/23/business/auto-semiconductors-general-motors-mercedes.html

4https://227gsr5ihx54be8by2hxnudd-wpengine.netdna-ssl.com/wp-content/uploads/2021/10/10-Oct-Trends.pdf

This article provided by Travelers Insurance, a Bolder Insurance partner.