9 Simple Reasons Why You Need Small Business Insurance

9 Simple Reasons Why You Need Small Business Insurance in 2023

Find an Agent

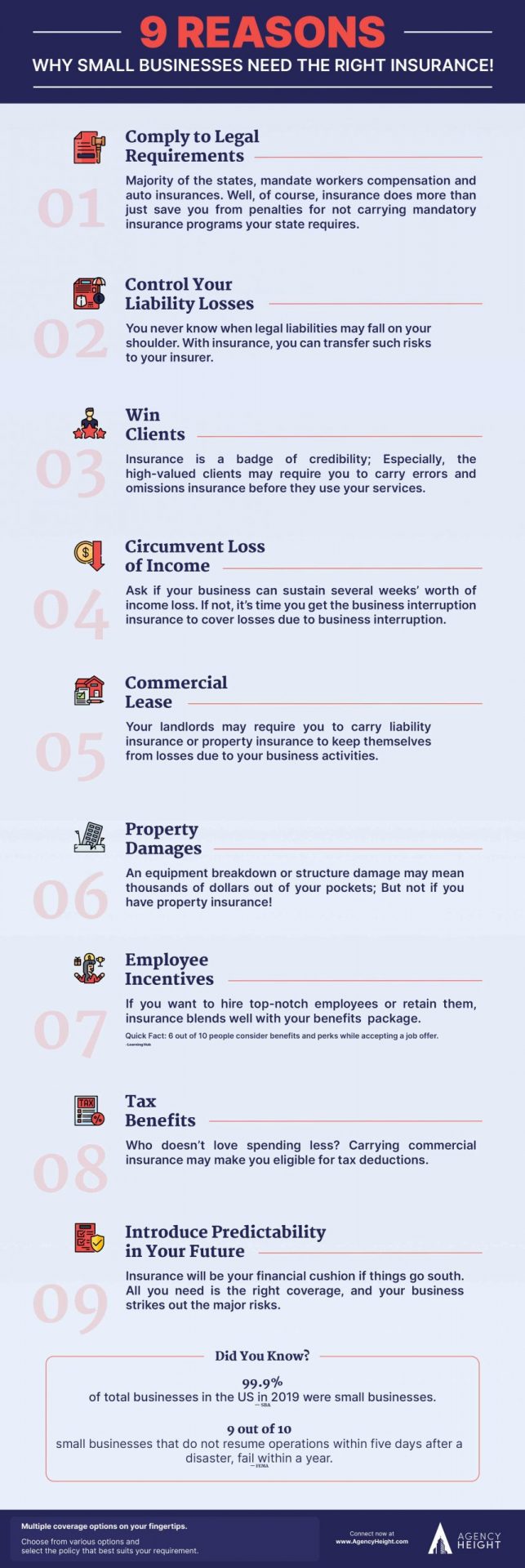

In 2019, 30.7 million small businesses were operating in the US as per the SBA Office of Advocacy. This number reflects 99.9% of total businesses in the US. However, many small businesses fail as a result of costly unexpected events like natural disasters or lawsuits. According to a May 2020 survey by Facebook, 31% of small businesses in the United States have shut down due the COVID-19 pandemic. However, having various insurance policies in place can protect your small business from sudden financial disasters.

Here are nine reasons why small business owners should have insurance:

In this blog

Why Small Business Owners Should Have Insurance

6 Steps Towards Selecting the Right Small Business Owners Insurance

Policies to Consider For Small Business Insurance

Legal Requirements for Small Business Insurance

Few types of insurance are legally mandated, such as workers compensation insurance and commercial auto insurance. The legal requirement depends on the state where you operate. For instance, if you’re located in Florida and employ four or more employees, you need workers compensation insurance. On the other hand, insurance is mandatory for every employer in Illinois. Texas is an exception and has no such requirement. An insurance agent can help you determine which policies you are mandated to carry.

Shift Liability with Small Business Insurance

Lawsuits and liabilities can easily fall on your plate. It takes one accident, one disgruntled employee, or a simple error to bring your business down both in time and money. The legal defense costs alone can be enormous. However, with liability insurance, you can shift the burden to your insurer while keeping your business from falling apart. You focus on running your business while your insurance handles the legal side. Your insurance covers defense as well as settlement costs.

Win Clients with Small Business Insurance

Having insurance in place shows your readiness for times when things may go wrong. Insurance adds to your credibility by reflecting your prudential approach. High-valued clients may require you to carry errors and omissions insurance. It covers any losses due to errors, omissions, or negligence during your professional conduct.

Protection from Loss of Income

While property and casualty insurance covers property loss caused by floods, earthquakes, and so on, it does not cover the lost income resulting from halted operations. That’s why, according to the NAIC, 30 to 40 percent of small businesses have business interruption insurance, which covers loss of income sustained by businesses during such times. Reflect if your business could continue to operate without several weeks’ worth of income. If not, consider purchasing business interruption insurance.

Required for Commercial Leases

When signing a lease, your landlord may require you to carry a certificate of liability insurance. Things may go south during your business conduct, and your landlords may be the victim of your mistakes. Therefore, many landlords require you to carry general liability or property insurance before renting a commercial space.

Connect With The Best Insurance Agents Near You

Contact a local agent online to help you with your insurance needs.

Find an Agent

Protection Against Business Property Damages

Your business insurance covers you from losses arising from property damage, equipment breakdowns, and so on. The insurance will compensate your small business for repairs and replacement of the property. For instance, if the equipment is damaged due to fire, your commercial property insurance will reimburse you for the losses.

Attract and Retain Quality Employees with Small Business Insurance

Insurance is not only about keeping you safe from loss events. It acts as an incentive to attract and retain qualified employees. Nowadays, job seekers look for the salary figures and the benefits package attached to the job. Such benefits can be life, disability, health, and other kinds of insurance to protect your employees. Therefore, having insurance that offers many benefits is a crucial motivator for employees to choose your business over a competitor.

Possible Tax Benefits

Carrying insurance not only appeals to the eyes of your customers but is encouraged by the government. If you have commercial insurance that serves a business purpose, the IRS may allow your business to take it as a tax deduction. The amount of the deduction could be up to the cost of your commercial insurance.

The Future is Unpredictable

You cannot predict what happens in the future, but you can bring a certain level of certainty via insurance. Wouldn’t it be great if you had a financial cushion that could help take care of your business when uncertainty strikes? With proper insurance in place, you can keep your business up and running while concentrating on taking your business to the next level.

6 Steps Towards Selecting the Right Small Business Owners Insurance in 2023

Follow these steps to make sure your business is managing its risks appropriately:

Understand your risks: Explore the risks your business is most vulnerable to.

Identify major risks: Find out which risks are most significant.

Shop insurance: Discover insurance packages.

Contact an agent: No one can help you get started better than an insurance agent.

Evaluate your options: Assess the policies that fit well with your needs and budget.

Purchase a policy: Select the policy that you think will best meet the needs of your small business.

Policies to Consider for Small Business Insurance

Below are recommended insurances that you should consider for your business:

Business Owners Policy (BOP)

Business Interruption Insurance

Commercial Auto Insurance

Errors and Omissions Insurance

General Liability Insurance

Malpractice Insurance

Professional Liability Insurance

Workers Compensation Insurance

With whatever insurance you choose, the selection of the right policy requires the eyes of an expert. A practiced insurance professional can advise you on which insurances would best benefit your small business as well as the ABCs of individual policies.

They can get into the nitty-gritty like what a particular business interruption insurance policy covers, what it excludes, or what are the terms and conditions you should be aware of. As a result, this will help you to get the right policy to ensure your business is adequately covered.

Take a step towards securing your business by exploring your options.

Want to find the right agent for your insurance needs? Have a look at our insurance directory!

Connect With The Best Insurance Agents Near You

Contact a local agent online to help you with your insurance needs.

Find an Agent

Related Articles

3 Simple Ways to Leverage Networking to Generate Leads for Insurance in 2021

How to Become an Independent Insurance Agent

A Cheat Sheet

Insurance Claim Process

Helping Clients is The Best Way to Retain Customers and Gain Referrals

The post 9 Simple Reasons Why You Need Small Business Insurance appeared first on Agency Height.