Medicare Is Changing

What You Need to Know

Medicare Part B premiums will go down.

Clients who stay in the hospital for a long time and have no coverage other than Original Medicare could face enormous bills.

The Medicare drug plan deductible is almost twice as big as the Medicare Part B outpatient and physician services coverage deductible.

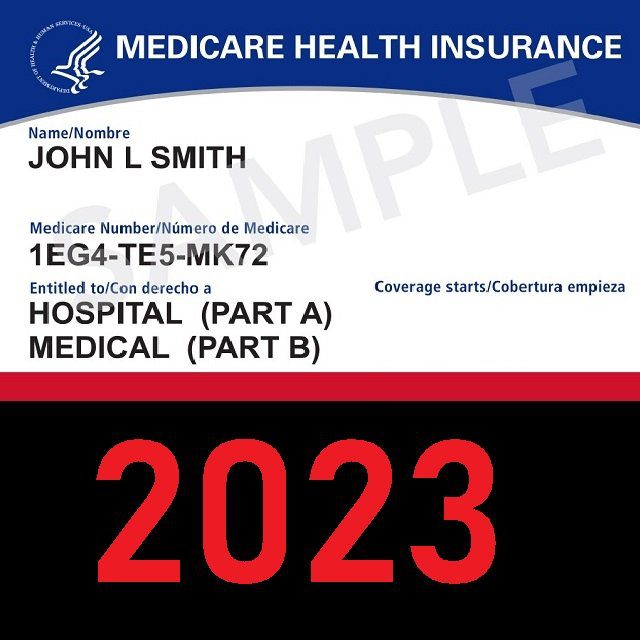

Changes are coming to Medicare starting in 2023.

Some items are the result of the typical pricing changes that occur annually.

However, some significant changes are on the horizon, thanks to Inflation Reductions Act components that aim to lower prescription costs.

Adjustments will increase some Medicare premium and deductible amounts, but the Medicare Part B premium is falling.

If you help clients choose and use their Medicare coverage, you likely know all of this.

If you are not a Medicare advisor yourself, you should still understand the basics, because Medicare is such an important part of the lives of older clients.

1. Medicare Part A Costs

Premiums

Most Medicare beneficiaries will get Medicare Part A coverage, or coverage for inpatient hospital care, without making premium payments.

Typical clients will get premium-free Part A coverage because they have paid Medicare taxes for 40 or more quarters, or at least 10 years.

However, some individuals must pay a premium for Medicare Part A.

For those who worked fewer than 30 quarters, the monthly premium will be $506.

For those who worked 30 to 39 quarters, the monthly premium will be $278

Deductible and Copayment Costs

When clients are admitted to the hospital, the per-occurrence deductible applies.

For 2023, the Part A deductible has increased to $1,600.

That deductible applies for each hospital admission.

Once the deductible is met, the first 60 days of coverage comes at no additional cost.

If clients are in the hospital for more than 60 days, the following out-of-pocket cost rules apply:

Days 61-90 = $400 per day.

Days 91-120 = $800 per day.

After 120 days, clients start using their lifetime inpatient days.

Once clients’ 60 lifetime reserve days are exhausted, they’re responsible for all costs.

However, the average hospital stay is three days.

If clients move to a skilled nursing facility, since the deductible was met at admission, there will be no charge for the first 20 days.

After 20 days, the client is responsible for a $200 copay for up to 100 days.

After 100 days, the client is responsible for all costs.

2. Medicare Part B Costs

Premiums

Medicare Part B covers outpatient and medical provider services.

Medicare Part B enrollees faced one of the most significant premium increases ever between 2021 and 2022. The increase was related to the cost of a medication that had its cost slashed after 2022 Medicare prices were announced.

In 2023, Medicare program managers will lower the Part B premium from $170.10 to $164.90.

Deductible and Coinsurance Costs