Three Eclipse Re deals take 2022 private cat bond issuance to $720m

Eclipse Re Ltd., a private syndicated collateralised reinsurance note, private catastrophe bond issuance and reinsurance transformer platform owned and operated by Artex Capital Solutions, has listed three more private cat bond issues totalling roughly $29.54 million of notes in Bermuda.

As ever, we don’t know the precise date of issuance with these, but they have all appeared as listings on the Bermuda Stock Exchange (BSX) this week.

As we do not know the actual issuance dates, we include these new private cat bonds in our data as of the time we discover them, so they will be classed as December issuances and feature in our upcoming fourth-quarter and full-year catastrophe bond market report.

All three of these new Eclipse Re private cat bonds provide their reinsurance or retrocessional protection to their cedents or sponsors up to due dates of June 1st 2023.

Eclipse Re Ltd. is a Bermuda domiciled special purpose insurer (SPI) and segregated account company that is managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.

Eclipse Re Ltd. has issued $10 million of Series 2022-04A notes, $13.875 million of Series 2022-05A notes, and just over $5.662 million of Series 2022-07A notes, each on behalf of different segregated accounts of the vehicle, across these latest three private cat bond series to emerge.

The proceeds from the sale of the roughly $29.54 million of private cat bond notes issued by Eclipse Re across these three series will have been used as collateral to underpin their related reinsurance or retrocession contracts, with the collateral held in trust.

We don’t know the underlying perils, but typically these Eclipse Re cat bonds feature property catastrophe risks. In addition, we do not know the type of trigger used for the coverage.

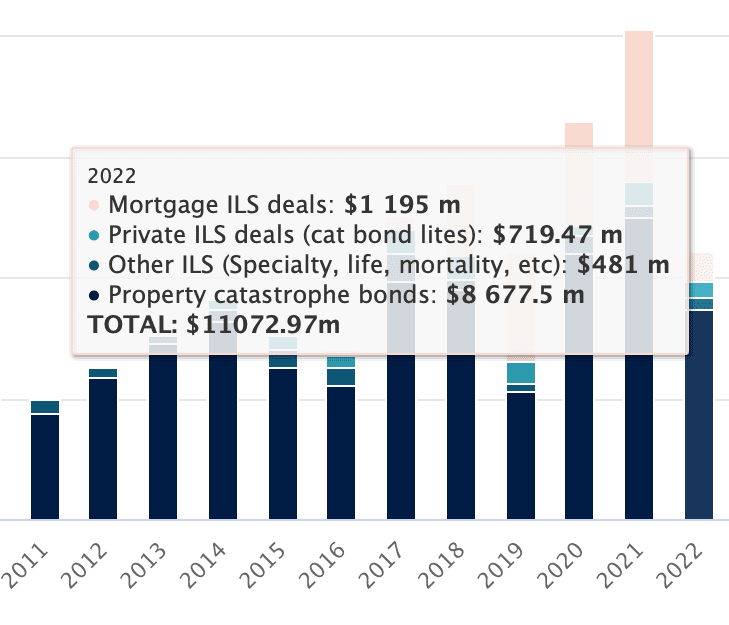

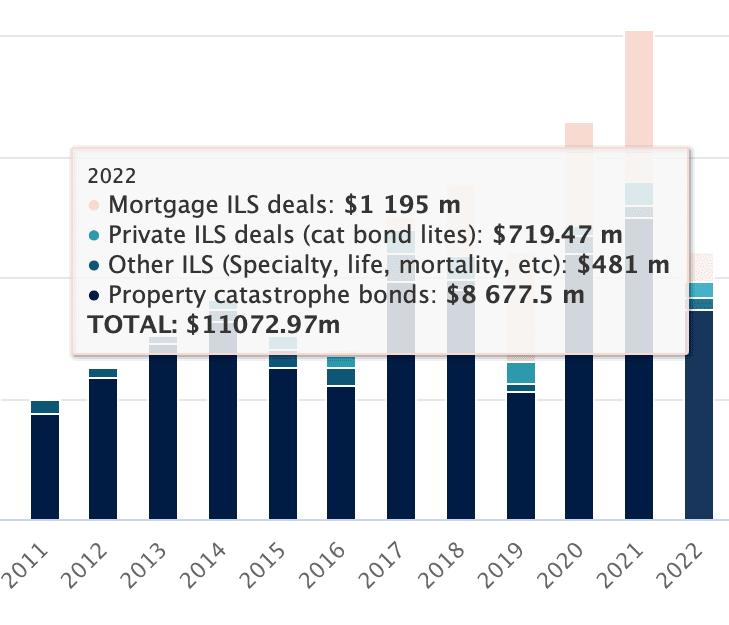

These three new Eclipse Re Ltd. issues are now listed in our Deal Directory and take 2022 private catastrophe bond issuance, which now stands at almost $720 million for the year so far.

These three new Eclipse Re Ltd. issues are now listed in our Deal Directory and take 2022 private catastrophe bond issuance, which now stands at almost $720 million for the year so far.

Analyse private catastrophe bond issuance by year using our interactive chart.

In 2021, private catastrophe bond issuance that we recorded in our Deal Directory surpassed $1 billion for the first time.

Issuance of private cat bonds, or cat bond lites as they are often called, has so far failed to keep pace, but given the challenges faced in the cat bond sector over the course of this year, that is not surprising.

As a result, to reach $720 million of these smaller privately placed deals before the end of the full-year is still an impressive signal that their utility is still important for cedents as well as for cat bond investors.

Eclipse Re typically issues insurance-linked securities (ILS) notes, via the transformation, securitisation and ultimately transfer to one, or syndication to a group of investors, of reinsurance or retrocession arrangements.

As a result, its main use-cases are issuance of privately syndicated collateralised reinsurance notes, or private catastrophe bonds (cat bond lites), with an ability to cover a wide range of underlying structures and perils, or lines of insurance business.

Eclipse Re private cat bonds aren’t always broadly syndicated and the structure has often been used as a transformer for an ILS fund manager, to help it securitize a risk and make it investable for a catastrophe bond fund strategy.

We now have seven Eclipse Re private cat bond issues listed in our Deal Directory for 2022.

ILS and reinsurance market service provider and facilitator Artex Capital Solutions plays a significant role as the manager for these Eclipse Re Ltd. transactions, with this special purpose vehicle a key part of its ILS infrastructure offering to clients.

You can track cat bond and related ILS issuance by year and type of transaction in this chart.

You can also view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.