Industry loss cat bonds show significant relative value: Twelve Capital

Given spread widening has been seen to be more considerable with index-linked, or industry loss triggered, catastrophe bonds, compared to indemnity deals, investment manager Twelve Capital says there is significant relative value in them and as a result it advises being overweight to the index trigger cat bond category.

Twelve Capital, the Zurich headquartered investment manager with a focus on insurance-linked securities (ILS), insurance and reinsurance linked investments, explained in a recent report that spread widening has affected the industry loss index trigger catastrophe bonds more than indemnity deals.

As a result of which, the index-trigger cat bonds are seen as a well-priced opportunity to buy and hold at this time.

Florian Steiger, Head of Cat Bonds at Twelve Capital, explained, “Observation shows that index-linked Cat Bonds have generally outperformed indemnity bonds in the past years, but the volatility around Hurricane Ian has resulted in a more complex picture with spread widening being more pronounced in index-linked Cat Bond compared to indemnity transactions.

“Given the current dislocation in spreads between index-linked and indemnity transactions, Twelve Capital believes that significant relative value can be gained from being overweight the index-linked transactions.”

Interestingly, Twelve Capital notes that after hurricane Ian, indemnity cat bonds saw the greatest recovery in values, while index-linked cat bonds have remained depressed.

However, “The main cause of this lack of recovery is a substantial spread widening in index-linked Cat

Bonds that is significantly larger than what can be witnessed across the indemnity space,” Twelve Capital said.

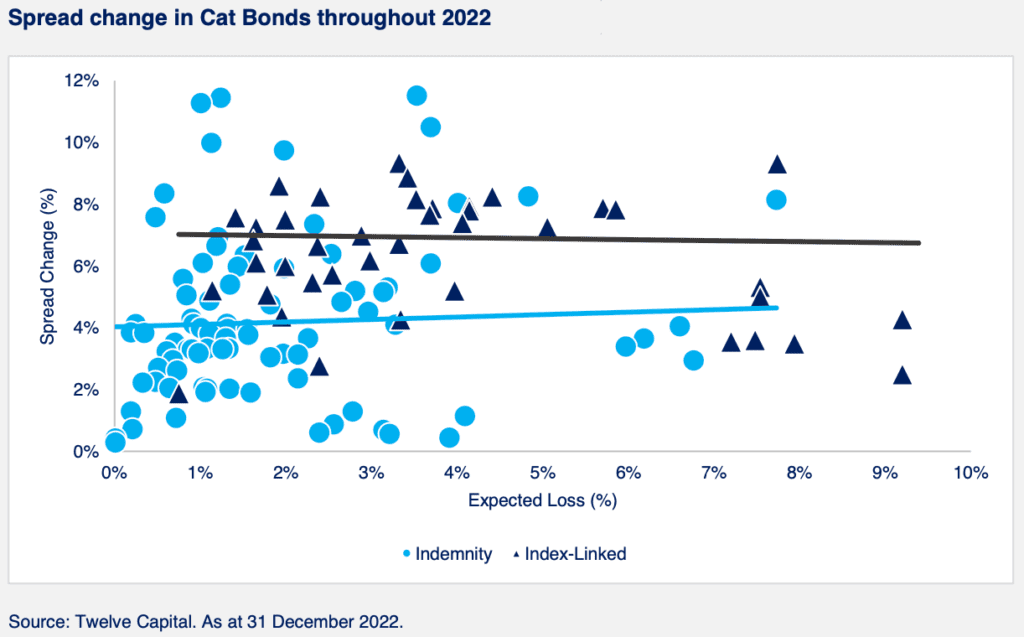

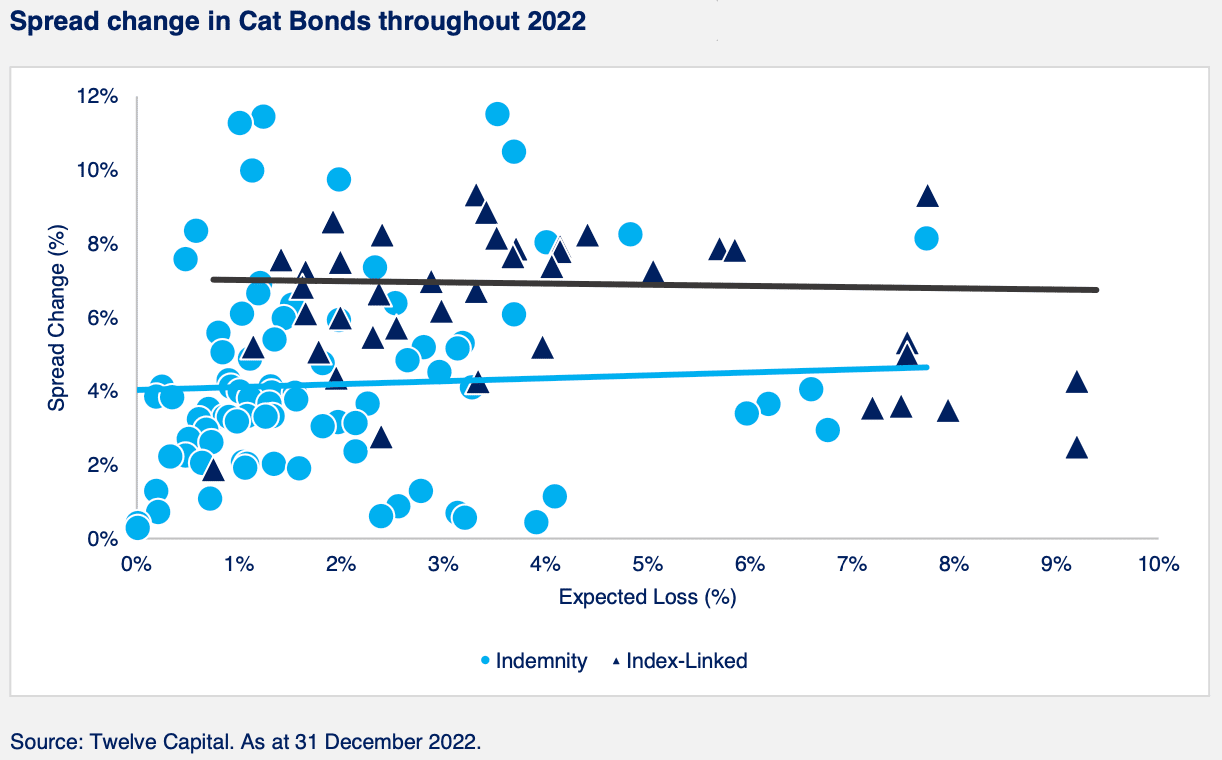

Twelve Capital’s analysis shows that industry index trigger cat bonds saw their spreads widen more than the indemnity cat bonds, resulting in a disparity (see below).

“Assuming an average credit spread duration of around two years, this would translate into a pricing drop of around -8% for indemnity Cat Bonds, compared to -13% for index-linked transactions. Of course, any fund with an overweight into these index-linked transactions would hence appear as underperforming against benchmark indices or competitors,” the ILS manager explained.

Continuing to say that, “As per the time of writing, index-linked Cat Bonds now exhibit spreads that are significantly wider compared to indemnity transactions. Whilst ultimately the spread is a reflection of a market price which in itself is a function of supply and demand, there are a couple of possible reasons why index-linkers have higher spreads.”

These include the risk levels of the cat bonds in question, with industry loss trigger bonds often having higher expected losses, as well as the types of perils covered, index deals being largely US focused, plus the fact industry loss trigger cat bonds are more typically providing retrocession than primary reinsurance.

The current spread differential gives Twelve Capital confidence in holding more of these index or industry loss trigger cat bond instruments.

The ILS manager said that this dislocation between the spreads of index-linked and indemnity cat bond transactions makes for an opportunity to be overweight the index and industry-loss side of the cat bond market, to generate better portfolio returns.

“In most cases, these transactions have less modelling risk and are more transparent during and after an event, which also translates into better secondary market liquidity,” Twelve Capital further explained.

But cautioned that, “Of course, such a positioning requires an investor’s willingness to accept the fact that index-linked transactions tend to have a higher correlation, in particular during severe tail events.”