What is the Best Mortgage Protection Policy in Ireland (2023 Edition)

Listen to the intro:

Friends, not all Mortgage Protection insurance policies are created equal.

Especially not the one your bank offers you.

And I get the appeal; I do. Buying a house, as we all know, is a pain in the hole as it involves any number of the following:

Keeping a paper trail.

Dealing with estate agents.

I lived at home in the box room with yer ma and da for a year to save a deposit.

We are dealing with estate agents.

Paperwork.

We are dealing with estate agents.

More paperwork.

Budgeting for stamp duty and a solicitor.

No wonder you might be tempted to say ‘feck it and go with your bank when they offer you a Mortgage Protection policy.

If you do, however, you’ll lose out on MUCHO MOOLAH – and, sure, look, you’ve made it this far; don’t fall for the bank’s cheap tricks.

See, banks are usually tied to one insurer, meaning you’re only getting policy choices from one place. You wouldn’t shop in a supermarket offering only one brand (Cadbury’s Mushroom Soup, anyone), so don’t do it for your mortgage protection.

So, to avoid a bad case of buyer’s remorse, today I’m going to help you choose the best Mortgage Protection policy FOR YOU!

As always, the caveat applies that no two people are the same, so no two policies should be the same. Instead, use this blog post to find out what’s important to you and go from there.

First things first, what do all Mortgage Protection policies have in common?

Well, this is going to be obvious, but: any policies will pay off your mortgage (to the bank) when you die.

All the insurers also have a reasonably similar batting average in that they all pay around 98% of all death claims.

This means: with all of them; once you’re insured, your mortgage will be paid off if you die. Presuming you haven’t done something silly like tell a whopping lie on your application that’ll get your claim invalidated.

I’m looking at you social smokers who pretend they don’t smoke.

Once you get past the raison d’etre (ooh la la) for Mortgage Protection, you’ll find loads of other bits tacked on, although they’re not as important as the actual cover. Still, they can be pretty useful, depending on your situation.

Many of them are a bit meh: for example, the maximum term you can get. Irish Life offers a 50-year term, while the other four (Aviva, New Ireland, Royal London, and Zurich) provide a standard 40-year term. This is relevant if you’re particularly young taking out the policy, but it isn’t a big concern for most of you.

Likewise, a minimum term length exists – ranging from two years (Aviva and Irish Life) up to five years for the others.

Another is called Maximum Age at Entry Conversion, which sounds a bit like a course you might do to get more in touch with the world’s energies or some other bullshit.

All of this will likely seem unclear – and you probably think that none of it seems that important.

And honestly, for most people, you’d be right. However, there are about seven bits and pieces that are worth considering.

Remember, if you go with your bank here, you only see one side of the insurer’s pentagon. Not to be confused with a pentagram, which symbolises all the young wans in black running around in fields with crystals and casting spells.

We all have that one cousin.

So without further ado…

What’s important when getting Mortgage Protection?

Underwriting Philosophy

If you’re in perfect health, you can choose any insurer.

Truthfully, I rarely see an application that doesn’t have some health condition or family history of a health issue. In that case, choosing the insurer most sympathetic to your situation is the most important thing. Forget about the bells and whistles. Finding an insurer who will offer you coverage at the lowest price with the least hassle would be best.

That’s where we come in. We’re the experts if you have a pre-existing condition.

You should first complete this medical questionnaire so I can find you the most suitable insurer.

What is Dual Mortgage Protection?

This little bad boy is the dirty secret of insurance. Most people end up with a joint policy, which pays out on the first death only. Dual Mortgage Protection pays out on both. That’s two payments. The bank would get the first payment to clear the mortgage; the second would go to your family.

It’s an excellent way of getting Life Insurance for cheap, basically.

You can’t buy dual mortgage protection from your bank; they’ll try to peddle a joint policy – run, ar nós an gaoithe (like the wind, for my non-Irish speaking friends, which probably includes most Irish people reading ?)

What is a Conversion Option?

A conversion option is fantastic.

There, I said it.

It’s great because it lets you add years to your cover without answering medical questions…which probably doesn’t make much sense on its own.

So: example.

Jim is 40 and has 20 years left on his mortgage. Fifteen years later, he’s near the end of his term, and his mortgage is pretty much paid off. However, he’s 55 now and has a dodgy ticker.

However, he has a conversion option, so now he can turn his MP policy into a Life Insurance policy. WITHOUT having to disclose the dodgy ticker, which would otherwise cost him a price hike.

Sound.

New Ireland, Royal London, and Zurich offer a conversion option on their mortgage protection. Aviva and Irish Life do not.

This one is important, so keep an eye on it when deciding.

For me, New Ireland is the winner here. Let’s say Jim initially took out a policy for €300k but only has €50k left. New Ireland will offer him a new plan for €300k; the others will only give him €50k.

Unless you’re older when applying. If so, choose Zurich Life, as they will allow you to convert your policy to your 87th birthday, no questions asked. With Royal London, you have to be under 70; with New Ireland, you have to be under 65.

NB: You will pay a few euros more to add the conversion option (roughly 5% extra), but it’s well worth it.

What is Guaranteed Insurability?

Guaranteed insurability sounds fancy, but I’ll break it down for you. It’s a second chance saloon that lets you increase your coverage on special occasions without answering health questions.

The special occasions include:

the birth of a child,

a new mortgage,

or even a new marriage.

Let’s say you’re 30 and fancy-free when you get your Mortgage Protection the first time around.

Fast forward ten years, you’ve had a kid and decided to move to a bigger house and mortgage. You’re now 40, have put on a few pounds, and your cholesterol is raised, as is your BP, but apart from that, you’re grand!

Typically, if you reapplied for cover, you might face a loading because of those new health issues.

However, because of guaranteed insurability, you can increase your coverage by up to 100 grand or 50 per cent of your original coverage without having to answer health questions.

Which is pretty sweet, let’s be real.

Aviva is slightly different here because it lets you increase your cover by €40,000 only when getting a new mortgage. But they also allow you to extend the term to be the same as the new mortgage. SOUND!

Guaranteed insurability is a great way to increase your coverage without worrying about a significant price increase as you get older/start falling apart.

What is a Waiver of Mortgage Protection premium?

This is also a biggie.

Zurich will pay your premiums if you’re injured or too ill to work for more than 13 weeks.

This isn’t a huge help if you’re only paying a tenner a month, though it could be worth it if you have a hefty premium (say €150 a month). That way, you can keep your insurance and spend €150 on something else, like food or the mortgage.

The other insurers don’t offer it.

What is a Medical 2nd Opinion Service?

It will come in handy if you’re someone recently diagnosed with a medical condition.

Essentially, it lets you double-check your diagnosis or the treatment you’re on. An independent medic will look into any alternatives or see what other options you have if you’re not getting better.

Plus, it’s a free add-on and is available to your children, your parents, your partner and their parents.

Aviva’s Best Doctor is top of the class here:

They also have Family Care, a counselling and support system that covers short-term counselling and carer support services. If you’re someone who might benefit from either, it’s a big plus for Aviva, so weigh that up when choosing between policies and considering the costs.

Remember, it’s not just about the insurance cost – but about the added value of the extras.

Royal London offers Helping Hand Benefit.

Irish Life has Medcare

Unfortunately, Zurich and New Ireland offer nada.

What is Accidental Death Benefit?

This one is kind of funny.

So let’s say you’ve JUST filed the papers for your insurance, but it hasn’t come through yet. You’re in insurance limbo, not knowing if you’re covered.

And then something tragic happens.

A vat of beer in a nearby brewery explodes, and you’re swept away and perish.

(This is based on actual events. Google ‘the London Beer Flood’.)

Technically you’re not covered, but if you have an Accidental Death Benefit, you’re automatically covered for up to €150,000 should you die in an accident.

All the insurers offer it except for Royal London.

This benefit is worth considering if you think there will be a long wait for medical reports.

What is Children’s Cover?

As a dad, I know this one is grim.

But it’s there as a consideration.

If one of your kids were to die (I know: it’s awful!), you get a lump sum from the insurer. Zurich Life has no children’s cover, while Irish Life has up to €7,000 cover.

What is a Reinstatement Clause?

If you forget/can’t make a payment and your policy is cancelled, the insurer allows you to pay the arrears within a certain time. If you do, they’ll put you back on the cover or even pay out if a death had occurred when premiums were missed.

What is Separation Cover?

This one is gas.

So let’s say you’re getting a mortgage with someone you’re unsure about. Maybe it’s grand, but you don’t know if ‘grand’ is enough for you.

Separation Cover would let you cover your bases. Basically, if needs must, you have an out on a joint policy where you can split it into two single plans, without having to answer any medical questions.

A consideration if you don’t think your relationship will outlast your mortgage.

That one is on you, buckaroo.

What is a Full Mortgage Repayment Guarantee?

Here the insurer agrees to clear the outstanding balance on your mortgage regardless of interest rates.

Yeah, I bet you didn’t know this was a thing you might have to worry about.

Without this guarantee, there might be a balance leftover to be paid (if your mortgage interest rate creeps above 6 per cent) before your bank officially gives your other half/family the house.

How much is Life Insurance for a Mortgage?

And last but not least.

I talk to a lot of people about insurance. It’s my job. For many, it comes down to price—a simple comparison of policy a vs b or c or d.

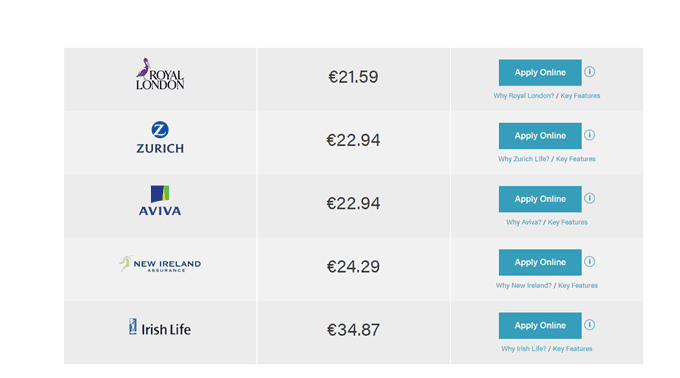

Let’s look at Jim again. He’s 40 and in decent health and wants to get €300,000 cover for the 25-year term of his mortgage.

His options, from my magical quote machine, look like this:

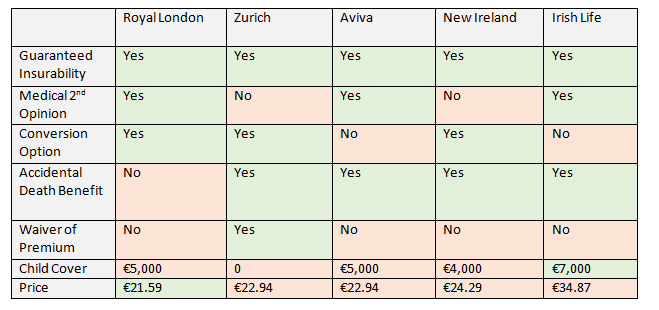

Except for Irish Life, there’s only a couple of euros in the difference. So this is how it falls, all in:

Mortgage Protection Benefits Comparison Table

For my money, look out for:

Dual cover. Dual cover can pay out twice, whereas joint protection only pays out on the first death. Dual is not available at any of the banks.

A conversion option. Particularly useful with Mortgage Protection and being able to convert it into Life Insurance down the line once your mortgage is sorted.

If you have kids: Child cover.

Medical issues: Medical 2nd Opinion.

Family planning on kids or upsizing: Guaranteed insurability.

How to compare Mortgage Protection in Ireland in 2023

A quick refresher in case you skipped all of the above!

Mortgage Protection is the type of insurance you need when buying a house. It pays off your mortgage if you die.

Now, let’s start with an example to help make this real.

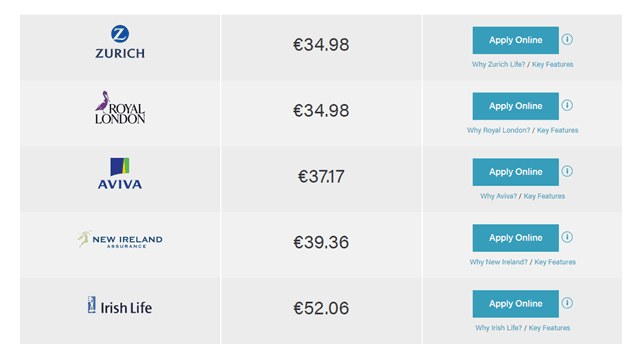

Jesse is 34 and buying a house with his partner. Jesse really likes CrossFit, because who doesn’t (amirite)?

His mortgage is €350,000, and he wants to pay monthly for the 30-year term of his mortgage.

Jesse doesn’t smoke (his body is a temple; I don’t know if you heard, if you haven’t, he’ll tell you soon, but he does CrossFit), and neither does his partner (they’d love to smoke, but because Jesse does CrossFit – there’d be murders over smoking).

He goes to the most useful online broker and finds the following quote:

Jesse’s first thought is probably that it’s between Zurich and Royal London and that Irish Life is robbing feckers, bleeding their customers dry of that extra €17 a month.

So does Jake take the path of least resistance and become a Zurich Lifer?

Should he?

The crucial thing to remember is that you’re not just paying for Mortgage Protection. There’s also a bunch of other stuff included. So let’s look at what the various insurers offer for your hard-earned.

Pro-tip: you can see all this information yourself when you get a quote – simply scroll down to the comparison charts.

1. Zurich

Cost: Joint lowest premium: +1 for Zurich. They also offer the following:

Up to 6 weeks free if we work our magic. ?

Free waiver of premium. (If you can’t work due to illness or accident for more than 13 weeks, Zurich will cover your payments). This is exclusive to Zurich Life.

Dual Life mortgage protection – you’ll pay a teeny bit extra.

The conversion option is available.

Guaranteed insurability up to €100,000. If you get a new, bigger mortgage, you could get an extra €100,000 cover without answering medical questions. Handy!

The joint-best Serious Illness Cover in Ireland (if you want to bundle it with your Mortgage Protection). But spoiler alert: DON’T. Because if you claim SIC on your MP, the spondoolies go to your bank. Which: ?.

90-day reinstatement clause. This kicks in if you missed payments. Your policy would be suspended, but you’d have 90 days to pay it back and be covered again, even if the policyholder got sick or died in the interim.

Accidental Death Benefit. You’re covered for up to €150k as soon as Zurich receive your application. This cover lasts 30 days or until Zurich accepts/declines your application.

2. Royal London

Cost: Joint Cheapest: +1 for Royal London. They also do the following:

The first month is free. Sound.

Dual life mortgage protection for the same price as joint life cover

You can make your policy convertible for an extra 5% in premiums

The Helping Hand benefit is free services for physiotherapy, bereavement counselling, and second medical opinions.

Free Child Life Cover. Not to be sniffed at.

Decent Serious Illness Cover. But again: negligible because you shouldn’t do it. If you want serious illness coverage, buy it on a life insurance policy for your own protection.

Guaranteed insurability.

100-day reinstatement (even better than Zurich’s)

3. Aviva

Cost: High – no discounts, no price matching. You get:

Best Doctors Second Opinion. A second opinion, for free, if you want one.

Here at Lion HQ, we have senior underwriters at Aviva on speed dial – these guys are excellent for clients with health issues.

Guaranteed insurability.

Accidental Death Benefit.

Fair underwriting

4. New Ireland Assurance

Cost: Competitive. Hardly a deal-breaker. Also on offer:

Conversion option – but at an extra cost. This is good, as it lets you renew your policy if it runs out before you’ve paid off your mortgage/shuffled off the mortal coil without facing hefty medical checks. Basically: it could save your cheese in the long run.

Guaranteed insurability up to €100,000.

€4,000 Children’s Life Cover was tossed in too.

Really fair underwriting for some health conditions.

Easy to amend your policy.

Accidental Death Benefit.

5. Irish Life

Cost: Decidedly, the most expensive. -1, chaps. You also get the following:

€7,000 Children’s Life Cover.

Protection Flexibility – see a link to review below.

Option to convert to a Life Insurance policy – at an extra cost. Useful if you pay your mortgage off and don’t want to lose all those premiums you’ve been paying.

Guaranteed insurability.

LifeCare benefit. This includes MedCare, a medical second opinion; NurseCare, access to two confidential medical helpline services; and ClaimsCare, access to a claim’s assessor and claims to counsel if needed.

Twenty per cent extra cover in the future, without answering medical questions.

Accidental Death Benefit.

Irish Life Mortgage Protection Review

Over to you…

With all that in mind, what you do will depend on your circumstances and any other insurance policies you might have. As you can see from this big ole list, it can get confusing with lots, plusses, and minuses.

However, I stand by my advice: take a look at the cost first. Then look at the list of benefits and choose the ones that you think are important—rank them by most relevant. From there, scroll back up and see who comes out on top.

If your brain starts to melt out of your ears, you can fill in this short form or give me a buzz at 057 93 20836, and I’ll get back to you with my thoughts!

Thanks for getting this far.

Nick

PS: This blog took AGES as it’s pretty comprehensive so PLEASE feel free to share with your friends or on your socials. TYVM!