Renewals: Catastrophe retro rates +50%, global property cat +37%, says Howden

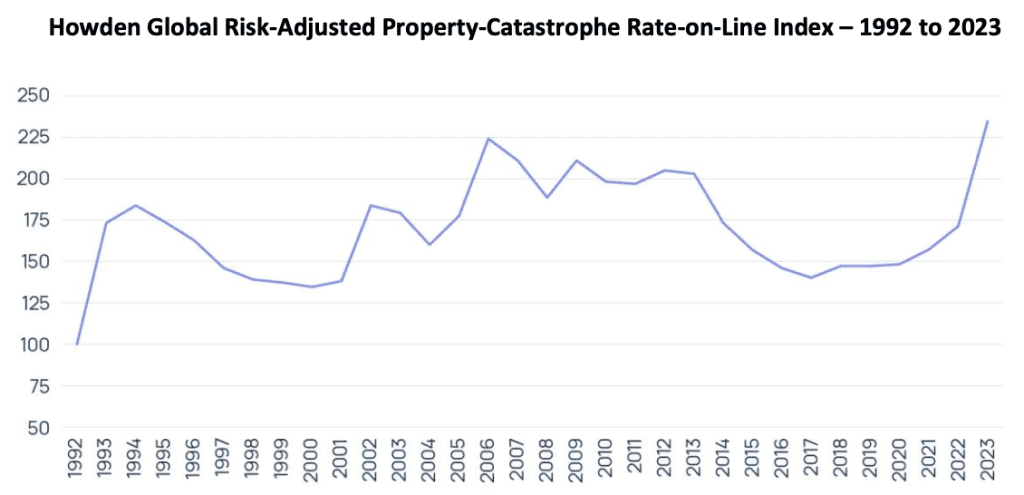

Risk-adjusted non-marine catastrophe retrocession excess-of-loss rates-on-line rose by 50% at the January 2023 renewals, while global property catastrophe reinsurance rates rose 37%, according to international broking group Howden.

In its latest report on the reinsurance renewals, broker Howden explains that “multi-decadal high” risk-adjusted increases in reinsurance rates-on-line were recorded at the January 1st 2023 contract signings.

“Significant volatility” has been introduced into the global reinsurance market, thanks to a confluence of factors including, geopolitical and macroeconomic shocks, war in Europe, fractured energy markets, inflation, interest rate hikes and catastrophe losses including hurricane Ian, the broker says.

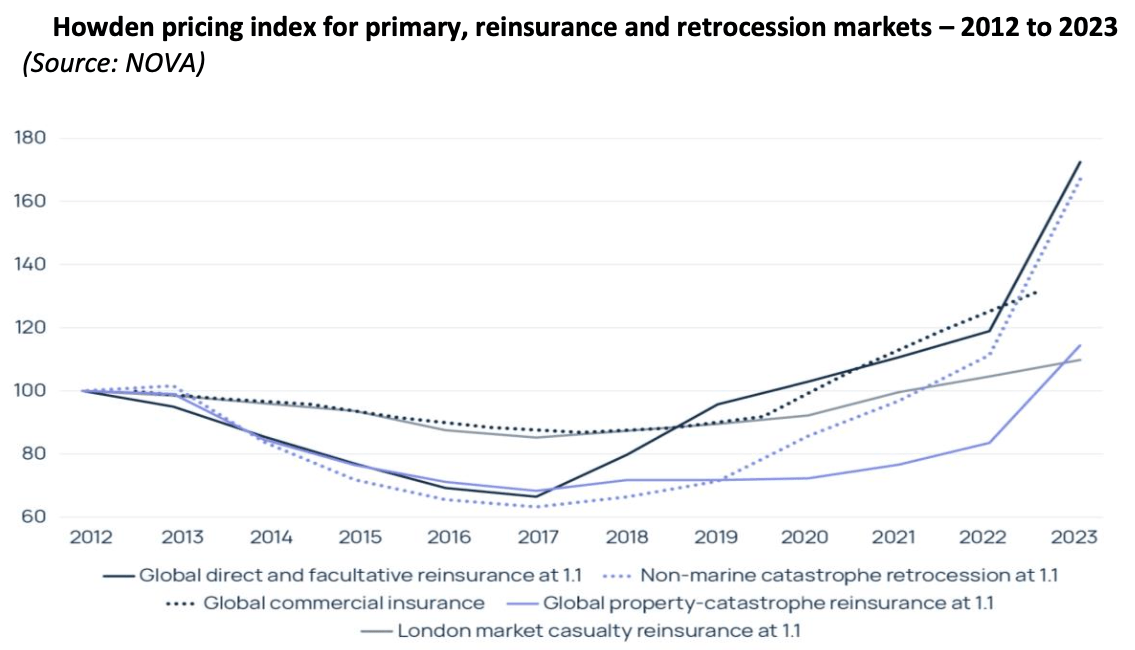

In the past, rate movements across reinsurance classes of business have been divergent, but at the 2023 renewals the “pricing cycles in the commercial insurance and reinsurance sectors are now converging,” Howden believes, with rapid acceleration and dislocation in reinsurance lines, in particular.

Overall, global property catastrophe reinsurance rates-on-line are seen to have risen 37% on average, according to Howden’s index (seen below).

The 37% increase this property cat reinsurance index has recorded is significantly higher than the 9% reported a year earlier and the highest year-on-year increase in thirty years, since 1992.

Rate increases were not even, with some regions experiencing even steeper increases.

The United States saw property cat reinsurance rates up by 50% on average, Howden estimates, reflecting a “highly stressed marketplace,” and this was “the most difficult U.S. renewal in decades,” the broker states.

Even the European reinsurance market saw steep property cat rate increases, with Howden estimating the average increase at the renewals at 30%, with “significantly higher” increases for loss affected programs.

A key driver was the state of retrocession, Howden says, as “Late or incomplete retrocession placements meant that property-catastrophe reinsurers had less clarity than usual around their net positions when offering renewal lines at 1 January 2023.”

The retro market had already been dislocated even before hurricane Ian came along, but that loss event has driven it to the most acute dislocation seen in decades, perhaps ever.

Because of Ian, “a sizeable portion of collateralised retrocession capital was trapped going into 1 January 2023 renewals,” Howden said.

Which was a further driver and resulted in, “Risk- adjusted retrocession catastrophe excess-of-loss rates-on-line rose by 50% on average at 1 January 2023, with a range of up 20% to up 90%,” Howden explained.

The acute retrocessional capital constraints were made even more obvious at the renewals as double-digit rate increases were even seen in higher-layers of occurrence retro towers.

The chart below from Howden’s report shows the scale of rate increases seen at the January reinsurance renewal season.

The renewals have been particularly challenging, Howden notes, highlighting structure and coverage terms as at the forefront of the negotiations, while reissued firm order terms and non-concurrent terms were also seen.

At the same time, in regions such as the US where rate increases were steeper and market conditions the most dislocated, many cedents needed to retain more risk as attachments rose.

“The reinsurance sector has reached concurrent secular and cyclical tipping points,” David Flandro, Head of Analytics, Howden commented. “It is experiencing sustained, heightened loss activity and war risk just as the global economy exits the ‘great moderation’ of interest rates and asset price volatility. Pursuant increases in carrier costs of capital are underpinning higher rates-on-line, lower capacity levels, and straitened terms and conditions.

“The last time we saw this level of capital dislocation was during the 2008-2009 global financial crisis. At the same time, the sector is experiencing its most acute, cyclical price increases since the 2001-2006 period if not before.”

Read all of our reinsurance renewals news and analysis here.