Cabs without a chatty — or any — driver are expanding in China

Across a sprawl of streets in southern Beijing, China’s answer to search engine giant Google is charting the path for driverless cars in the world’s biggest electric vehicle market.

Baidu Inc.’s Apollo program, which allows customers to hail and ride a fully autonomous robotaxi, has racked up more than 1.4 million public journeys, and is expanding a network that already covers dozens of square miles across 10 key cities that also include Wuhan and Chongqing. By next year, the company wants to have the largest autonomous service area in the world — an ambitious target considering it needs to complete with General Motors Co.’s fast-expanding robotaxi unit Cruise and California-based Waymo. Baidu is also being challenged in China by competitors like WeRide and Pony.ai.

The pace of development is on display at a company showroom in Yizhuang district, where an early autonomous model — a boxy red compact 4×4 rigged with steel beams to hold a camera and lidar sensors — contrasts with a sleek, white SUV that’s slated to launch next year. Nearby, a room out of Willy Wonka’s factory is wallpapered from floor to ceiling with QR codes that are used to train and test vehicle systems and equipment.

Watch what it’s like here

While the technology behind the cars is thrilling, taking a ride in one across Beijing is surprisingly standard. Using Baidu’s white-and-green app to book a ride on a recent afternoon had a driverless cab arrive within minutes, and the fare, which included a promotional discount, was low: 4 yuan (65 cents) for a 10-minute journey.

The company’s robotaxi fleet uses the mass-produced Arcfox model aT that’s souped up with an array of sensors. The vehicle follows the speed limit diligently, merges early in traffic and turns smoothly on the broad, mostly empty avenues surrounding its facility. When a cyclist abruptly darts from a sidewalk, the robotaxi taps the brakes until he’s well across.

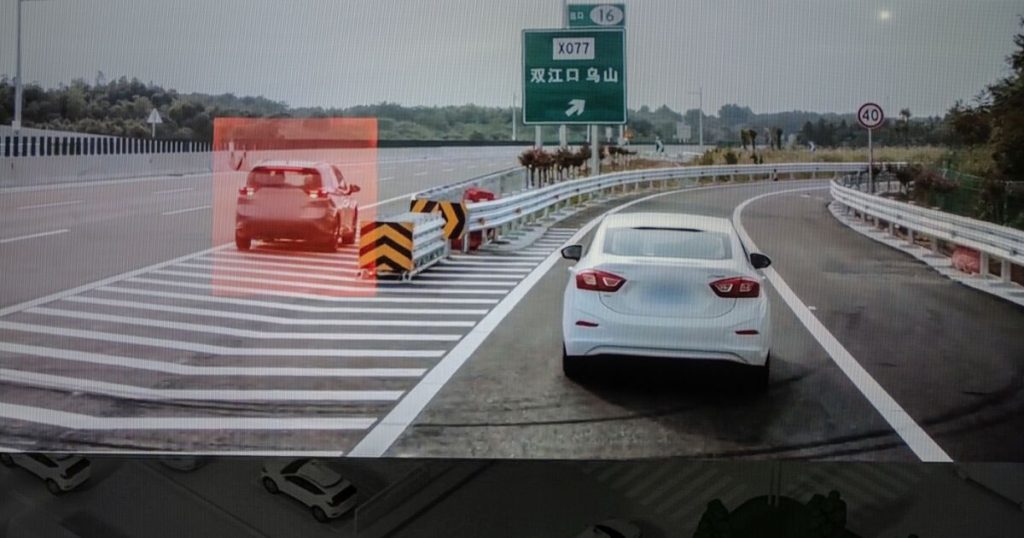

Because Baidu is currently using regular models designed for a human motorist, riding in the back does offer the unnerving vision of a steering wheel turning as if being spun by a ghost. Monitors in the rear cabin add to effect, displaying the same images the car interprets — pedestrians, vehicles, bicycles, buses and trains all rendered into figures that look more like Monopoly game pieces. Another 10-minute ride across town is similarly smooth, quiet and drama-free.

For China’s operators, however, there is a potential hurdle ahead. In October, the US imposed tighter controls on exports of some chips and chipmaking equipment to the nation to stop it from developing capabilities that could become a military threat, such as supercomputers and artificial intelligence.

“For the part of our businesses that need advanced chips, we have already stock enough in hand actually to support our business in the near-term,” Robin Li, Baidu’s president, said during an earnings call last month.

For the time being, Baidu — which is increasingly shifting its focus to artificial intelligence and autonomous vehicles after its core advertising revenue shrank — sees robotaxis as the best near-term opportunity. It’s preparing to ramp up production of the Apollo lineup, and has won contracts with cities like Guangzhou to build digital infrastructure for city streets. Investors can also expect to see “meaningful revenue contributions” from Baidu’s auto solutions businesses, which mainly involves selling driving-assistance software, starting in 2024, Li said.

That could impact the autonomous driving industry, which trains its artificial intelligence on cloud platforms that rely on the advanced chips impacted by the controls, said Bao Linghao, an analyst with Trivium China Ltd. If Chinese companies have their computing power limited, that could eventually hamper efforts by Baidu and local rivals to keep pace with Alphabet Inc.’s Waymo, which already leads in terms of vehicle miles tested. “Over the long term, it’s going to be a big problem,” Bao said. “If China’s AI computing power is being capped, that would put Chinese AI companies at a disadvantage at a starting line.”

Baidu, which has nearly triple the road test miles of its key domestic competitors, sees a limited immediate effect. Ultimately, the firm expects China’s auto sector to become less reliant on imports.