First Time Buyer Mortgage Protection Insurance Ireland 2023

First Time Buyer Mortgage Protection Insurance Ireland 2023 – FAQs

You’re buying your first home – congratulations!

So you’re looking for the best deal on First-Time Buyer (FTB) mortgage protection insurance?

And asking yourself questions like:

What’s the difference between mortgage protection and life insurance? Which should I buy? Which company should I buy from?

I remember how stressful buying your first home can be, as I did it myself not too long ago.

So I’m here to make arranging your mortgage life insurance a doddle.

What is Mortgage Protection?

Mortgage protection is a basic type of life insurance policy that pays off your mortgage should you die during the term of your mortgage.

It’s mandatory, but the bank, at their discretion, may waive the need for mortgage protection in the following circumstances.

Investment/rental mortgages.

If you can’t get cover due to health reasons, you can get coverage but only at an outrageous premium.

If you’re over 50 at the time the loan is approved

Consumer Credit Act of 1995

What’s the Difference between Mortgage Protection and Life Insurance?

Mortgage Protection (or mortgage life assurance)

Mortgage protection is a basic death policy that clears debt to the bank. In other words, it covers the bank’s arse if you die – that’s why they insist you take it out.

Over time, the amount of cover on a mortgage protection/mortgage life insurance policy reduces.

Say you’re getting a mortgage for €250,000 over 25 years.

You die next year with €248,000 outstanding – your policy pays €248,000 to your bank.

You die in 24 years with €600 outstanding – your policy pays €600 to your bank.

Mortgage protection will never leave money to your partner or children.

If you have children, you should also consider a life insurance policy to protect them from financial hardship.

Life Insurance

Life insurance, term life insurance AKA life assurance differs from first-time buyer mortgage protection because it leaves a tax-free lump sum to your family if you die.

e.g using the previous example, you’re getting a mortgage for €250,000 over 25 years.

You die next year with €248,000 remaining – your policy pays €248,000 to your bank, and €2,000 is left to your family.

Some people buy a life insurance policy to clear the mortgage and leave a lump sum for their family.

Don’t do it.

As you can see from the above example, if you die early in the policy, your family will be in trouble. How long could they survive on €2000?

Life insurance leaves a lump sum, mortgage protection doesn’t.

Tell me more about Income Protection for First-Time Buyers.

Income protection is the most important type of life insurance policy…that you’ve probably never heard of.

If you can’t work for over four weeks, income protection will pay you up to 75% of your income every week until you get back to work or until you retire.

It’s the policy I recommend above all others because if you don’t have an income, how will you pay for your mortgage?

Your income pays for everything – if your sick pay through work only pays you for a few weeks or you don’t even have sick pay, then you need income protection.

It’s that simple.

What about Serious Illness Cover?

If you can afford serious illness insurance cover, you should buy some.

Serious illness cover clears the mortgage if you’re struck down with an awful illness (cancer, heart attack, stroke and 54 others), letting you focus on getting better without worrying about how to pay the mortgage.

Without this type of safety net, how would you pay your mortgage if you couldn’t work due to the illness?

Top Tip

Always buy serious illness cover on a separate policy. If you add it to your mortgage protection policy, the bank will get the proceeds on any claim.

Read more about serious illness cover for your mortgage

Which company is best for a First-Time Buyer of Mortgage Protection?

Have a butcher’s at our mortgage protection comparison link below.

How much does mortgage protection insurance cost in Ireland?

There are a few factors the insurers have to take into account when giving a mortgage protection quote.

follow us on insta

How to get the Best Mortgage Protection Quote.

I knew you would ask that…so I covered it in detail here.

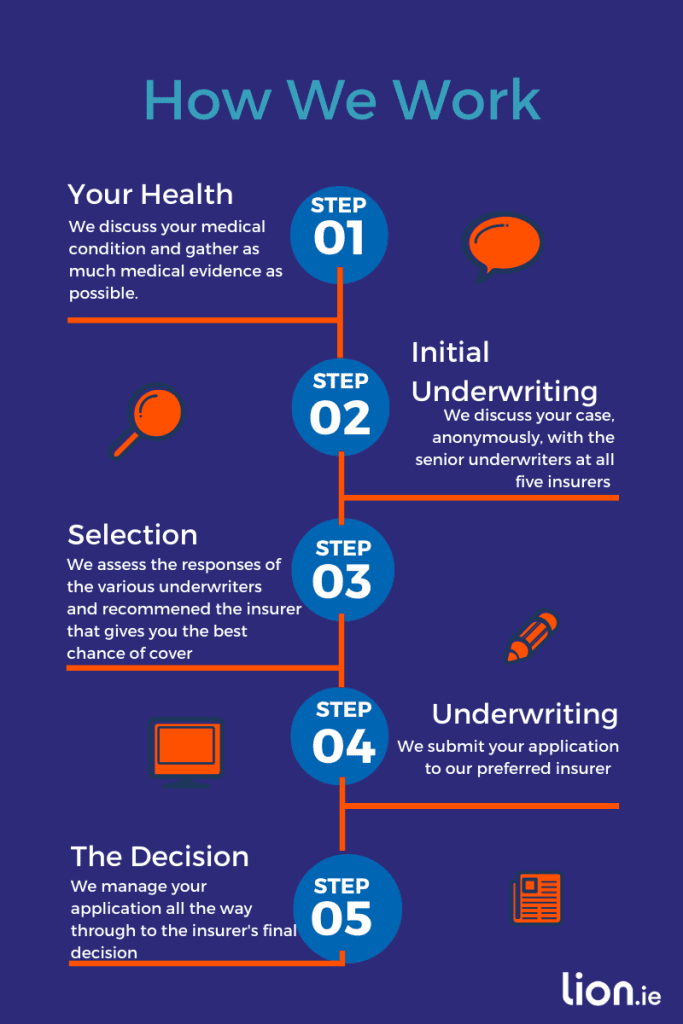

Or, if you don’t have time to read that, the best mortgage protection quotes are available through a broker, not your bank.

And unlike going to your bank, we can offer quotes from 5 insurers, not just Irish Life and Bank of Ireland.

We offer discounted quotes and straight-talking advice on policies from:

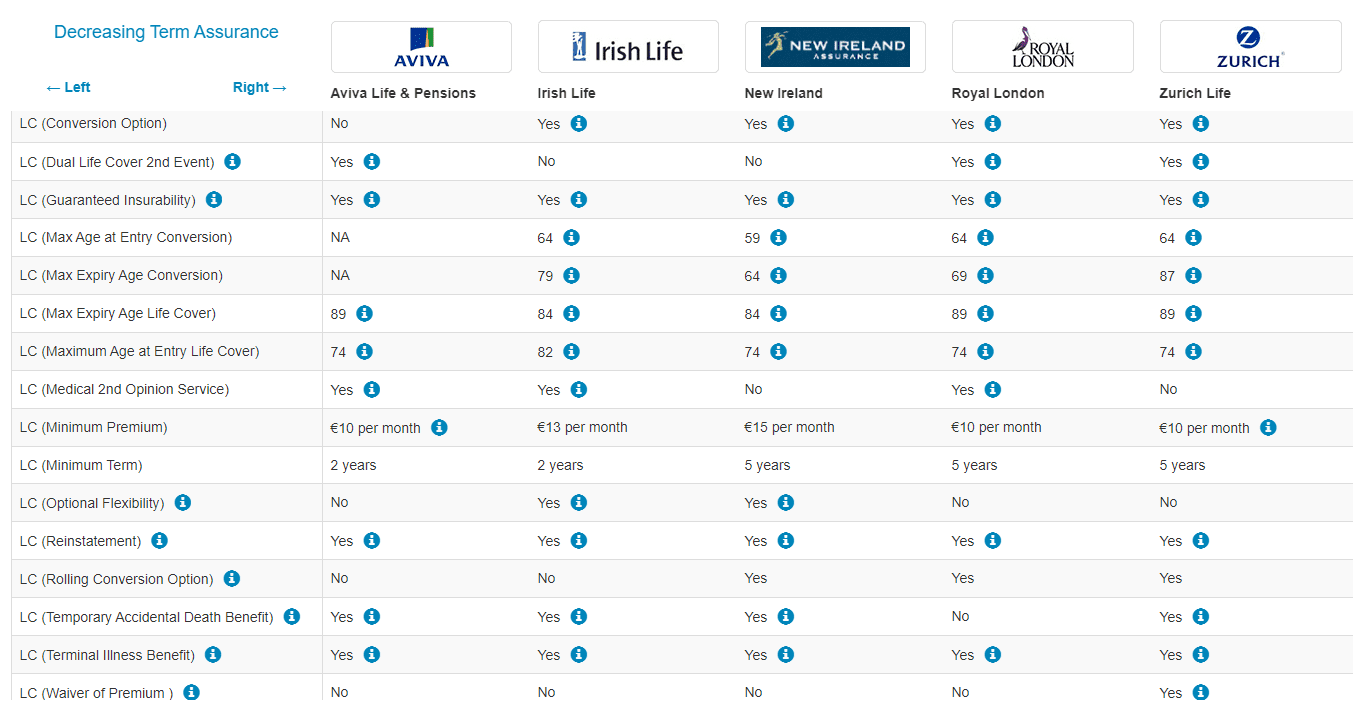

Where can I Compare Mortgage Protection Policies?

Our mortgage protection comparison table makes it easy to compare the various policies on offer at a glance:

And here’s an in-depth look at how to compare mortgage protection in Ireland

At what stage should I be Applying for Mortgage Protection?

Generally, the bank will require your policy a couple of weeks before you’re due to close/get the keys to your house, so they have time to review the documentation and assign it.

Watch out, though!

Some banks will put the squeeze on you and pressure you into issuing your policy before your even get your loan offer.

This is unfair and used purely to stop you from shopping for a better policy.

If your bank is asking you to do this, ask them why.

Remember, you don’t owe the bank anything until they hand over the mortgage cheque, so why should you have to pay mortgage protection premiums before then?

I kinda went off on one there, sorry…back to the question, when should you apply?

I discuss this topic in detail here:

When Should You Apply for and Start Your Mortgage Protection Policy?

You should apply as soon as you have a closing date. If your closing date is way in the future (3 months+), you could hold off until six weeks before you are due to close.

But if you have any health issues, apply asap because it could take ages to get cover if your GP isn’t on the ball.

When do My Payments Start if I Apply for a Mortgage Protection Policy Today?

You won’t pay a cent until you give the go-ahead to issue your policy documents so you can get your ducks in a row well on a timer without being out of pocket.

Top Tip

Some of our insurers will give you free cover for the first month (you won’t get that at the bank!)

Over to you…

Look, I was once a first-time buyer, so I know how stressful buying a house can be – so many questions, so many wrong answers.

If I can help, please get in touch on (01) 693 3382 or drop me an email at nick @ lion.ie

Till then…good luck with the house hunt!

You might find this Glossary / Jargon Buster useful.

By the way, if you’re confused about the types of cover you should be looking at, please complete this questionnaire, and I’ll be back over email with a no-obligation recommendation.

Thanks for reading

Nick

This blog was first published in 2017 and has been regularly updated since